How is your positioning during volatile fixed income markets?

If you have often thought about improving your positioning during volatile fixed income markets, Samantha Azzarello and Jordan K. Jackson, J.P. Morgan Asset Management give their verdict.

There were very few places to hide from volatility in 2018. U.S. equity markets were down for the year and fixed income did not fare much better with the Barclay’s U.S. Aggregate flat, providing no buffer to equity market losses. Unfortunately, 2019 may prove to be another challenging year for fixed income investors.

The slow unwinding

For one, the Federal Reserve is expected to hike rates at least once more this year and will continue the slow unwinding of the balance sheet. While there is still a degree of uncertainty with many macroeconomic factors that impact interest rates, the path of least resistance for rates still appears to be up.

With that in mind, investors still need exposure to the asset class while being appropriately positioned for interest rate volatility and late-cycle market jitters. In a volatile environment a fixed income strategy which can withstand price volatility as rates move and provide protection from a downturn or potential recession are key.

Within a portfolio this means increasing exposure to short-dated Treasury assets and gradually adding high-quality duration.

Lowering sensitivity to rising rates through short duration

With the Federal Reserve expected to raise rates again in 2019, the short end of the curve should move higher. Contrast that with long rates which are less influenced by the Fed and more influenced by lower inflation and growth prospects. On net, we think it is likely that the curve will continue to flatten in 2019.

Adding short-term securities to a portfolio lowers volatility mainly by decreasing the portfolio’s overall duration or sensitivity to rising interest rates. Because short-term bonds have shorter durations and therefore are not as sensitive to changes in interest rates, they will have a lower price volatility as rates move.

Moreover, investors are now able to enjoy positive real yields (inflation-adjusted) and in turn better income from this type of investment. The steady increase in yields on short-term treasuries provides a cushion against rising interest rates.

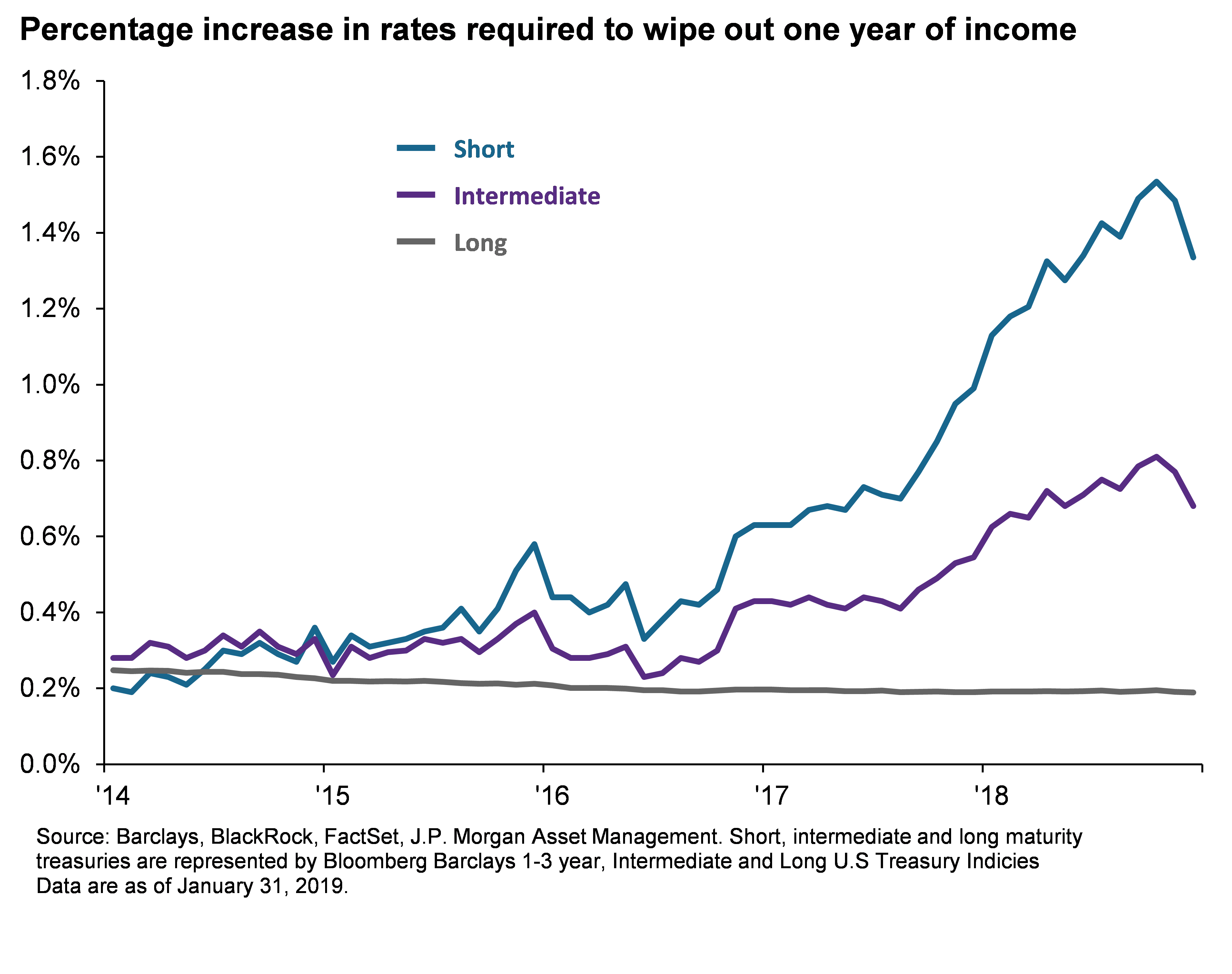

As shown below, interest rates would have to move up more than 1% (a scenario we do not see as likely) to wipe out a year of income received from the coupons. This cushion is far greater on short-term maturities than on longer-dated maturities.

Adding high-quality duration

Whether an investor believes we are mid, late or late-late cycle, we think many portfolios could benefit from adding high-quality duration. Duration helps to shield investors from stock and bond volatility and, most importantly, a recession; both of which are inevitable, particularly given our position in the cycle.

While there is no imminent recession in sight, the probability of a recession increases dramatically over the next two to three years. With added uncertainty around trade and US politics, any exogenous shock increases the risks of pushing the economy into a recession. These variables imply that duration should have a welcome place in a portfolio.

Also, as mentioned previously, yields might not have much more room to climb, therefore limiting negative price returns. While by historical standards yields seem low, they have increased substantially from July 2016 when the ten-year Treasury yield bottomed.

Even with the Fed on course to continue raising rates there are still structural downward pressures on the long end of the yield curve – including foreign demand for treasuries and lower growth and inflation in the U.S and overseas.

Capital depreciation has been a headwind for fixed income investors because of rising yields and that dynamic should continue, albeit less severely in 2019.

Importantly, when the next recession hits we will undoubtedly see yields retreat once again and benefit bond investors through capital appreciation.

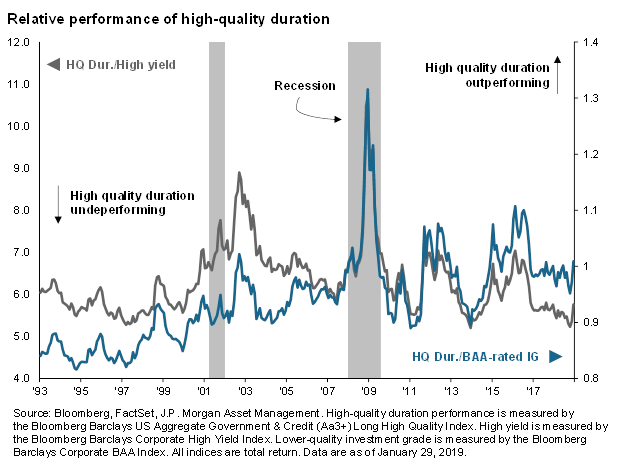

As shown, high-quality duration expressed through long-dated Treasuries and higher quality investment grade credit outperforms lower credit quality bonds in the later-stages of the economic cycle and through a recession.

Within credit, investors should also consider moving up the quality spectrum and avoid over-exposure to names right at the cusp of Investment Grade and High Yield.

The recommended approach

For fixed income investors, while rising rates implies short-term pain, there are now viable ways to take advantage of that increased income. Moreover, higher yields from fixed income and late-cycle protection implies duration deserves a second look.

In the later stages of the economic cycle a dual-approach to fixed income investing is warranted to take advantage of real income and hedge risk.