Is ‘bad breadth’ putting your global portfolio at risk?

The rise and fall of concentrated stocks

In the 1960s and early 1970s, the 'Nifty Fifty' was a group of large-cap growth stocks like Kodak, IBM, and Xerox that dominated the US equity market. Their eventual crash highlighted the risks of ignoring fundamentals and relying on popular sentiment.

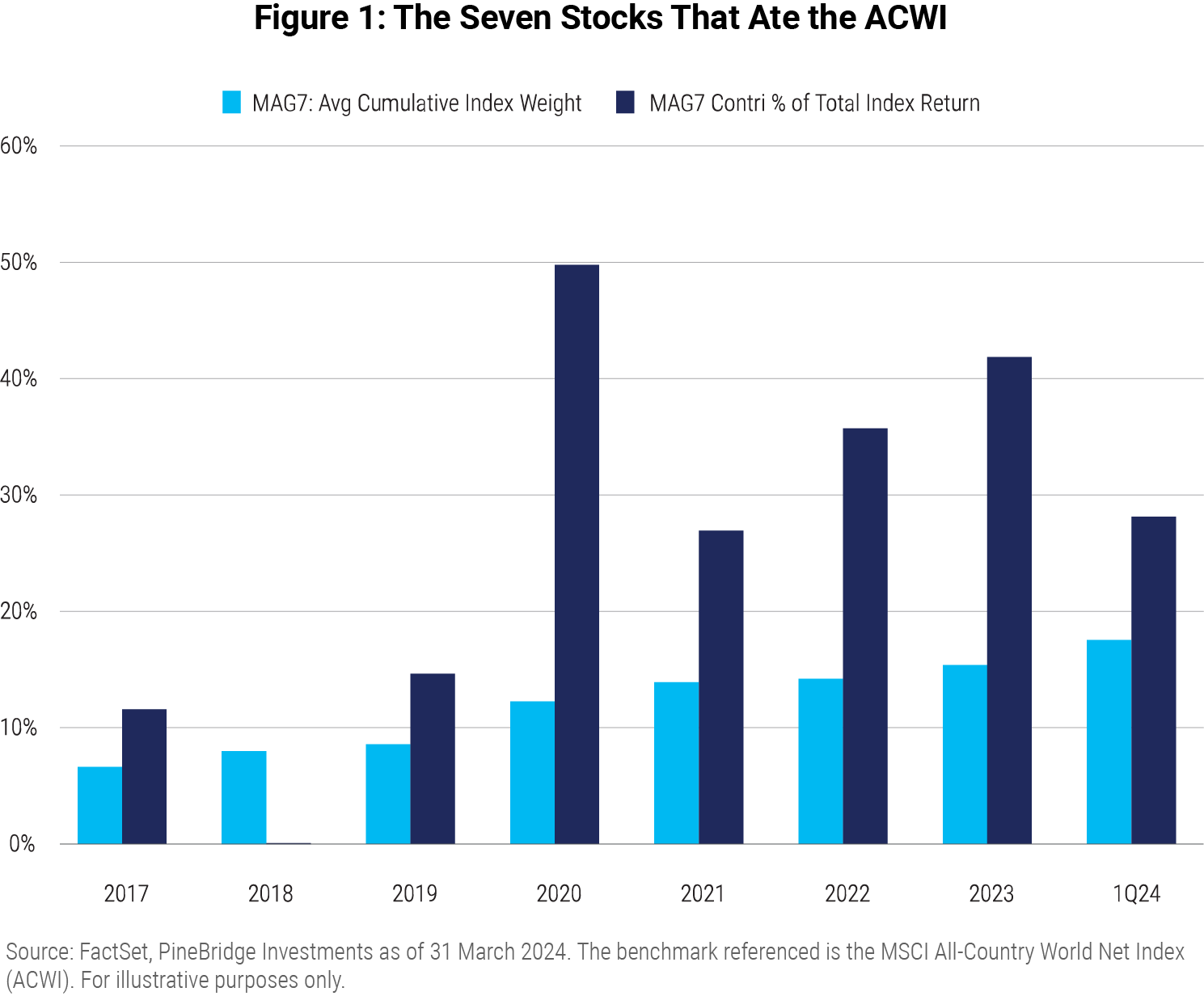

Today, we have the 'Magnificent Seven' – a highly concentrated group of US mega-cap stocks, including Nvidia, Microsoft, Apple, Tesla, Meta, Amazon, and Alphabet. By the end of 2023, these companies represented 15.4% of the market cap weight and 41.8% of the year’s gains for all 3,000 stocks in the ACWI Index. These figures surged to 17.5% and 28.1% in the first quarter of 2024.

The problem of 'bad breadth'

This concentration, or 'bad breadth', presents a dilemma for investors. The Magnificent Seven significantly impacted the market’s performance, contributing to over a third of the market’s 18.4% drop in 2022. While index investors have benefited from the gains of these stocks, relying heavily on them risks poor diversification. Conversely, avoiding these stocks seems imprudent, leaving investors feeling stuck.

However, it's possible to achieve diversification, manage risk, and still attain strong results while underweighting the Magnificent Seven.

Understanding the Magnificent Seven

The Magnificent Seven evolved from the FANGs/FAANGs, and their dominance is due to performance and size rather than similar business operations. Since the early 2010s, these companies have consistently delivered earnings and guidance, driven by powerful secular themes and transformative products and services.

Despite often being lumped together as 'technology growth stocks', only Nvidia, Microsoft, and Apple are in the information technology sector. The others have shifted between growth and value indices, reflecting their diverse business models and the arbitrary nature of traditional classifications.

Lifecycle categorization research

Our equity team developed the Lifecycle Categorization Research (LCR) framework to address dynamics like these. Instead of using sectors or acronyms, it categorizes stocks by their growth and cyclicality characteristics and development stages. Companies expected to grow earnings at high rates are compared to similar 'High Stable Growth' companies, while mature cyclical companies are compared to other 'Mature Cyclicals'.

Using this framework, the Magnificent Seven are divided into three categories:

- High stable growth: Four companies, compared to others like Eli Lilly and LVMH.

- High cyclical growth: Two companies, similar to Sherwin-Williams and Hitachi.

- Mature cyclical: One company, akin to JPMorgan Chase.

By the end of the first quarter of 2024, we determined that four of the seven fit our LCR investment criteria, while three did not.

Evaluating the Magnificent Seven

The three companies that didn’t fit our criteria were excluded based on clear rating decisions. One notable omission was a Mature Cyclical company overvalued by the market, which underestimated its cyclical profile and overestimated its growth potential. Similar issues were identified with another firm considered a High Stable Growth company whose market valuation did not reflect maturing growth.

The four favoured companies

Our favoured Magnificent Seven companies capitalized on the transformative theme of generative AI, boosting growth prospects. One company, for instance, had an ownership stake in a generative AI tool integrated into its platform, creating a recipe for High Stable Growth. Two others showed strong growth potential with their AI offerings built on profitable franchises. The fourth was a leading supplier of GPUs, crucial for the AI revolution, positioning it for continued cyclical growth.

Achieving balance

Our Lifecycle framework aims for balance by focusing on bottom-up stock selection rather than top-down macro bets. This approach doesn’t require investing in all the Magnificent Seven or every sector but seeks a balanced collection of companies representing similar growth and cyclicality to the benchmark.

While the Magnificent Seven offer significant growth opportunities, it's crucial to maintain diversification and manage risk by evaluating companies based on their fundamental characteristics rather than market sentiment. This balanced approach helps avoid the pitfalls of 'bad breadth' and ensures a robust investment strategy.

For more information on our time-tested Lifecycle Categorization Research framework, please visit pinebridge.com

About the authors

Rob Hinchliffe, CFA is a Portfolio Manager and the Head of Global Sector Cluster Research at PineBridge.

John Song, CFA is a Research Analyst at PineBridge.

Michael Mark is a Research Analyst at PineBridge.

Disclosure

Investing involves risk, including possible loss of principal. The information presented herein is for illustrative purposes only and should not be considered reflective of any particular security, strategy, or investment product. It represents a general assessment of the markets at a specific time and is not a guarantee of future performance results or market movement. This material does not constitute investment, financial, legal, tax, or other advice; investment research or a product of any research department; an offer to sell, or the solicitation of an offer to purchase any security or interest in a fund; or a recommendation for any investment product or strategy. PineBridge Investments is not soliciting or recommending any action based on information in this document. Any opinions, projections, or forward-looking statements expressed herein are solely those of the author, may differ from the views or opinions expressed by other areas of PineBridge Investments, and are only for general informational purposes as of the date indicated. Views may be based on third-party data that has not been independently verified. PineBridge Investments does not approve of or endorse any republication of this material. You are solely responsible for deciding whether any investment product or strategy is appropriate for you based upon your investment goals, financial situation and tolerance for risk.