Has the golden era of private credit lost its shine? We don’t think so

SuperReturn North America was an event to remember - one of the highlights was an engaging session with Nayef Perry, Head of Direct Credit Investments at Hamilton Lane, who shared his outlook on the evolving private credit landscape. Amidst a backdrop of monetary easing and a resurgence in banking, Nayef examined whether the golden era of private credit may be shifting. Looking ahead, the future of private credit remains a hot topic. For those keen on exploring this further, the SuperReturn International Private Debt Summit will be another prime opportunity to hear from industry leaders as they discuss the next phase of private credit in 2025 and beyond. For now, have a read of an exclusive report by Hamilton Lane on the matter.

Have investors missed the "golden era" for private credit?

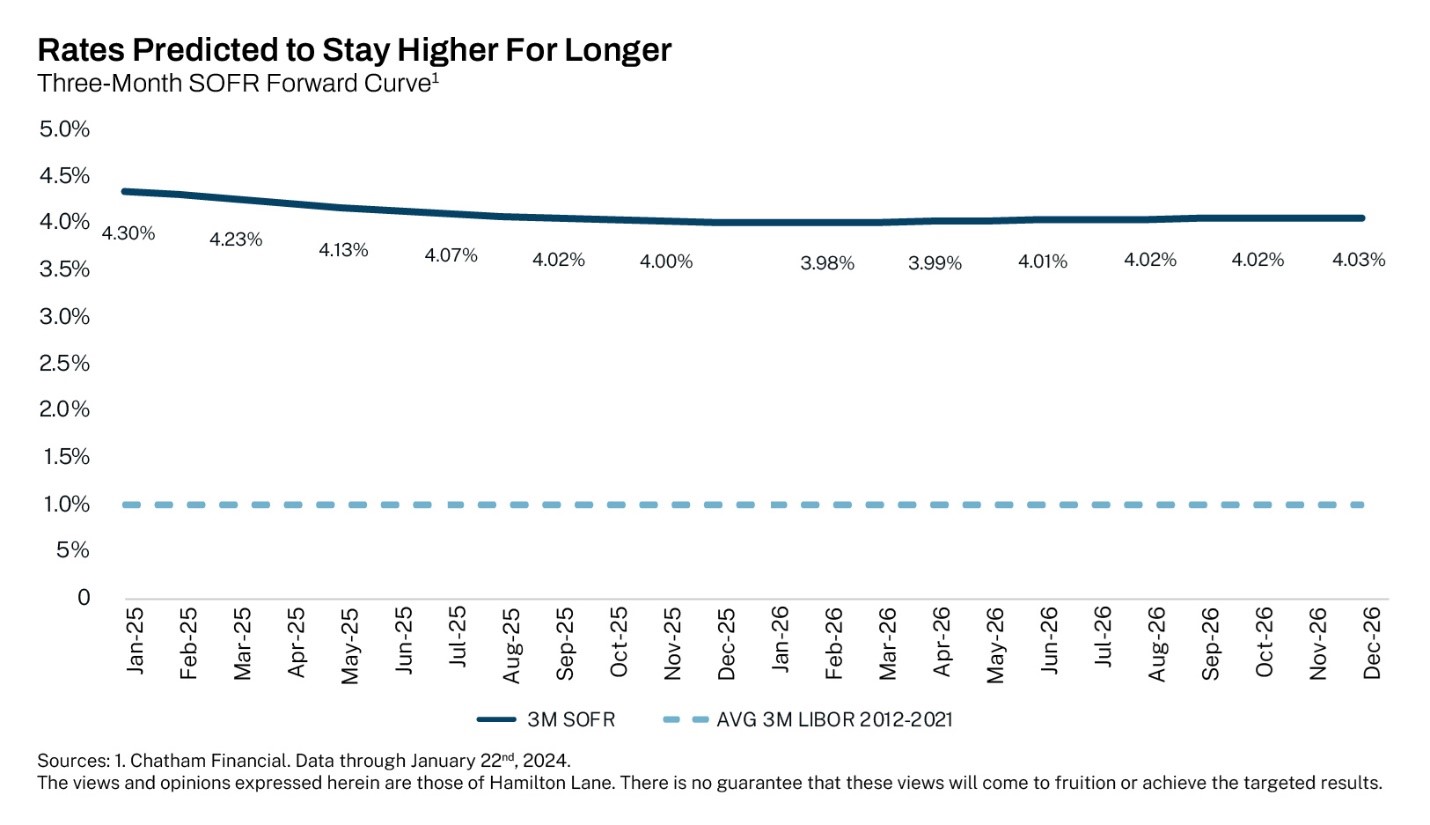

Despite three rate cuts in 2024 and more anticipated, private credit investors are well-positioned to enjoy higher yields for longer, which suggests the golden era has room to run and investors have not missed it. Where this is most evident is in the forward SOFR curve, which is U.S. private credit’s typical reference rate. Looking ahead, private credit investors are poised to benefit from ~300 basis points (bps) of enhanced floating yield, relative to the decade preceding 2022’s rising interest rate environment.

Looking at the chart below, as of January 29, 2025, the three-month Term SOFR was 429 bps with a forward target between 3.9% and 4.2% over the next decade. If we compare that to the three-month LIBOR in the decade preceding 2022, it averaged less than 1%, leading to a reliance on the typical LIBOR floor of 1% for private credit deals during that period. The difference between the forward SOFR curve and historical LIBOR is where we expect investors will enjoy more floating yield.

From a policy perspective, the Federal Reserve’s December rate cut was also accompanied by Federal Open Market Committee (FOMC) member forecasts, which reflected expectations for fewer and slower additional Fed interest rate cuts through the end of 2025, 2026 and 2027 than the FOMC forecasted in September 2024. Compared to September figures, median forecasts of interest rates were raised to 3.9% for the end of 2025, up from 3.4%, and 3.4% for the end of 2026, up from 2.9%. Yet another higher-for-longer data point.

While these are simply forecasts, the velocity of rate changes will ultimately be influenced by various factors. The Fed will likely ease policy more slowly if inflation remains elevated. Some of the negative forces on inflation could include changes in trade and immigration policy, supply chain disruption caused by geopolitical events, stronger-than-expected household spending and persistent housing cost increases. On the other hand, policy easing could take place more rapidly if labor market conditions deteriorate, economic activity weakens or if inflation returns to 2% more quickly than anticipated.

Regardless of the velocity of rate changes, what the FOMC forecasts have made clear is that interest rates are range-bound to approximately 3% in the next few years, pointing to a higher-for-longer rate environment. It is also worth noting that the probability of rate increases in 2025 is not 0% given the potential risks to inflation.

Is too much money being raised in private credit?

Having distributed my time across five continents in 2024, investors consistently asked me, “Is private credit too crowded? Is too much money being raised?” I often responded in a respectful, convivial way: “Unequivocally, no. Take a breath with me and let’s look at the fundamentals.”

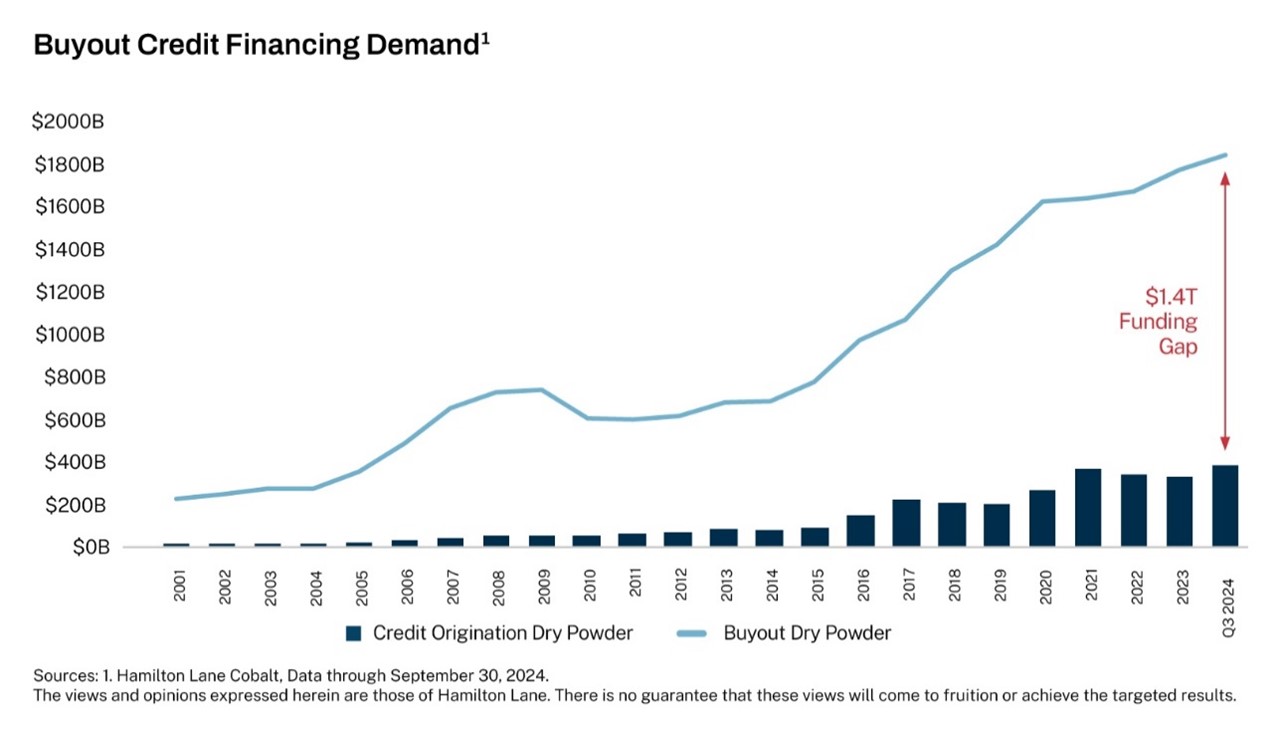

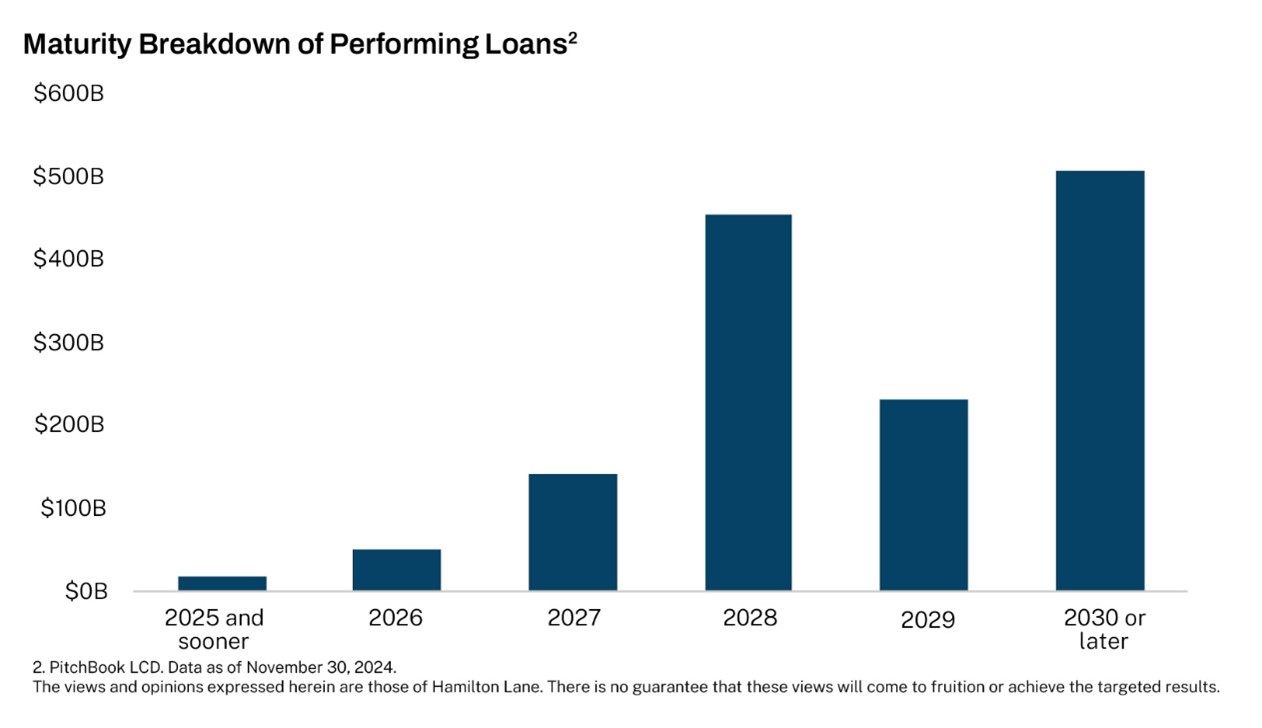

As of Q3 2024 there was a $1.4 trillion funding gap between the amount of private equity buyout dry powder raised and the amount of credit origination dry powder raised. If we marry that figure to a growing maturity wall of over $700 billion in performing loans through 2028, we estimate that there is comfortably a $2 trillion funding gap over that period.

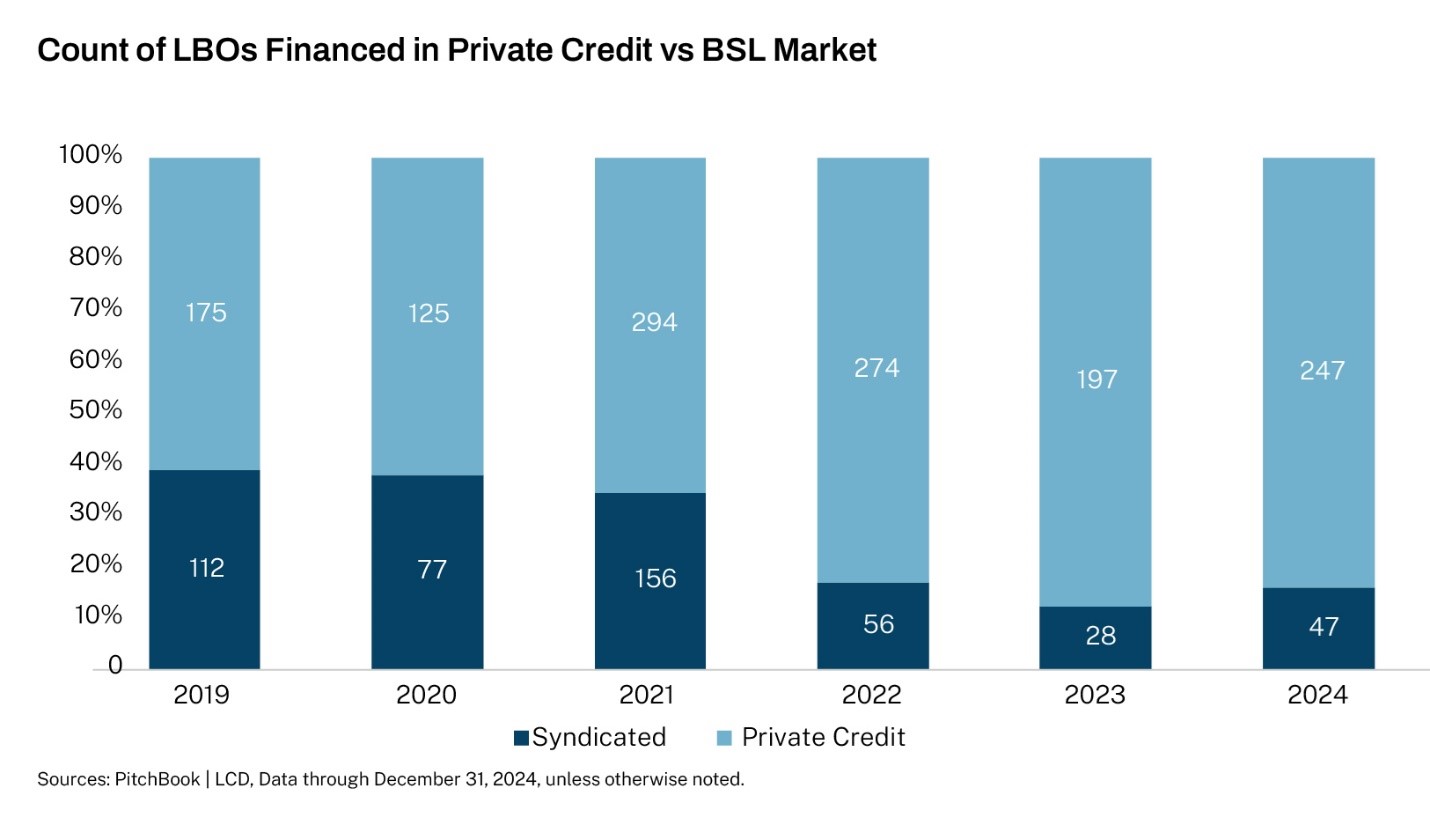

I know what you are thinking: "Wont the banks fill that gap?" It's unlikely, and for two reasons. First, bank regulation following the global financial crisis (GFC) helped to accelerate market share gains by non-bank lenders, a trend that was already underway. Look at the count of leveraged buyouts (LBOs) financed in private credit versus the broadly syndicated market over the past 5-6 years. Private credit execution has meaningfully outpaced bank-led LBO financing.

Secondly, private credit can offer borrowers numerous benefits over public financing alternatives, despite being more costly. Some of those benefits include:

- Closer relationships

- Speed of execution

- Greater financing certainty

- Ability to understand complexity

- Stricter confidentiality

Is private credit's consistent performance too good to be true?

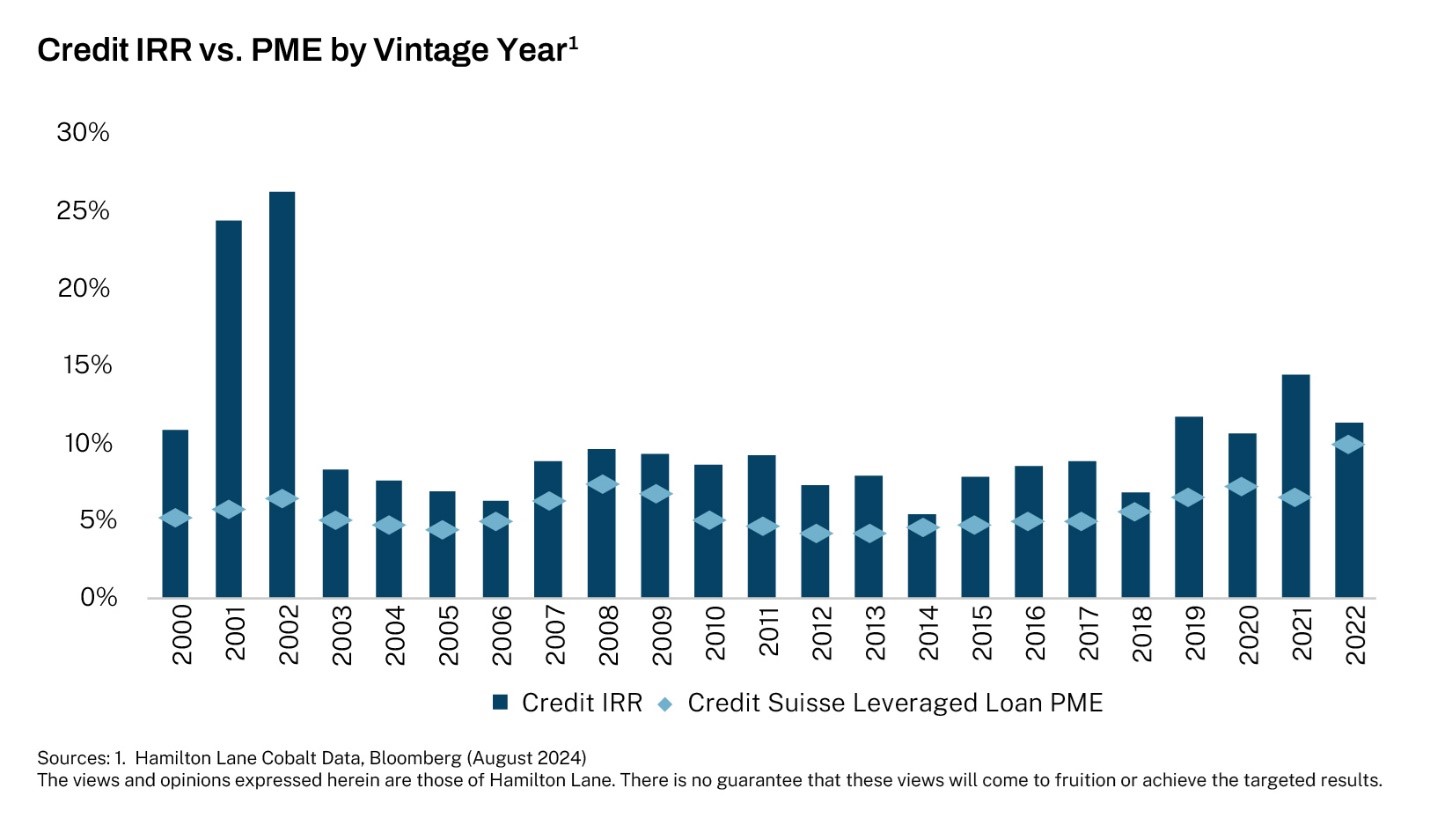

Private credit has demonstrated positive vintage year IRR in every year for the past 23 years and has outperformed the Credit Suisse Leveraged Loan Index (a public market equivalent) in every vintage year. Pause and think about that.

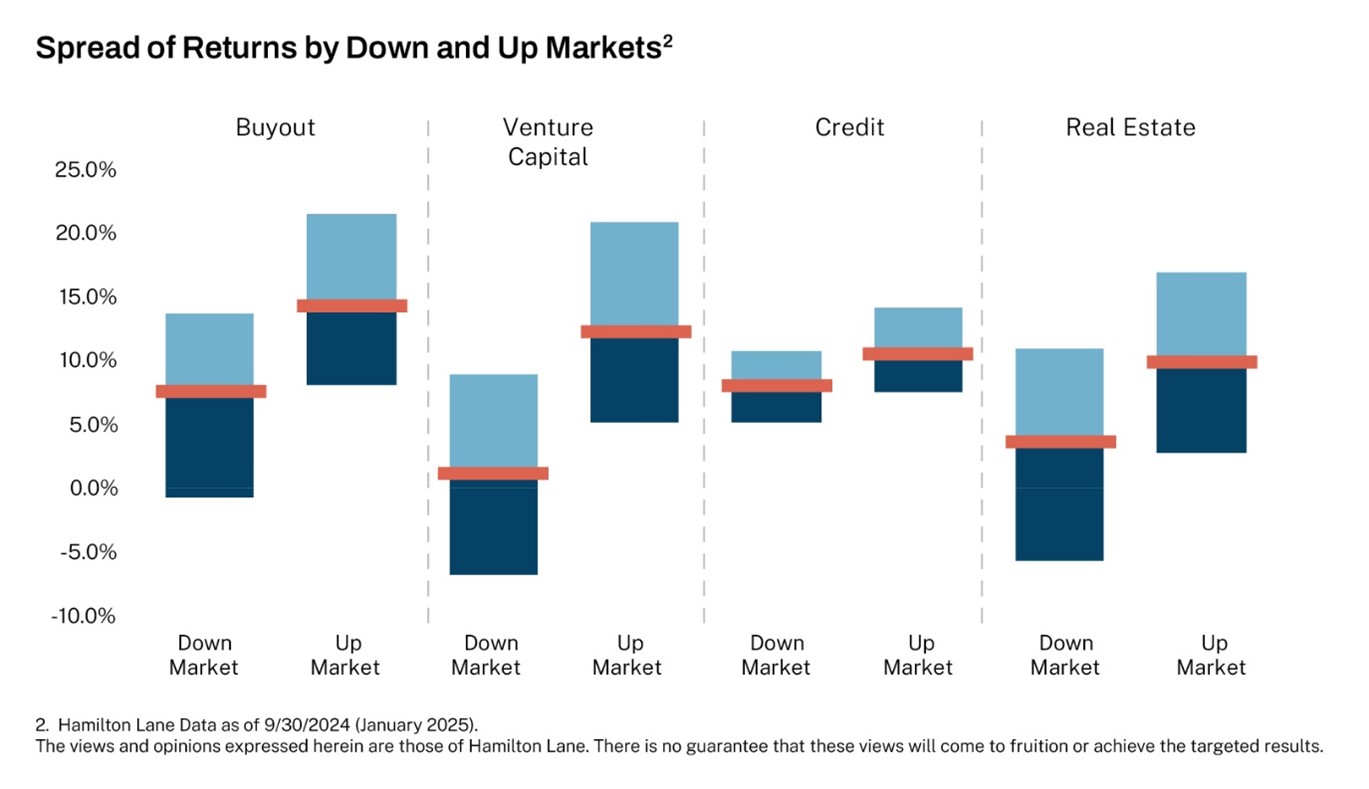

The asset class has experienced three recessions over that period. And not only has it demonstrated consistent performance over long periods, but it has also done so with the narrowest spread of returns in up and down markets relative to other private markets assets. It makes you wonder if private credit is simply the golden asset class. Forget eras. Overall, we remain confident that private credit is favourably positioned to continue delivering consistent performance and yield to investors amidst an evolving landscape.

****

Strategy Definitions: All Private Markets – Hamilton Lane’s definition of “All Private Markets” includes all private commingled funds excluding fund-of funds, and secondary fund-of-funds.

Corporate Finance/Buyout – Any PM fund that generally takes control position by buying a company.

Credit – This strategy focuses on providing debt capital.

PME (Public Market Equivalent) – Calculated by taking the fund cash flows and investing them in a relevant index. The fund cash flows are pooled such that capital calls are simulated as index share purchases and distributions as index share sales. Contributions are scaled by a factor such that the ending portfolio balance is equal to the private equity net asset value (equal ending exposures for both portfolios). This seeks to prevent shorting of the public market equivalent portfolio. Distributions are not scaled by this factor. The IRR is calculated based off of these adjusted cash flows.

Venture Capital – Venture Capital incudes any PM fund focused on financing startups, early-stage, late stage, and emerging companies or a combination of multiple investment stages of startups.

Real Estate – Any closed-end fund that primarily invests in non-core real estate, excluding separate accounts and joint ventures.

Private Equity – A broad term used to describe any fund that offers equity capital to private companies.

Real Assets – Real Assets includes any PM fund with a strategy of Infrastructure, Natural Resources, or Real Estate. DM Buyout – Includes any buyout fund that is primarily investing in developed markets of North America, Western Europe and Global.

VC/Growth – Includes all funds with a strategy of venture capital or growth equity.

Natural Resources – An investment strategy that invests in companies involved in the extraction, refinement, or distribution of natural resources.

Infrastructure – An investment strategy that invests in physical systems involved in the distribution of people, goods, and resources.

Index Definitions:

Credit Suisse Leveraged Loan Index – The CS Leveraged Loan Index represents tradable, senior-secured, U.S. dollar-denominated non-investment grade loans.

MSCI World Index – The MSCI World Index tracks large and mid-cap equity performance in developed market countries. BofAML

High Yield Index – The BofAML High Yield index tracks the performance of below investment grade U.S. dollar-denominated corporate bonds publicly issued in the U.S. domestic market.

MSCI World Energy Sector Index – The MSCI World Energy Sector Index measures the performance of securities classified in the GICS Energy sector.

DJ Brookfield Global Infrastructure Index – The DJ Brookfield Global Infrastructure Index is designed to measure the performance of companies globally that are operators of pure-play infrastructure assets.

Disclosures:

This document has been prepared solely for informational purposes and contains proprietary information, the disclosure of which could be harmful to Hamilton Lane. Accordingly, the recipients of this document are requested to maintain the confidentiality of the information contained herein. This document may not be copied or distributed, in whole or in part, without the prior written consent of Hamilton Lane.

There are a number of factors that can affect the private markets which can have a substantial impact on the results included in this analysis. There is no guarantee that this analysis will accurately reflect actual results which may differ materially. These valuations do not necessarily reflect current values in light of market disruptions and volatility experienced in the fourth quarter of 2020, particularly in relation to the evolving impact of COVID-19, which affected markets globally.

The information contained in this presentation may include forward-looking statements. Forward-looking statements include a number of risks, uncertainties and other factors beyond our control which may result in material differences in actual results, performance or other expectations. The opinions, estimates and analyses reflect our current judgment, which may change in the future.

All opinions, estimates and forecasts contained herein are based on information available to Hamilton Lane as of the date of this presentation and are subject to change. The information included in this presentation has not been reviewed or audited by independent public accountants. Certain information included herein has been obtained from sources that Hamilton Lane believes to be reliable, but the accuracy of such information cannot be guaranteed.

This presentation is not an offer to sell, or a solicitation of any offer to buy, any security or to enter into any agreement with Hamilton Lane or any of its affiliates. Any such offering will be made only at your request. We do not intend that any public offering will be made by us at any time with respect to any potential transaction discussed in this presentation. Any offering or potential transaction will be made pursuant to separate documentation negotiated between us, which will supersede entirely the information contained herein.

The information herein is not intended to provide, and should not be relied upon for, accounting, legal or tax advice, or investment recommendations. You should consult your accounting, legal, tax or other advisors about the matters discussed herein.

Hamilton Lane (UK) Limited is a wholly-owned subsidiary of Hamilton Lane Advisors, L.L.C. Hamilton Lane (UK) Limited is authorized and regulated by the Financial Conducts Authority. In the UK this communication is directed solely at persons who would be classified as a professional client or eligible counterparty under the FCA Handbook of Rules and Guidance. Its contents are not directed at, may not be suitable for and should not be relied upon by retail clients.

Hamilton Lane Advisors, L.L.C. is exempt from the requirement to hold an Australian financial services license under the Corporations Act 2001 in respect of the financial services by operation of ASIC Class Order 03/1100: U.S. SEC regulated financial service providers. Hamilton Lane Advisors, L.L.C. is regulated by the SEC under U.S. laws, which differ from Australian laws. The PDS and target market determination for the Hamilton Lane Global Private assets Fund (AUD) can be obtained by calling 02 9293 7950 or visiting our website www.hamiltonlane.com.au. Hamilton Lane (Germany) GmbH is a wholly-owned subsidiary of Hamilton Lane Advisors, L.L.C. Hamilton Lane (Germany) GmbH is authorised and regulated by the Federal Financial Supervisory Authority (BaFin). In the European Economic Area this communication is directed solely at persons who would be classified as professional investors within the meaning of Directive 2011/61/EU (AIFMD). Its contents are not directed at, may not be suitable for and should not be relied upon by retail clients. As of March 12, 2025