Global travel – a compelling secular growth opportunity

Why Invest in Global Travel?

Favourable demographics, changing consumer preferences and technological innovation create an emergent growth opportunity.

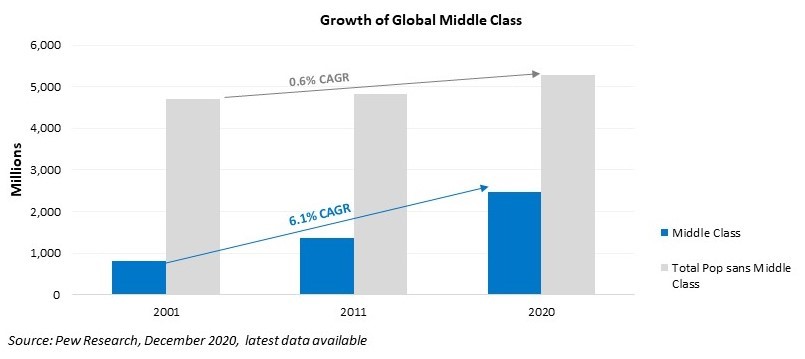

Over the past 20 years, the global middle class has more than doubled, from 800 million to over 2 billion, resulting in a dramatic increase of consumers with higher levels of disposable income, higher education levels and more cultivated purchase preferences.

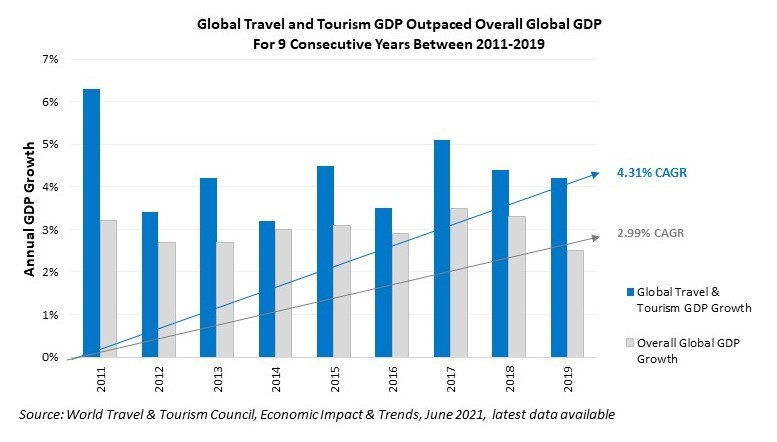

We believe that the long-term trend in global travel will outpace global GDP in the coming years, continuing a trend that existed before the COVID-19 pandemic in 2020. Between 2011 and 2019, growth in global travel spending increased at a 4.3% annual rate, compared to global GDP, which grew at a 3% rate during the same period.

Technological Innovation Expands Access and Lowers Costs

In addition, disruptive technologies such as internet booking sites, home rentals and curated travel experiences may be accelerating this trend by lowering costs and increasing access and choices, and further expanding the total addressable travel market.

Travel Spend is Rebounding

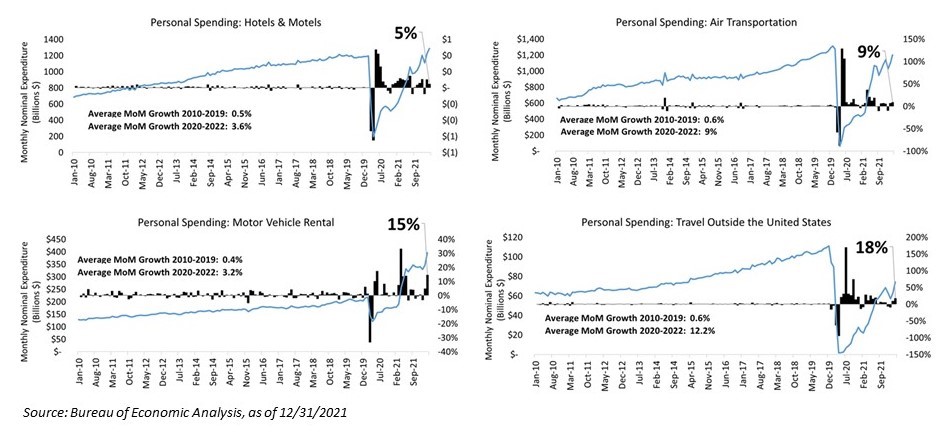

Although COVID-19 significantly affected global travel spending, the recovery has been relatively swift with what we believe will be significant potential growth as COVID-19 vaccines are distributed globally and travel confidence increases.

Since the depths of the pandemic in early 2020, travel related spending on services such as lodging, air travel and rental cars has experienced a sharp reversal and return to growth. Strong pent up demand could allow the travel ecosystem to pass inflationary costs through to the consumer. As a result, travel related companies could experience attractive growth in sales and earnings relative to other consumer related stocks.

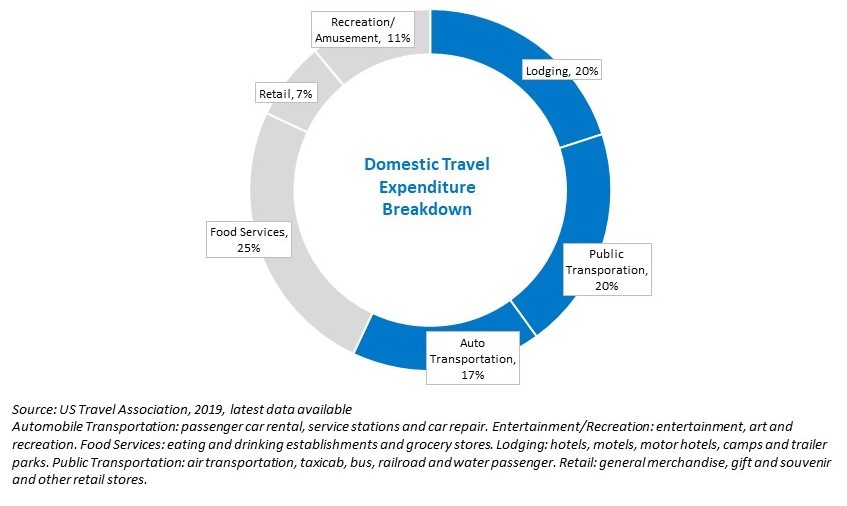

Over 40% of Travel Spend is Beyond Traditional Travel Companies

Travel spend encompasses far more than traditional airfare, cruise lines, lodging and car rentals – it also includes food services, recreation/amusement, payment processors and retail/consumer goods and services.

We call these companies “travel beneficiaries,” which are companies that derive a significant component of their revenue from global travel, benefit from the travel ecosystem and capitalise on the demographics and spending characteristics of the vast and growing global middle class.

According to US Travel Association data, over 40% of travel spend is allocated to travel beneficiaries such as food services, retail and recreation/amusement.

Global Travel Beneficiaries Approach

As travel spend is more than just direct travel costs, we believe investors may benefit from an approach that includes both direct travel and travel beneficiaries.

Identifying Global Travel Beneficiaries

To identify travel beneficiaries, we developed an approach using natural language processing (NLP). Company transcripts are processed and scored based on the frequency and use of keywords such as “travel,” “vacation,” “itinerary,” “passenger” and “leisure” among many others.

An algorithm scores these results to prioritise global companies for potential consideration.

Quality and Growth Characteristics

Travel companies can exhibit highly cyclical behaviour. To potentially mitigate this characteristic, earnings growth and quality characteristics are incorporated to provide more attractive fundamental exposure while enhancing portfolio diversification.

Summary

We believe that global travel provides a compelling secular growth opportunity, backed by both surging demographics driving demand and technological innovation enhancing the supply and access to new and unique experiences and services.

An approach that incorporates both direct travel companies and travel beneficiaries, along with fundamental earnings growth and quality considerations, may provide investors with favourable investment outcomes.