European investors are paying less in fees, on average, than ever before. How is that affecting their investment choices?

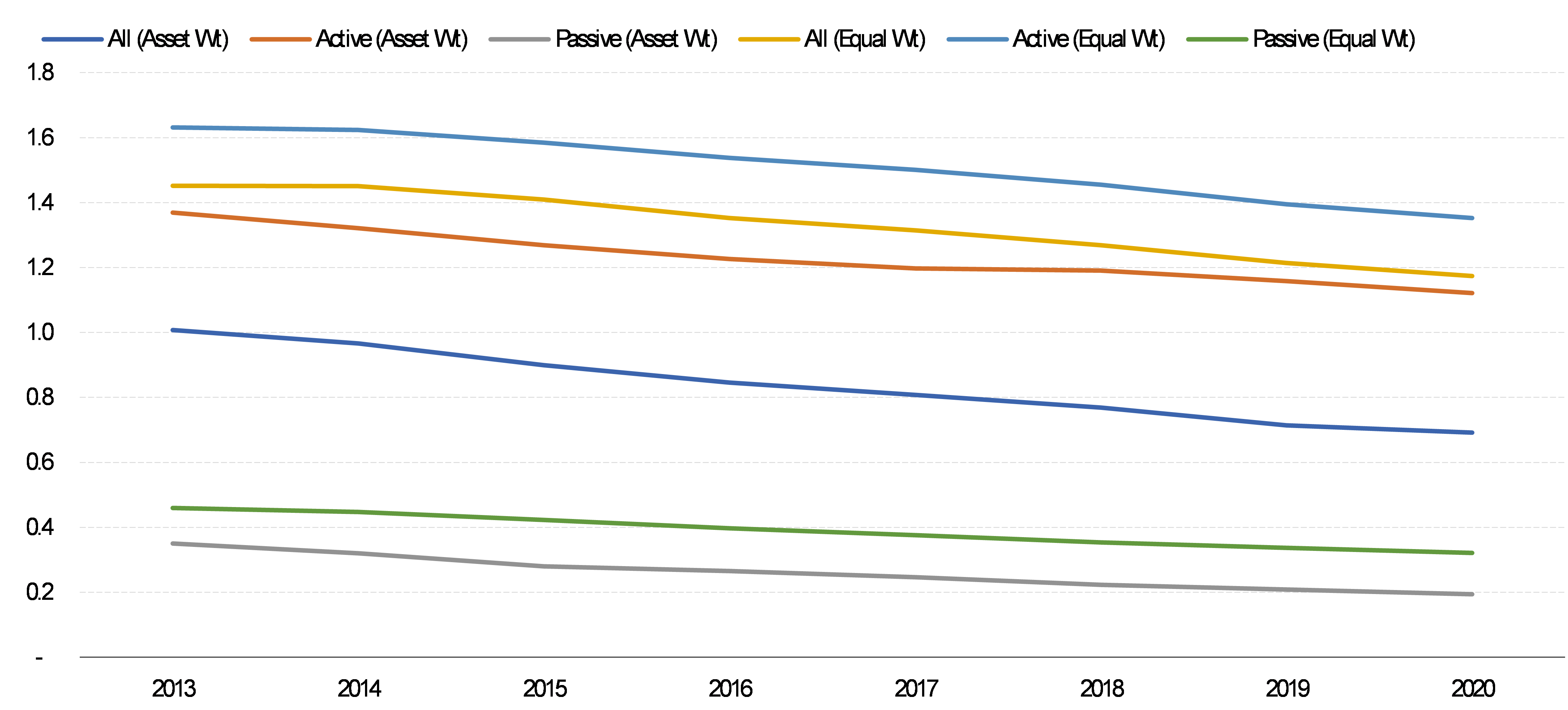

European investors are paying lower expenses, on average, than ever before. Morningstar has published a study in which we analyse trends in fees for a group of equity and fixed-income investment categories during the period from 2013-20. Our study found the asset-weighted average ongoing charge across funds, which measures the fees that investors paid for the funds in which they were invested during the period, was 0.69% in October 2020, a 31% decline from 2013.

Exhibit 1 Change in Fees

Source: Morningstar Direct. Data as of 30/10/2020.

The decline in fees is a big positive for investors. Morningstar research has demonstrated that fees are a reliable predictor of future returns. Low-cost funds generally have greater odds of surviving and outperforming their more-expensive peers. This is because fees compound over time and are a great detractor of returns.

Active and passive funds had declines in fees on both measures, but passive funds have led the charge. For example, the asset-weighted average fee for passive funds declined by 44% from 0.35% to 0.19%, while that for active funds dropped by 18% from 1.37% to 1.12%. These have been years of strong growth for the passive fund industry and providers have been engaged in a competitive fee war. Meanwhile, the decline in fees in the active fund space has been largely driven by net outflows from expensive to cheaper clean share classes or into passive funds.

Indeed, since 2013 investors have shown a clear preference for lower-cost propositions within the categories we analysed. The sum of flows into funds and share classes charging fees that rank within the bottom quartile of their category have consistently outpaced flows into funds and share classes in the more-expensive quartiles. Besides, within the cheapest-fee quartile, there is evidence of migration from active funds to passive ones.

The popularity of ESG

Acknowledging the increasing popularity of ESG investing, our study also analysed fee trends between the cohort of ESG and mainstream funds. One of the main questions that investors pose is whether choosing ESG funds comes at a fee premium relative to mainstream propositions. This question is particularly relevant for the group of investors who remain unsure of whether investing sustainably means sacrificing performance.

We found that, for the group of categories we analysed, the average fees charged by the consolidated cohort of ESG funds, that is, considering both active and passive funds, are lower than those for the group of non-ESG peers. In October 2020, the asset-weighted average fee for ESG funds was 0.57%, whereas it was 0.71% for non-ESG funds. Both ESG and non-ESG funds have seen fees fall since 2013. The average fee for ESG funds dropped by 42% and for non-ESG funds by 29.6%.

However, when looking separately at active and passive ESG relative to their non-ESG counterparts we found that while fees for active ESG funds are lower than those for non-ESG funds, fees for passive ESG funds are higher than those for non-ESG funds. This can be explained by the fact that many passive non-ESG funds in popular categories such as U.S. large-cap blend equity charge rock-bottom fees. However, with flows into ESG investments growing exponentially, there are already signs of fee competition in ESG products amongst passive fund providers.

The flows picture in 2019 and 2020 for ESG is structurally biased toward funds in the more-expensive quartiles. This has been particularly so in the case of passive ESG funds. This is because in cheapest-fee quartile we typically find funds which only apply basic exclusions, whereas funds that combine exclusions and best-in-class selection, and which investors now prefer, fall into the more-expensive fee quartiles.

Overall, we expect fee competition to remain a feature of the European fund market in years to come. Low-cost passive funds continue to grow market share, and this is putting pressure on active fund houses to provide more competitive offerings. This is great news for investors as they will be able to keep more of their investment.