Have classic buyout funds run their course?

Increased specialization is challenging funds to define where their next phase of growth will come from, said Bain & Company's Hugh MacArthur and Mike McKay. Read on for a brief summary on buyouts from their 2021 Global Private Equity Report.

For more than 30 years, buyout firms have stood at the center of the private equity industry. For the last 10, that position has been slipping.

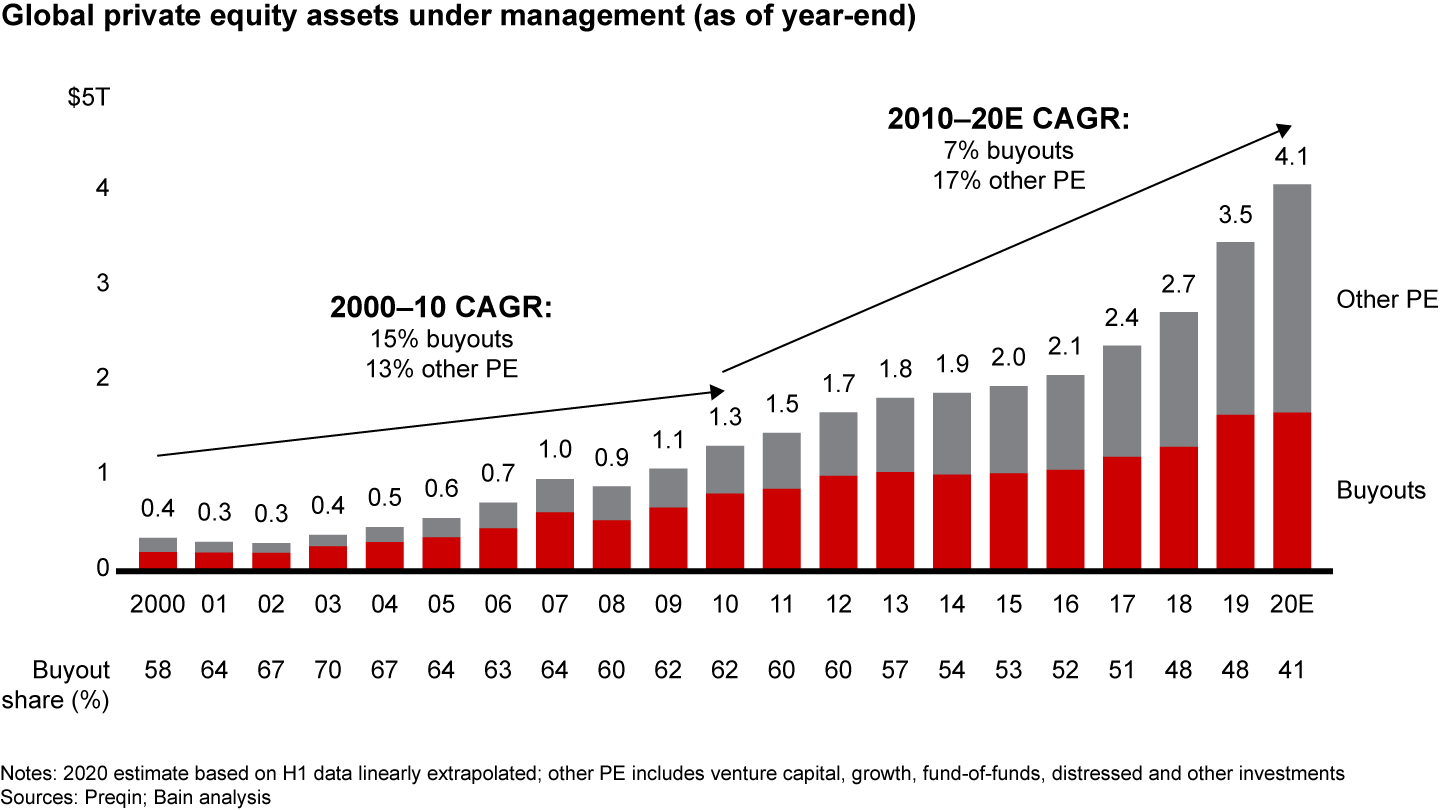

While assets under management held by buyout funds grew 7% compounded annually during the industry’s historic expansion over the past decade, other PE asset classes grew more than twice as fast. Buyouts are still the industry’s single largest category, but their share of global AUM shrank to 41% in 2020, down from 62% in 2010 (see Figure 1).

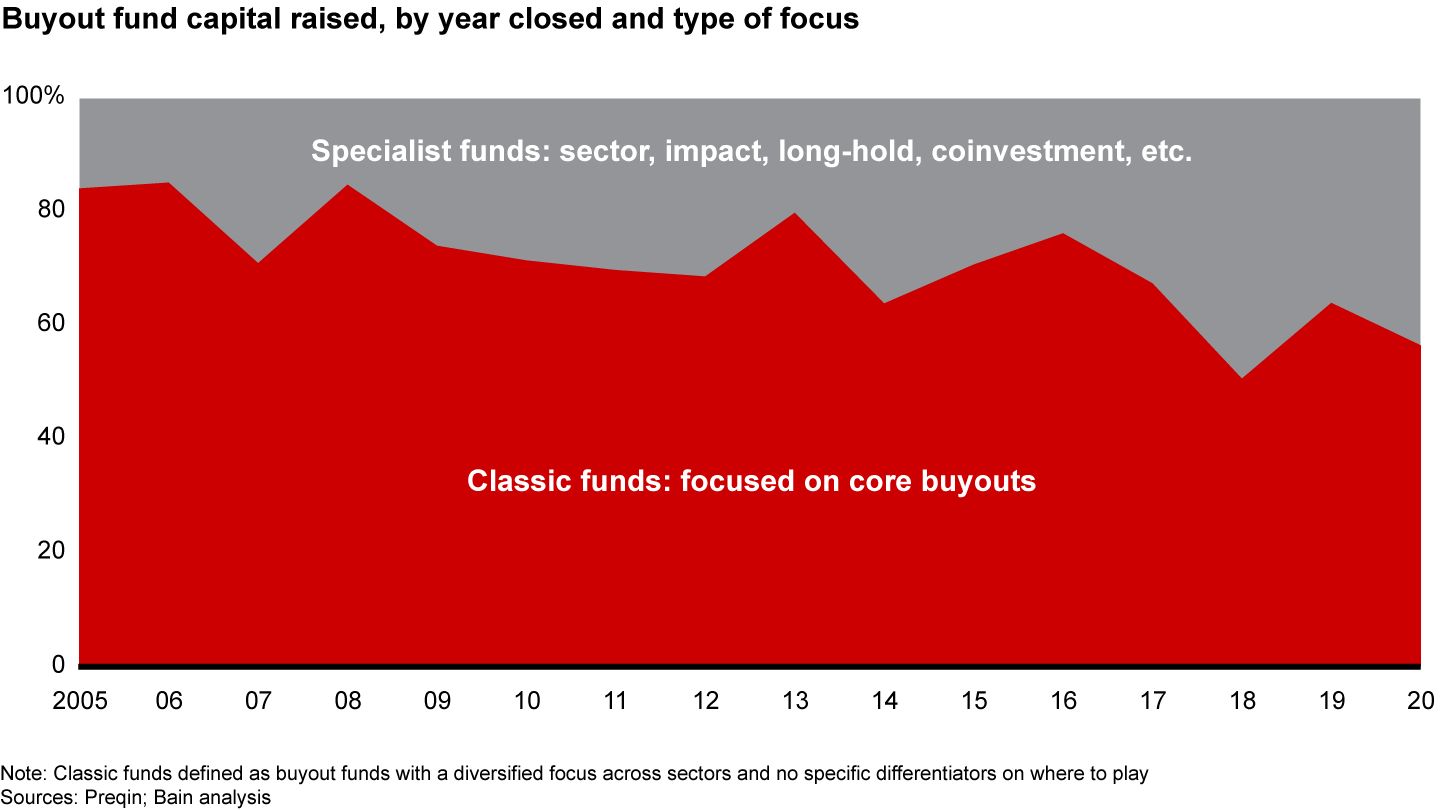

Growth within the buyout category has also shifted significantly. For the first two-thirds of private equity’s relatively brief history, the industry was shaped by the classic buyout fund, one geared to hunt for value in a number of industries and sectors with a diversified portfolio. Since 2010, however, these classic funds have been losing share to specialists—firms that have carved out clear areas of expertise and exploited them aggressively, including hyperfocused subsector funds, growth funds, impact specialists, long-hold funds, etc.

The share of capital raised for classic funds has slipped from a recent peak of 80% in 2013 to 56% at the end of 2020 (see Figure 2). Extending this trend line out another 5 or 10 years strongly suggests that classic buyout funds may have an increasingly harder time attracting new capital.

The uncomfortable middle

For a long time, the path to growth was clear. Adding value to the general partnership meant raising a bigger fund and doing more buyouts wherever you could find the best opportunities. But the last five years or so have been a different story. Unprecedented capital availability, fierce competition for assets and chronically high price multiples have turned up the heat on firms to find deeper insights, develop a better playbook and attract the best talent. That and a growing preference for specialization among limited partners have led to a rapid expansion of innovative new fund types.

This presents a special challenge for classic buyout firms in the market’s middle. On one flank, they are competing with diversified giants—funds like Blackstone, KKR and Carlyle that have permanent sources of capital, products in most segments and the resources to launch new ones with minimal risk to the business. On the other, they face innovative new funds like London-based Corten Capital, which is narrowly focused on technology-driven B2B services, or Cove Hill Partners, which specializes in long-hold funds. These scrappy, entrepreneurial funds were hatched as specialists. Their targeted, differentiated strategies are specifically tailored to current fund-raising trends.

Decision time

Classic buyout funds encountering these trends face fundamental strategic questions: With asset prices sky high and in no danger of falling, how can we continue to generate attractive returns unless we find a differentiated advantage, especially now that many LPs expect it? Moreover, how are we going to pay for it? Unlike the largest firms that can shift investment to a new strategy without taking much risk, that can be a bet-the-firm decision for a midsize player.

Making a bold move, however, may be the best way to change a firm’s trajectory. Consider Vista, which in 2000 started as a $1 billion fund focused on buying legacy software companies and making them more efficient. Recognizing that staying ahead in this red-hot industry would require deeper expertise, Vista steadily expanded into asset-class adjacencies within the sector that would help the firm participate in the complete software growth cycle and feed ideas to the core strategy.

Since 2010, it has launched several growth-equity funds to capture opportunities among rapidly growing adolescent software companies. In 2014, it expanded beyond equity to create a credit fund. It also launched a public equity long/short fund and in January 2021 raised $2.4 billion for a new long-hold fund. The firm now has more than $73 billion in AUM, and its success has inspired a number of other technology specialists, many of whom are scaling fast.

Avoiding stall-out

Bold moves like these begin with the realization that what worked over the past 20 years may not work as well in the coming 10. A market that clearly favors differentiated expertise requires firms to carefully assess what is going to make them stand out. So Audax has become a tightly focused buy-and-build specialist. Roark has turned consumer and business services expertise into a specialization in franchise and multilocation business models.

Firms that have successfully charted a new path for growth in the coming decade follow a logical sequence. They first define (with facts) where the firm is now, spelling out its core repeatable model for generating value. From that starting point, they focus their strategic inquiry in five areas:

- How can we adopt new products and adjacencies that capitalize on our strengths?

- Which sectors or subsectors are we prepared to go deep on—and really mean it?

- How can we use data, digital and advanced analytics to transform how we find and evaluate targets?

- What is our value-creation playbook, and is it both digitally enabled and distinctive?

- What is our ESG strategy, and do we truly understand how shifting consumer and employee motivations are changing the calculus for success in almost every industry?

Private equity investors have built an industry on the principle that hewing to the status quo is rarely a formula for creating new value. For many classic buyout funds, decision time is fast approaching.