Is green good again?

The spell cast over European fund investors by responsible investing appears to have been broken in the past two years, as a potent mix of headwinds sapped demand and even saw net sales dip into the red in several quarters (according to data from Morningstar Direct on sales of Article 8 and Article 9 funds, as classified under SFDR).

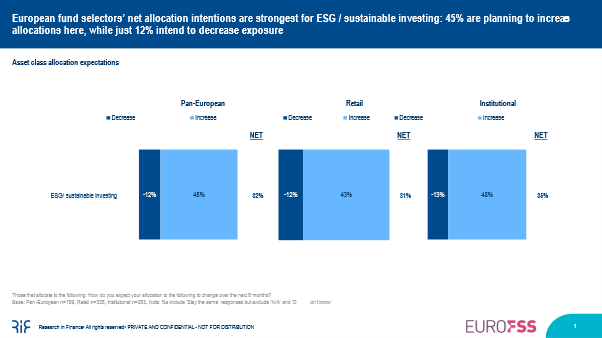

But could appetite for all things green be on the up again? That certainly appears to be the case in the latest wave of Research in Finance’s European Fund Selector Study (EuroFSS): net allocation intentions are higher for ESG / sustainable investing than any of the other eight asset classes and investment types we track. Of the nearly 900 third-party fund selectors we surveyed across eight markets in March-May this year, just under 800 expressed a view on ESG allocations for the next six months, of whom 45% said they were planning to increase allocations to ESG / sustainable investing, versus just 12% who intended to reduce allocations. Results were similar among both retail and institutional selectors.

Different this time?

You could be forgiven for any sense of déjà vu – we’ve been here before. Last year, wave 2 of EuroFSS (which was conducted slightly earlier in the year, in February-March) highlighted that ESG / sustainable investing was the most in-demand investment type for new allocations at that time too, with reported net allocation intentions even stronger than this year. Indeed, sales of responsible funds were positive… in the first quarter. There followed three quarters of outflows as ongoing inflation, rising interest rates, geopolitical challenges, concerns about greenwashing, and lacklustre fund performance in some related sectors all conspired to undermine appetite for responsible investing, with the better returns on offer elsewhere luring money away.

This isn’t without precedent: the global financial crisis also put paid to investor demand for the (then nascent) responsible fund universe back in 2008, only for appetite to spring back and ESG investing to take hold once the economic turbulence settled. The latest figures from Morningstar highlight that European demand for responsible funds has also returned to the black again this year, with net inflows registered in January-April – albeit driven by the ‘lighter green’ article 8 funds.

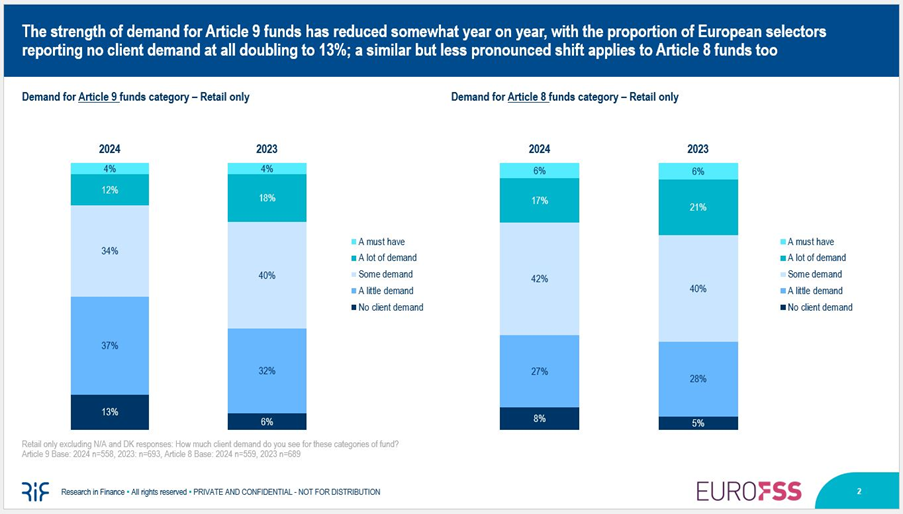

This is borne out in EuroFSS too – we asked retail selectors about the level of demand they see from end-clients for article 8 and article 9 funds. Both are a little more muted this year than at the start of 2023, but more so for article 9, where just 16% of selectors report that article 9 funds are ‘a must have’ or that there is ‘a lot of demand’, down from 22% in 2023. At the same time 13% of selectors reported ‘no client demand’ for article 9 funds, up from 6% last year. For article 8 funds, just under a quarter of selectors report that these are ‘a must have’ or seeing ‘a lot of demand’ from clients – down a couple of percentage points since Q1 2023.

Keeping open minds

As investors continue to adapt to the prevailing economic conditions, and assuming no unexpected bumps in the road – political, economic, or other – the allocation intentions data suggests a sunnier outlook for responsible investing in 2024, undoubtedly helped by an uptick in demand for equities in general and 8% of selectors reporting they expect to make their biggest fixed income withdrawals from money market funds – both signs of a more risk-on environment.

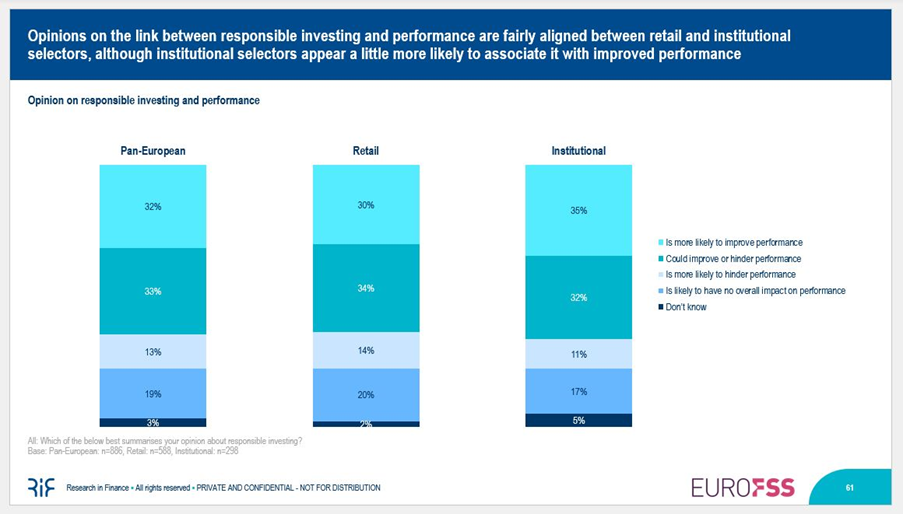

This should be assisted by professional investors maintaining open minds when it comes to returns expectations for responsible investing too. This year we asked European selectors about their opinion on the link between responsible investing and investment performance for the first time. One third responded that it ‘is more likely to improve performance’ while a further third believe it ‘could improve or hinder performance.’ Just 13% said it ‘is more likely to hinder performance,’ with the remainder stating either that it ‘is likely to have no overall impact on performance’ (19%) or ‘don’t know’ (3%). We’ll be tracking this in future waves to observe any developing trends, but the difficulties of the past few years don’t seem to have left a particularly bitter taste when it comes to responsible investment returns.

Casting our gaze a little further into the future, ESMA’s recently published guidelines on sustainable fund naming could apply to existing funds from Q1 2025. While there are predictions that fund renames could result in divestments and reallocations where funds are in breach of the new rules, ultimately this could help to overcome the current scepticism and desire for improved product labels and reporting standards, and foster greater trust in products claiming to invest sustainably. We will be discussing the results from the latest wave of EuroFSS, with a focus on Private Markets and other topics alongside industry experts at our panel discussion, “New European fund selector research: What will be the most effective distribution strategies for 2025?”, taking place at 12pm on The Distribution Stage on Wednesday 26th June. We look forward to seeing you there!