In the cross-border funds industry, Hong Kong’s ambition to become a leading global fund center is no secret. Last year a major milestone was reached when Hong Kong signed an agreement with Switzerland for registered funds to be sold freely in each other’s markets. It is Hong Kong’s first formal agreement with a jurisdiction other than Mainland China and the first fund passport between an Asian and European jurisdiction. This year another key initiative is expected to go live that should further bolster the appeal of Hong Kong as a fund domicile.

Introducing the Open-ended Fund Company

Historically, open-ended mutual funds could only be established as unit trusts in Hong Kong. However, this year Hong Kong’s Securities and Futures Commission plans to introduce Open-ended Fund Companies (OFCs) as an approved structure. OFCs are corporate fund vehicles, similar to the fund structures commonly used in other global cross-border centers, such as Ireland and Luxembourg. Corporate fund structures are the preferred fund vehicle for cross-border distribution because OFCs tend to export better to jurisdictions where the unit trusts do not exist. Additionally, corporate fund vehicles may avail of double taxation treaty benefits on their underlying investments in a manner unit trust structures cannot, which makes them more attractive to investors.

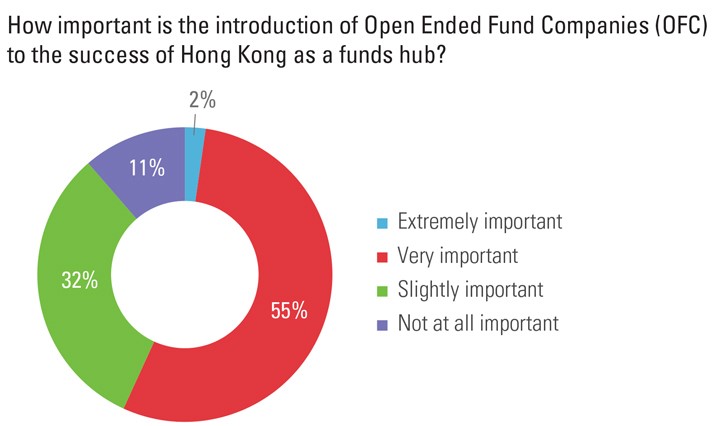

Last year we published a report titled Cross-border 2025: The Rise of Hong. The report analyzes the industry’s expectations for Hong Kong as a global fund domicile. When asked about the OFC, 55% of the respondents indicated that its introduction is very important to Hong Kong’s success as a fund domicile. Thankfully, for the industry, the OFC is a key priority for Hong Kong this year.

Taking a step back, the adoption of corporate fund vehicles is not limited to Hong Kong. Singapore and Australia have similar initiatives underway. Since both are rivals to Hong Kong in the race to become the leading Asian cross-border fund hub, this underscores the importance of OFCs for Hong Kong’s success.

Patience Needed

There is clear excitement in the industry over the potential of Hong Kong as a cross-border fund hub. In fact, 80% of the respondents think there is a medium to high chance that Hong Kong will be the leading Asian cross-border fund domicile in 2025. However, asset managers should assess these new opportunities in the context of their larger commitment to Greater China. Policymakers are looking to develop Hong Kong into a fund center and local substance requirements must be considered. Fund managers must have a physical presence in Hong Kong and will need to be registered and hold the appropriate local licenses.

Nonetheless, the creation of the OFC represents significant steps in Hong Kong’s evolution as a fund domicile. OFCs bring Hong Kong into alignment with the global cross-border market and this addition to Hong Kong’s cross-border toolkit should be welcomed by asset managers.

Part of this article was originally published in the 2017 Regulatory Field Guide. The guide features insights from a number of our experts on important regulatory developments for asset managers in the year ahead. Visit bbh.com/regulatoryfieldguide to explore the guide.

Brown Brothers Harriman are FundForum China Platinum sponsor at FundForum Asia, taking place in Hong Kong 24-26 April 2017. Find out more about Asia's leading asset management conference.

Disclaimer

The views expressed are as of 3/23/17 and are a general guide to the views of BBH. The opinions expressed are a reflection of BBH’s best judgment at the time, and any obligation to update or alter forward-looking statements as a result of new information, future events, or otherwise is disclaimed. Nothing contained herein is intended as a recommendation to buy or sell any security, or to invest in any particular country, sector or asset class. BBH is not affiliated with Fund Forum Asia. IS-2017-04-06-2783