Leaning into volatility: why investors should embrace Bitcoin’s price swings

At Hashdex, we have a saying: “In volatility we trust.”

We know market volatility can be nerve-wracking. But large price swings—up and down—are an essential part of any emerging asset class. Bitcoin is no exception.

Media attention often narrowly focuses on bitcoin’s volatility, suggesting it's a speculative bubble (in up markets) or a failed experiment (in down markets). However, the reality is much different.

Our team at Hashdex has been investing in crypto for a long time, and we've seen many periods of high volatility. In fact, in the last 10 years bitcoin has experienced seven drawdowns of more than 50%.[1] This might sound dramatic, until considering the price of bitcoin has increased more than 57,000% over this period.[2] And, since the pandemic-driven selloff in March 2020, bitcoin has risen roughly 385%, nearly quadrupling in value in the last two years alone.[3]

At Hashdex, we maintain an unwavering belief in bitcoin’s long-term investment value. Whether driven by macro or idiosyncratic factors, price volatility will remain a fixture of bitcoin’s profile for the foreseeable future. We believe investors should embrace this volatility.

Higher highs, higher lows

Bitcoin’s long-term value proposition is as strong as ever. While the volatility in May 2022 resulted in bitcoin dipping below its lowest price of 2021, it’s important to “zoom out” and consider historical performance. Bitcoin has reached a higher “low” in every calendar year of its existence. Its 2021 low of $31,801 was up 495% from 2020’s low of $5,348.[4] So, despite short-term volatility, bitcoin has exhibited higher highs and higher lows.

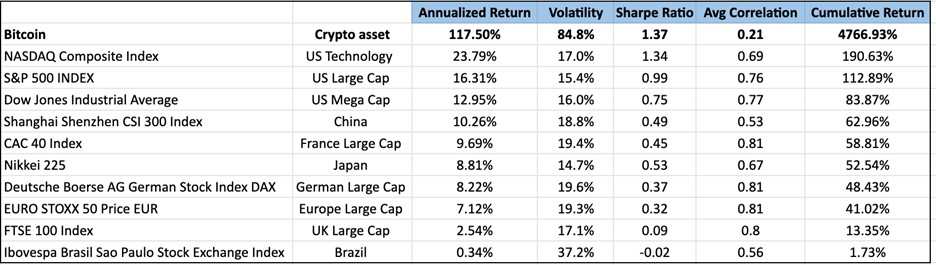

To contextualize the magnitude of bitcoin’s risk/return profile, we compared it to a global set of equity indices from 2017 to 2021,[5] one of the strongest historical performance periods for stocks. Bitcoin’s volatility over this period was more than double the next most volatile equity index. However, its absolute return of 117.5% was nearly five times as high as the next best performing equity index.

Bitcoin had the highest Sharpe Ratio—a measure of risk-adjusted return—over this period, rewarding investors more than any other asset class per unit of risk. It also had the lowest correlation to this group of stock indices—by far.[6] These factors underscore that investors should not be focused on short-term price volatility, but rather on bitcoin’s long-term risk/return trajectory.

It is also important to remember that bitcoin’s unique attributes, including its verifiability, scarcity, and divisibility, help to strengthen its long-term investment case. The transparency of bitcoin transactions and its well-defined supply/demand characteristics also help make the case for looking beyond short-term price swings.

Investors need more access

While some headlines may focus on bitcoin’s dramatic price swings, we have seen little evidence to suggest that investors with long-term horizons are being scared away by volatility.

There is currently over $16 billion invested in crypto ETFs and ETPs.[7] While there has been significant growth in this area in recent years, the world’s largest market—the U.S.—remains mostly absent.

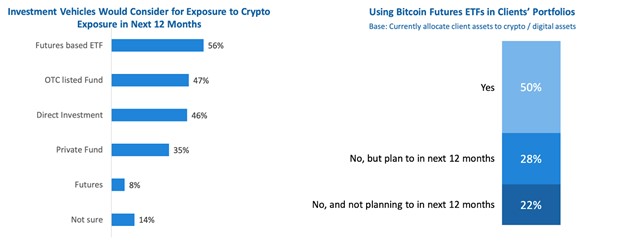

This lack of available investment vehicles is not due to a lack of demand. A recent Nasdaq survey[8] found that 44% of financial advisors have allocated to crypto or plan to in the next year. The advisors that have allocated to crypto believe that a 6% target is ideal, and more than 7 in 10 said that a spot crypto ETF would make them more likely to allocate to the asset class.

Source: Nasdaq Crypto Index (NCI) Advisor Research survey, March 2022

Source: Nasdaq Crypto Index (NCI) Advisor Research survey, March 2022Clearly, investors are looking beyond bitcoin’s short-term volatility and are clamoring for access to investment products that will allow them to simply and securely access the cryptocurrency. We believe the ETF structure is the most beneficial to the greatest number of investors because of lower investment minimums, greater liquidity, and a NAV more in line with the underlying asset value than trusts or private placements can offer.

Bitcoin has been around for over 13 years, and its influence continues to grow despite periods of large price swings. We believe its position as an attractive long-term investment only strengthens in the wake of down markets, as does our trust that volatility will ultimately make bitcoin more resilient over time.

As a global pioneer in crypto asset management, Hashdex is committed to providing innovative investors simple and secure access to bitcoin. While price volatility will be part of the crypto markets for the foreseeable future, investors should remain confident that the long-term outlook for bitcoin has never been stronger.

#InVolWeTrust

Find more expert insights on the wealth management industry here >>

[1] https://www.visualcapitalist.com/bitcoin-historical-corrections-from-all-time-highs/

[2] Bitcoin’s price was ~$4.93 on May 13, 2012 and ~$28,251 on May 12, 2022.

[3] Bitcoin’s price was ~$5,820 on March 22, 2020 and ~$28,251 on May 12, 2022.

[4] Price data from messari.io

[5] Among liquid classes. Some illiquid alternative investments, such as Private Equity and Venture Capital, are riskier but traditional market risk metrics do not apply due to opaque prices. The stock indexes are from Bloomberg’s Launchpad World Stock Indexes (standard view) in USD. Indices not shown in Table 1: S&P/TSX Composite Index, S&P/BMV IPC, IBEX 35 Index, FTSE MIB Index, OMX Stockholm 30 Index, Swiss Market Index, Hang Seng Index, and S&P/ASX 200.

[6] Average correlation is measured against the entire group of indices listed in Table 1.

[7] https://etfgi.com/news/press-releases/2022/04/etfgi-reports-crypto-etps-listed-globally-gathered-net-inflows-us785

[8] Nasdaq Crypto Index (NCI) Advisor Research survey, March 2022