Theo Lau, Founder of Unconventional Ventures and top FinTech thought leader, explores the potential of voice technology to revamp the insurance industry and why it's so important to see it as more than just a a bot to dictate commands at.

Although voice may not a solution for all situations, there is no denying that the momentum and interest for voice technology is growing. In the Q3 2017 earnings report, Amazon disclosed that it has sold “tens of millions of Echo units” since the first release in 2015. According to “The Rise of Voice” report by Invoca, the voice opportunity is predicted to be worth more than $18 billion by 2023. A recent report by Pindrop indicated that 84 percent of businesses surveyed expect to utilise voice AI technology to interact with their customers within the next year.

Consumers have been using voice assistants from seeking information to playing music and shopping. Accessibility, convenience, and simplicity are some of the main reasons behind the user adoption. For those who cannot read or who may have trouble navigating the menu options on an app or website, ability to speak to a device offers a more intuitive option to obtain real-time information. Voice technology is also life-impacting for those suffering from isolation/loneliness. In all, it has the potential to become a more inclusive technology that can appeal to a board audience and serve a wide purpose.

For insurance industry, adopting voice technology can be viewed as a competitive advantage and an important driver of customer satisfaction.

For insurance industry, adopting voice technology can be viewed as a competitive advantage and an important driver of customer satisfaction. As Capgemini and Efma’s most recent World Insurance Report has highlighted, digital agility is a key to long-term success and provides new opportunities to actively involve and inspire customers.

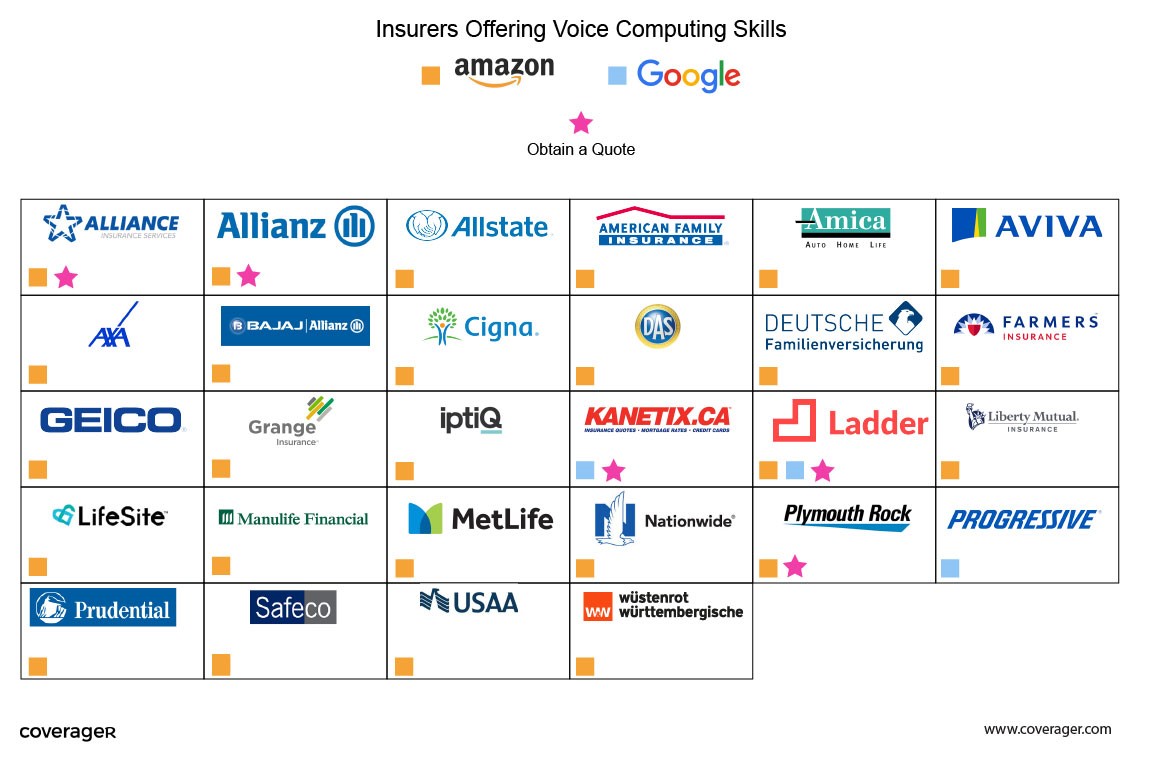

Back in 2016, Liberty Mutual Insurance became the first insurance carrier to release an Alexa skill, enabling customers to get quotes and access a glossary of insurance jargons. It also provides advice on moving to a new home, staying safe on the road, and preparing for hurricane. Since then, more companies have followed suit. Below is a nice recap on the current ecosystem.

AI-powered voice technology has also started to move into healthcare industry, with potential applications ranging from patient education to medication adherence and caregiving. Pillo is an interesting example. It is a voice and video-enabled intelligent assistant that combines Machine Learning, facial recognition, video conferencing, and automation to work as a personal home health companion, dispensing medication, issuing reminders, answering questions, and connecting to caregivers. In the future, such technology can enable healthcare organisations to send and collect information from patients and provide more intuitive conversational experiences and better care at potentially lower cost.

It is no question that talking is a more intuitive mode of communication compared to browsing on a mobile phone or laptop. The true power lies in the combination of artificial intelligence and voice technology in a connected environment.

Another interesting use case is using AI and voice technology to augment call-center agents. Cogito is one of several companies whose voice analysis solution gives the call center agents in-call behavioral guidance, by measuring in real time, the tone of voice, speech rate, and how much each person is participating in the conversation. Their solution has since been adopted by companies including MetLife, Humana, and Zurich.

It is no question that talking is a more intuitive mode of communication compared to browsing on a mobile phone or laptop. The true power lies in the combination of artificial intelligence and voice technology in a connected environment. To realise its full potential, it needs to be a true conversation instead of a voice command, and we must go beyond simply transporting functions from the browser to voice. Afterall, how useful is it if all the consumer can do is to ask for an insurance policy number or the due date of a bill?

We are entering a new digital era where conversations can take place via multiple modalities. And we have a chance to create a whole new experience, be truly embedded in a consumer’s daily lives, and be useful. While voice will not replace screens or other touchpoints, it will play an important role in the ecosystem, providing companies an additional way to engage with their customers in simple language and build brand loyalty. True conversational AI will give us a real shot at turning the tide and changing the customer’s journey, forever.

Will you be on the sidelines to watch technology transform, or will you be part of it?