How sustainability is transforming the economy and creating opportunities for investors

The climate transition and the drive to create a more inclusive society are transforming the global economy. If the past year has taught investors anything, it’s that the process is going to be unpredictable.

The decade prior to 2022 saw a rapid expansion of the sustainable investing theme, propelled by swelling investor demand and the multiplying commitments of governments and companies to address climate change and social inequality. Last year’s market volatility delivered a reality check, as the spiralling cost of living and energy supply concerns exacerbated by the war in Ukraine shifted attention to immediate economic issues.

Yet while 2022 may have brought the honeymoon for sustainable investing to an end, it did not derail the underlying economic restructuring. In fact, the sustainability transition could be accelerated by factors such as the energy shock, which underscored the need for securing natural gas from alternative suppliers while increasing ambition for renewables. For investors, understanding this process will be essential to managing their assets effectively in the years ahead.

Uniting to drive the sustainable transition

We are in the midst of one of the biggest secular macroeconomic shifts in memory, powered by a strengthening global consensus on the need to address climate change and social inequality. Transformative changes are needed throughout the economy, driven by a united effort that includes supportive public policy and rapid advances in technology.

Reshaping the economy will require investment in companies and their value chains across all sectors. To make this happen, mobilizing capital at scale will be critical. For example, Goldman Sachs Global Investment Research estimates that the price tag for decarbonising 75% of the global economy now stands at $3.1 trillion per year.

Reality check for sustainable investing

Market volatility and the surging price of energy in 2022 gave a lift to companies such as traditional energy producers that many sustainability-focused investors had typically omitted from their portfolios. This served as a drag on sustainable investing strategies, as reflected in the underperformance of MSCI’s five main ESG stock indices compared with the broader market1.

While this market turmoil was challenging for sustainable investing, we believe its strategic consequences will potentially support economic transformation. The sustainability investment case remains strong, supported by resilient investor demand, and global resolve to achieve key sustainability goals remains robust. Companies and governments have continued to commit to reducing greenhouse gas (GHG) emissions in line with the overall goal of achieving net zero emissions by 2050.

The challenges of 2022, in particular the energy security issues in major European economies, could also accelerate the energy transition by boosting efforts to develop and deploy sustainable alternatives to fossil fuels. Despite some short-term setbacks such as increased reliance on coal2, we believe last year’s energy shock has strengthened longer-term incentives to advance the shift to renewables and increased electrification.

Creating the right incentives

A successful transition will require a swift ramping up of investment. For example, the nearly 190 countries that signed the UN’s landmark Kunming-Montreal Global Biodiversity Framework in December aim to mobilize at least $200 billion per year in biodiversity-related funding from public and private sources3. To muster private capital on this scale, public policy must create the right incentives, especially in high-emission, hard-to-abate sectors such as industrial, transport, energy, chemicals and construction.

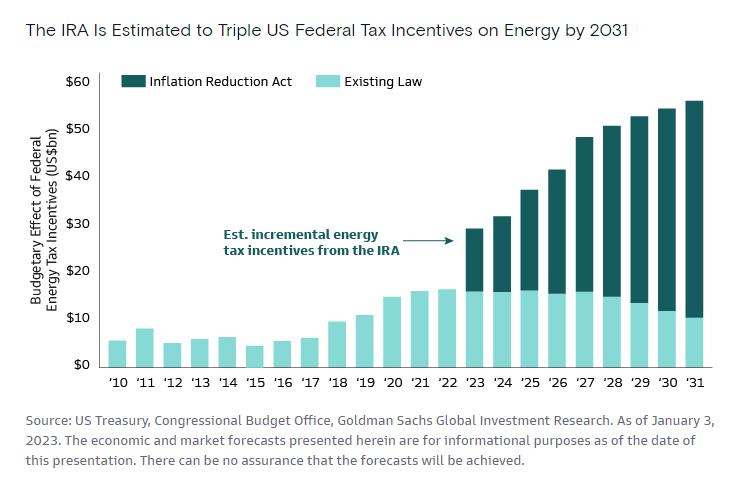

Recent evidence shows that policy makers are getting the message. For example, in 2022 the US finalised the Inflation Reduction Act (IRA), which includes climate-related measures designed to accelerate the transition to a clean energy economy. The Act unleashes more than $390 billion in federal support for climate and energy initiatives over 10 years, with about $270 billion of that coming in the form of incremental tax incentives4.

Finding transformative investment opportunities

We believe companies that transition successfully will be best positioned for success in the new sustainable economy. For investors, this is not an impact bet but an understanding of where the economy is going, and the task is to be the smartest at spotting opportunities amid the turbulence.

Green solution providers are essential to facilitating the transformation, but they cannot do it alone. We depend on an enormous range of products from traditional industries, and the biggest investment opportunities will likely be found in these sectors. If companies such as producers of energy and building materials navigate the transition well, they can become leaders in the sustainable economy.

To find the companies, sustainable investors will need to broaden their scope. Many investment strategies that incorporate environmental, social and governance (ESG) criteria have a bias towards “pure play” sustainable business models and hold fewer stocks from high-emission sectors. This creates an opportunity for investment strategies focused instead on the transformation of heavy industry and high-GHG sectors where the potential for real-world impact is the greatest.

The global economy is changing fast, propelled by a long-term regime shift around sustainability. This creates both new risks and new opportunities for investors. Embedding a forward-thinking, transformative approach in investment decisions and financial products will be crucial for future investment returns and prudent risk management. Such an approach has the potential to generate robust returns and make a positive contribution to the transformation of the economy. By guiding investors and the companies they invest in on their sustainability goals, this approach can also deliver greater impact for society.

Goldman Sachs were Gold Sponsors of IMpower 2023. Find out more about the event here >>

[1] “The Performance of ESG Indexes: Year in Review,” MSCI. As of January 31, 2023. The broader market is represented in this comparison by MSCI’s flagship global index, the MSCI ACWI. MSCI explains in the report that its ESG indexes historically had lower relative allocations to the energy sector and higher allocations to information technology. These allocations contributed to the outperformance of ESG indexes in the decade before 2022, but this did not hold true last year.

[2] “The world’s coal consumption is set to reach a new high in 2022 as the energy crisis shakes markets,” International Energy Agency. As of December 16, 2022.

[3] “Press Release: Nations Adopt Four Goals, 23 Targets for 2030 In Landmark UN Biodiversity Agreement,” United Nations. As of December 19, 2022.

[4] “10 Predictions for Sustainable Investing in 2023,” Goldman Sachs Global Investment Research. As of January 3, 2023.

Glossary

Greenhouse gases absorb infrared radiation and trap heat in the atmosphere. This so-called greenhouse effect is associated with global warming. Examples include carbon dioxide, methane and nitrous oxide.

Green solutions are products, strategies and technologies that contribute to reducing greenhouse gas emissions and mitigating environmental impact. Examples include renewable energy technologies, energy-efficient buildings and sustainable agriculture practices.

MSCI ACWI is a market capitalization weighted index designed to provide a broad measure of equity-market performance throughout the world. It comprises of stocks from 23 developed countries and 24 emerging markets.