LP’s exit options: private equity GP led restructuring and liquidity solutions

A tectonic shift is occurring in private equity as a majority of capital raised flowed to the top 20 private equity players. At the same token, it is startling to note that over the past 6 years, some 1,600 funds spread across 1,200 GPs have not raised new capital.

A tectonic shift is occurring in private equity as a majority of capital raised flowed to the top 20 private equity players. At the same token, it is startling to note that over the past 6 years, some 1,600 funds spread across 1,200 GPs have not raised new capital.

The first foray of GP led restructurings involve zombie funds or “end-of-life” underperforming funds. While zombie funds continue to be restructured and equitized, more and more restructurings are tied to healthy GPs to actively manage their fund’s portfolio and as a mechanism to boost fundraising of their next fund while satisfying the needs of LP investors. In 2017 alone, $14 billion of volume generated by GP led restructuring. That compares favorably to $9 billion in 2016. Over the past 5 years, the compounded annual growth equaled to nearly 55%.

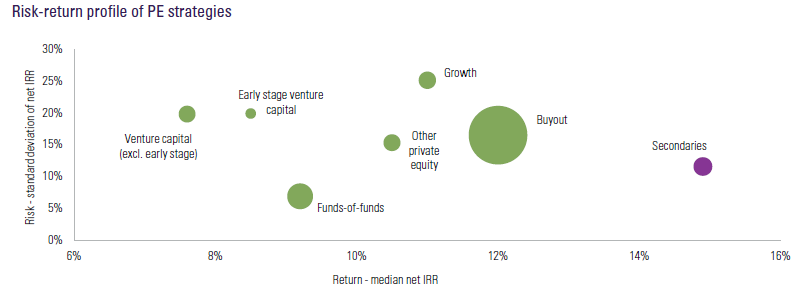

Note: Data as of December 2016 - Vintages 2003- 2013. Source: Preqin.

Note: Data as of December 2016 - Vintages 2003- 2013. Source: Preqin.Unlike secondaries direct in which the GP divests the fund’s remaining assets to a secondary investor at a discount or premium, liquidity-based solutions in a restructuring may take various themes:

GP Extend for Longer Runway

For performing portfolio companies whose EBITDA and free cash flow are high and durable, rather than sell such companies to another GP, procuring new capital with reset economics in the new vehicle produce benefits to GPs and LPs alike; GP enjoys continuing management fee and carry – albeit nominally lower; LPs is motivated to sell, be it for liquidity reasons, portfolio management or to lock in gains or limit losses, or both.

Preferred Equity Stapled Investment

As a mechanism to seek liquidity of older funds and top up new dry powder, GPs seeking capital to make new investments often offer a secondary investment in the current fund as an inducement for procuring primary capital. When the two are linked, the GP negotiates a new partnership agreement with the new investor which are likely to include new incentives attached to new money, an extended fund life and the provision of follow-on capital to support or enhance a portfolio.

A notable European GP led restructuring transaction involved Coller and Goldman Sachs acquiring Euro 1.5 billion worth of NAV held in the Scandanavian buyout firm’s 2008 vintage Nordic Capital. Another landmark stapled investment, namely CPPIB’s Providence Equity Partners vintage 2011 fund, signifies the growing GP and LP acceptance of such transaction and could break the logjam and clear unrealized value trapped in tail end funds.

Structured Portfolio Management

Complex fund recapitalization with tailored bespoke solution involving asset sales, preferred equity via LP tender of legacy portfolio with follow-on capital and capital used to lock in gains; Typical changes to fund documents through reorganization, fee and carry reset and reserves.

Benefits derived from the GP led transaction are numerous producing a better risk adjusted returns.

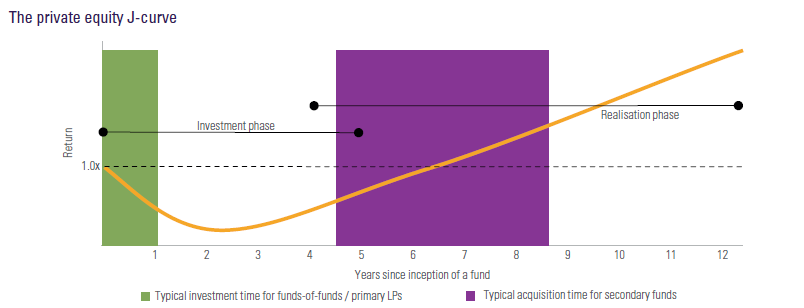

- J-Curve Mitigation – By acquiring positions in mature funds, j-curve is virtually non-existent as cash is returned faster which significantly reduces capital at risk

- Complex liquidity transactions meets the objectives of multiple stakeholders (GP, selling LP, Non-selling LP and the buyer)

- Change capital reinvigorates GP and portfolio companies

- Transaction complexities deter secondaries buyers and less commoditized than secondaries direct

- Deep credit analysis and due diligence of single asset

- Deal level fee and fund level fee can be reduced

Preferred equity has emerged as a preferred method for sellers to achieve par valuations to NAV on complex portfolios. The high levels of take up – some 40% of buyers observed in 2017, especially for asset deals.

Real asset secondaries is a burgeoning opportunity with some $4 billion of private equity real estate secondaries alone was transacted in 2016. As private equity LP and GP adopt these liquidity options, the long-term adoption in other alternative asset classes that encompass infrastructure, natural resources and private credit. Plus funds raised pre-2008 crisis will also need to be structured including emerging market funds, fund of funds and pan regional funds.

John F. Tsui, Managing Principal of New York based Peninsula House, LLC, is engaged as a single family office investing across alternative assets; Co-invests with Asian, American and European institutional partners in niche strategies, be it funds, separate managed accounts or direct investments.