Investor outlook for 2018: what are LPs and GPs focusing on?

Last year was record year in fundraising. But as we go into 2018, which has already been punctuated by a US Government shutdown and volatile markets, investor worries are piling up on the horizon.

Macro concerns

Ian Charles, Partner at Landmark Partners, gave us a whistle-stop tour of the key issues investors need to think about at Tuesday’s SuperReturn in Berlin.

On the macro side, while growth was strong and equity markets had experienced exceptional returns, this cloud did not have a silver lining. Growth, warned Charles, never stayed synchronised and strong. In addition, this was the 9th year of economic expansion in the US, which made the question of late-cycle risks grow ever louder.

The era of low interest rates was also at its end. We are clearly moving into tightening monetary policy. Globally, central banks are reducing their balance sheets. Yet this was a discussion not being had often enough in the industry, felt Ian. In addition, equity and debt markets have never been this expensive.

On an asset class level, the high fundraising levels had led to masses of dry powder which in turn was driving up valuations. But capital was concentrated among a small group of GPs who were offering bigger funds and newer products.

What are the hot-button issues affecting private equity today and beyond? Prakash Melwani, Managing Director & Chief Investment Officer at Blackstone, shares his insights.

The LP perspective

Where does this leave LPs, and how does it impact the decisions they make? One nettle that LPs were grasping was how they could differentiate themselves in a time of booming fundraising levels. Unsurprisingly, most agreed that having a good relationship with the GP was key.

“We try to be a good partner, and we expect GPs to do the same,” said Michael Lindauer, Global Co-Head of Private Equity at Allianz Capital Partners. Allianz delivered value by focusing on the stuff they were “really interested in,” he said, adding: “And we stick to our promises.”

Consistency of process and view, as well as longevity of the LP team were other aspects singled out by the panel as important differentiators. ESG, a topic increasingly part of the conversation at SuperReturn, was becoming more important in the industry, they said.

It was clear that fees remained a hot topic. Some felt that there were occasions when GPs were too aggressive, such as charging fees for extensions, or not including management fees in carry. But they ruefully conceded that, in the current environment, the balance of power tended to be with GPs.

Blurred lines

With a maturing industry, where LPs seek more co-investments and even direct capabilities, were the lines between LPs and GPs becoming blurred?

Robert Coke, Head of Absolute Return & Buyout Investments at The Wellcome Trust, felt that, as long as the industry keeps performing, it would be difficult to change the LP structure. “There’s a lot of inertia in the industry, performance needs to continue and then more and more will enter the industry.”

However, the future may see some change: “At some point private equity will stop outperforming public markets, but I have no answer as to when.”

Chief concerns

Chief concerns among another panel of esteemed investors included many of the risks outlined by Ian Charles. Katja Salovaara of Ilmarinen Mutual Pension Insurance Company, said that credit lines and getting the right set of numbers was an ongoing issue for LPs.

Access to co-investments, a good culture and proper succession planning were all ongoing issues that the LPs watched out for.

Sweta Chattopadhyay from RMI Railpen felt that the amount of capital raised demanded extra scrutiny on deals, especially where additional capital was being raised. “You have to make sure the strategy is still aligned. LPs need to be aware of exactly what they are investing in, and what risks they are taking on,” she said.

Camilla Axvi of AP2 said that this extended to checking whether underwriters were disciplined enough in their terms in the structure of the deals. LPs had to be careful, she warned, “that they don’t add risk that they are not getting paid for”.

But Daniel Winther from Skandia Life interjected, saying that, with the flood of money in the market it wasn’t surprising that managers were innovating and coming up with new products. “It’s good for LPs and let’s not forget LPs are part of the problem; they are the ones pushing the capital into the market. You have more options today than ten years ago that’s good for us,” he said.

Access to co-investments, a good culture and proper succession planning were all ongoing issues that the LPs watched out for. But the majority were also wary. All agreed that they had never lived through these kinds of levels of financing, begging the question of what 2018 might have in store.

As Ian Charles had said earlier in the day about credit and equity prices: “You can ignore this and pretend that it is different this time.” But investors might just do that at their peril.

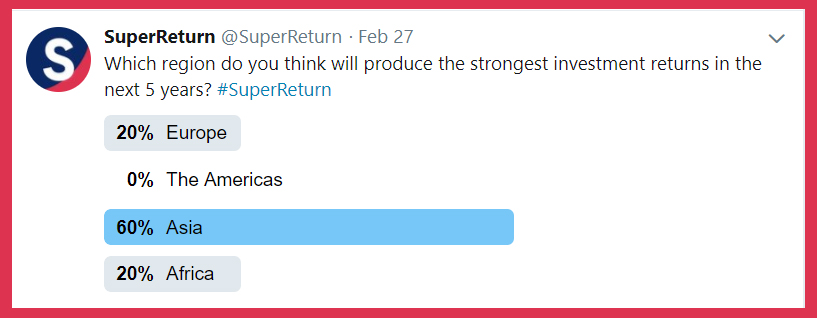

We asked the @SuperReturn Twitter community which region will produce the strongest investment returns in the next 5 years.