Banks and insurers are spending significant time, effort and money on their climate risk programmes right now. But embedding climate risk successfully in decision-making in the first and second lines is challenging. Here, we set out the five key lessons learnt from supporting several of the early movers on their climate change journeys.

Lesson 1: Scope your climate risk management target state tightly – a “plan for a plan” will not survive

If you want to ensure that you can stand behind your climate risk programme scope – and therefore the funding and resourcing – make sure you have a clear articulation of the target state for each risk type at each stage of the risk management lifecycle.

This clarity – which can be summarised in around 30 capability statements – is key to your ability both to keep control internally of your programme scope, and to demonstrate holistic thinking to your regulators and auditors.

Lesson 2: Risk and finance must work in partnership with the businesses

Many CROs find themselves in charge of their banks’ climate data and analytics – and as a result becoming the de facto “climate change centre of excellence” in their organisations. However, Finance also has a critical role to play, for example in embedding net zero targets in business planning and in the internal incentives required to drive origination in line with those targets.

Working in partnership with the businesses to help them to see climate change not as a constraint on the business, but as a driver of growth opportunities, is also critical to the long-term success of your climate change programme (see step 3 below).

Lesson 3: Get specific about the opportunities to finance transition in order to engage businesses

The first line may not get over excited by risk management. Find ways to get them engaged in the topic through a combination of:

- Content rich, sector-specific training on how transition may play out in different sectors, and when and where the “tipping points” to financing transition may materialise

- Counterparty engagement that enables the business to identify new opportunities to finance transition, while also gathering the information that you need to assess counterparties’ transition plans. Recently, a Baringa client engaged its top 2,000 counterparties on their transition plans, significantly deepening its customer relationships

- Providing businesses with counterparty-level scenario analysis outputs that enables them to have an informed conversation with their clients on climate change.

Lesson 4: Don’t rush to set climate risk appetite

Although you may feel the pressure to set climate risk appetite, it is likely to lead to “tissue rejection” from the businesses if it is not based upon metrics that they: understand; sign-off; can forecast; and control.

Instead, use your climate risk MI to develop a view of the metrics that will, over time, meet these criteria and enable you to manage concentrations of climate risk.

Lesson 5: Use climate scenario analysis to stimulate discussion of the relative winners and losers in your portfolio - bottom-up, asset-level modelling is critical

Through Aladdin Climate BlackRock is on a journey to support the industry in managing climate risk and the transition to a net zero economy

As a practitioner, BlackRock’s own journey of embedding climate risk and net zero consideration in our processes has offered invaluable insights on the matter. To address the needs of our clients and our investment platform, we have developed modelling capabilities for transition risk, physical risk, temperature alignment/net zero and climate scenario expansion.

To maintain and further develop Aladdin, our enterprise and risk platform, and Aladdin Climate, our climate analytics toolkit, we are making significant investments (as of 30 September 2021):

- More than 5000 experts (of >20k total staff) are dedicated to the Aladdin platform

- More than 2000 FTEs are dedicated to R&D for Aladdin, including over 100 for development and servicing of Aladdin Climate

- More than 260 institutions globally use Aladdin, with around 40 using Aladdin Climate

This means the development of Aladdin Climate benefits not only from BlackRock’s own IP (with $9.46 trn AUM behind it), but also collective user feedback of the broader Aladdin Climate user community.

Why the need for centralized climate analytics and what are key considerations?

Through our own journey and our experience supporting the industry in their journeys, some key lessons have emerged:

- One holistic platform combining transition risk, physical risk and net zero views across functions enables a more seamless integration

- A high degree of methodological flexibility and modularity to cater for each function’s unique use case is key

- To extract actionable insights a granular counterparty level analysis as well as a portfolio view is required

- Comprehensive sector and asset class model coverage incl. consistent data, methodology and coherent underlying assumptions is a key differentiator

- To future proof, robust infrastructure is critical to improve usability, enable sound model and data governance and maintain audit trail

Transition risk: Climate risk can already play out in the short to medium term for some counterparties

Whilst climate transition risk will likely be prominent in the long-term, institutions need to be able to identify the exposures presenting a more imminent risk now.

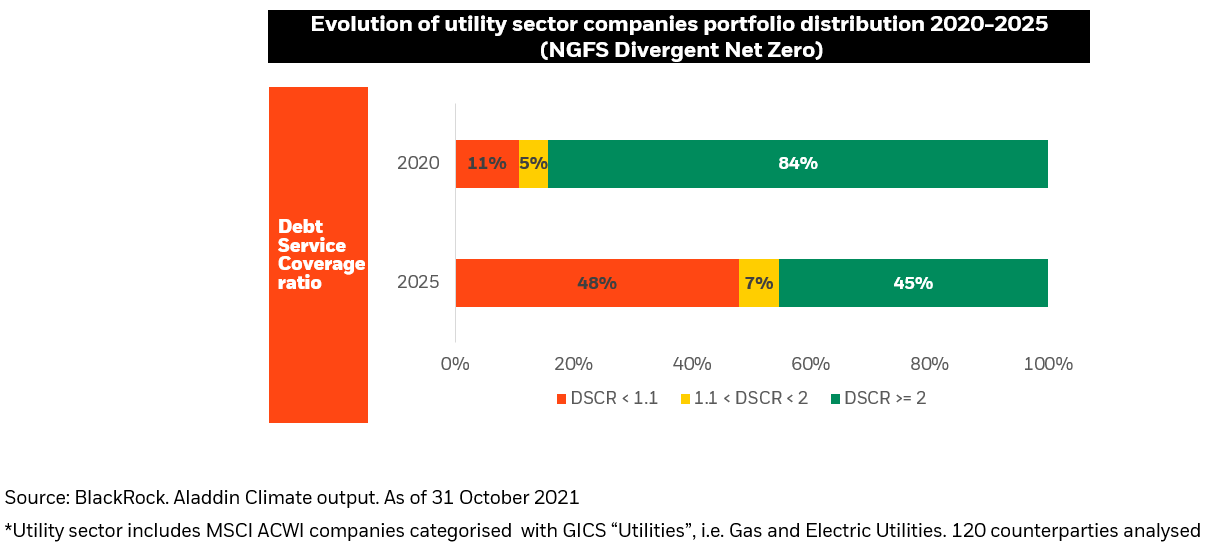

Based on an initial analysis of 120 global counterparties in the power utilities sector, it can be observed that almost half of these companies will have a Debt Service Coverage Ratio (DSCR) below 1.1 by 2025 in the NGFS Divergent Net Zero 2050 scenario, which may warrant further consideration in banks’ risk management process today.

Transition risk: Having granular counterparty views is key to identify vulnerabilities and opportunities

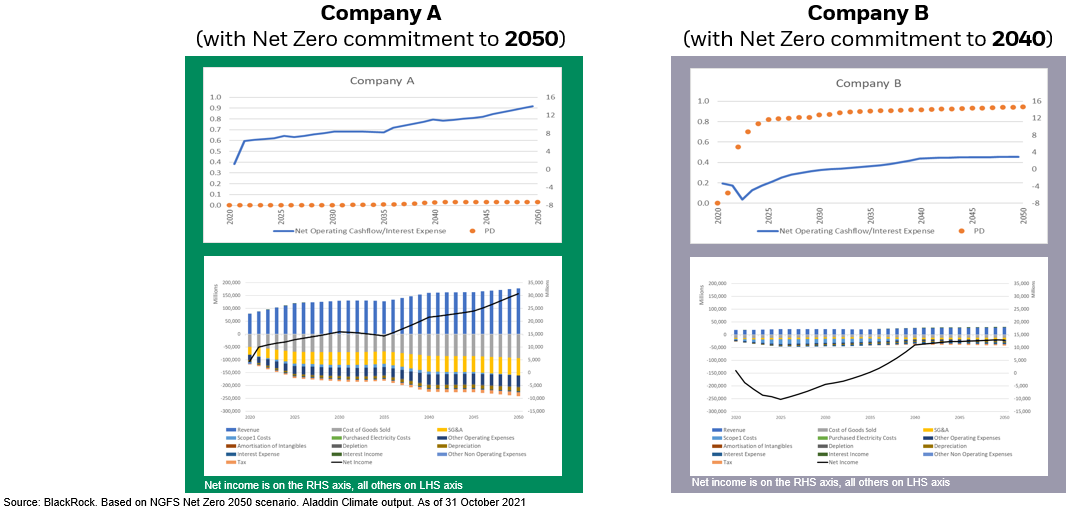

It is also not sufficient to only take a sector view of climate risk, as outcomes could vary substantially within a sector. Take as an example two European based power utility companies; though exposed to similar risk drivers in the same industry and region, company A show more resilience than company B (Source: BlackRock. Aladdin Climate output. As of 31 October 2021).

There are several idiosyncratic factors at play, such as company B’s higher exposure to coal and gas relative to company A and higher Scope 1 emission and costs.

Interestingly, even though company B has a more ambitious net zero target, it shows a higher transition vulnerability as the expected emission intensity is significantly higher. Counterparty level modelling enables a more holistic view of “greenness”, riskiness, and opportunities, and is also important when conducting stress tests.

Net zero: Alignment of the portfolio often requires focused efforts – power utility portfolio example

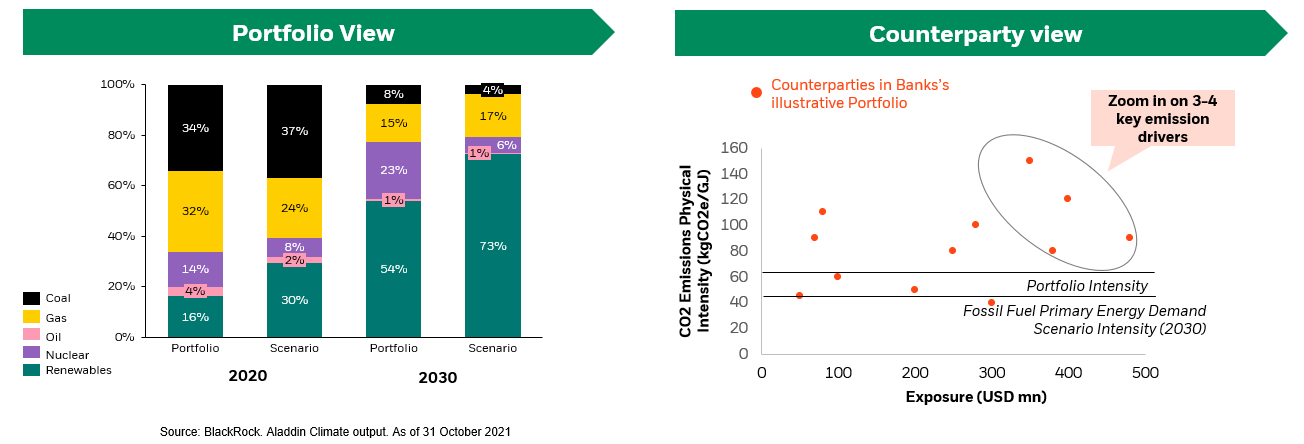

Net zero commitments require institutions to understand how their portfolio composition needs to evolve over time. For example, when looking at power portfolio for most institution the key levers for alignment include managing exiting coal exposure and increasing exposure to renewables.

Zooming in to focus on the coal portfolio; counterparty level analysis is key to enable drill down of portfolio view and identify key emission drivers; quite often financial institutions need to focus their attention on 3-4 counterparties which drive majority of emissions (Source: BlackRock. Aladdin Climate output. As of 31 October 2021). Granular view also allow identification of opportunities to capitalise on the world’s transition journey.

What should keep you up at night?

As financial institutions continue their journeys to embed climate risk, here are some important questions to consider:

- Is your climate risk and net zero view consistent across the institution?

- Can you measure your climate risk in a way that enables you to embed it to your first and second line business decisions?

- What are your biggest opportunities in the transition to low carbon?

About the authors

James Belmont, Partner, Climate Risk Lead

James Belmont, Partner, Climate Risk Lead

Baringa advise clients across financial services, government, regulatory bodies and wider sectors on climate risk and net zero strategy. From AVIVA to Standard Chartered and BNPP, they have supported 6 of the 7 UK largest banks on their climate change journeys.

Baringa developed the market-leading Climate Scenario Model which was acquired by BlackRock in 2021 to enhance their Aladdin Climate Analytics technology.

Julien Wallen, Head of EMEA Financial Markets Advisory, BlackRock

Julien Wallen, Head of EMEA Financial Markets Advisory, BlackRock

Julien Wallen is Managing Director, Head of BlackRock Financial Markets Advisory (FMA) EMEA and FMA Global Sustainability Advisory Lead. He is a senior expert on Risk Management and Sustainability with 20+ years’ experience advising financial institutions and regulators on strategic and analytics driven transformation. Prior to joining BlackRock, Mr. Wallen worked at McKinsey where he served banking clients and co-founded a web start-up