Early in my career, I was told that the difference between a good private equity investment and a bad private equity investment was “luck”. After 20 years in the industry, I can’t say I subscribe to that belief.

Instead, I think Benjamin Franklin put it best when he said that “diligence is the mother of good luck.” Even with an increasing appetite for private markets exposure, investors and consultants are ensuring they make their own luck by continuing the trend of deeper, more thorough, and more sophisticated due diligence practices.

This year marked our third annual Private Markets Due Diligence Survey, the largest to date with respondents’ private markets AUM/AUA totalling >$580bn. Responses were collected from investor and consultant participants about the key components of their due diligence processes and – for the first time – fund managers to get their perspectives on a range of topics, including being on the other side of due diligence processes.

Here are three of the key findings we can conclude from the report.

Alignment of interests may exist, but what about alignment of perceptions?

Gathering and comparing the perspectives of both groups produced some interesting results, most notably that fund managers and investors and consultants are not entirely aligned in their views of what factors about a manager are important during a due diligence process.

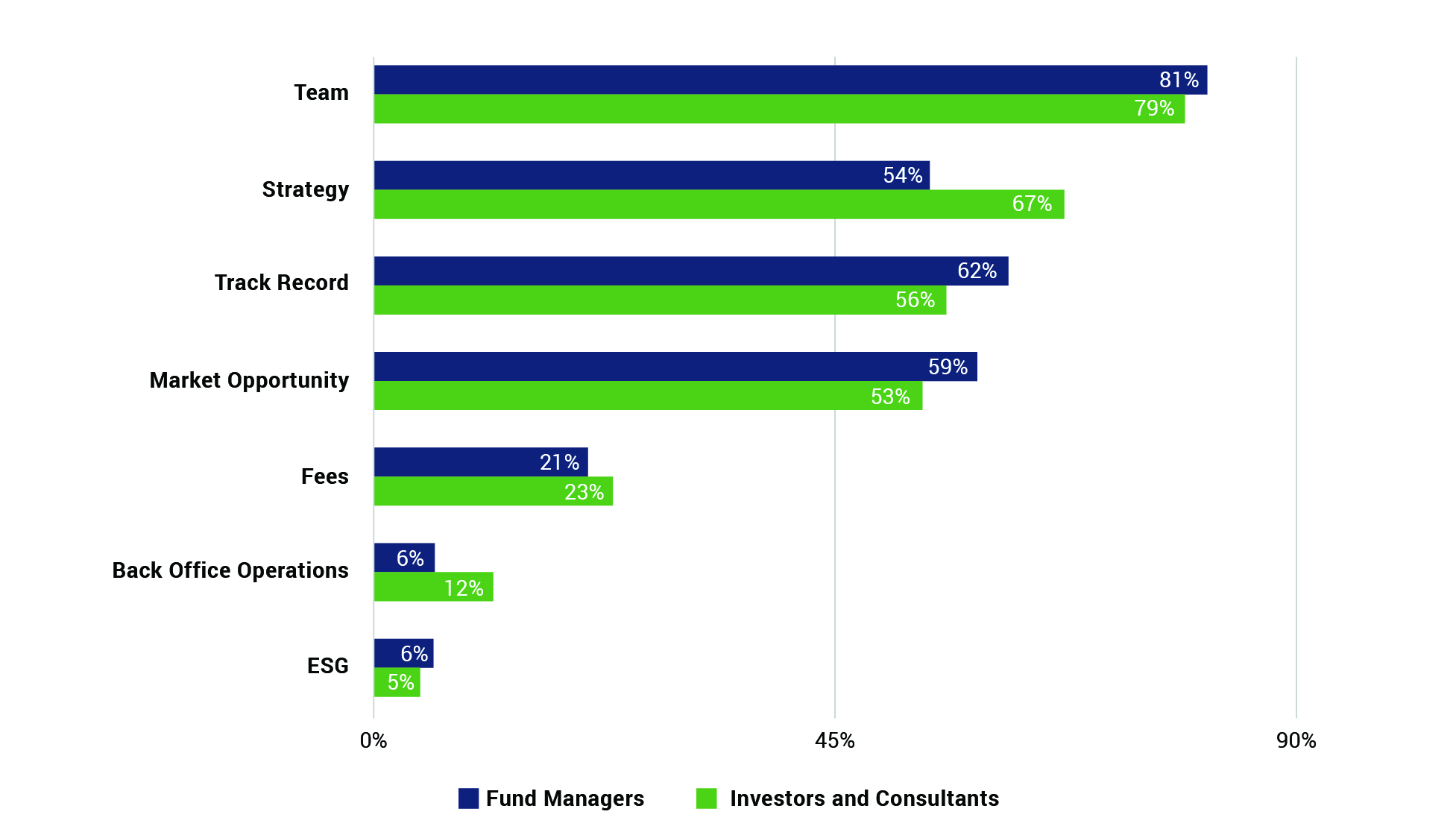

Fund managers, investors and consultants perceived “team” as the most important aspect of due diligence on a fund, yet it was interesting to note that investors and consultants placed greater relative importance on “strategy” than managers did. Conversely, fund managers perceived “market opportunity” to be more important to investors than “strategy” (Figure 1).

One area that both groups did find agreement on, however, was concern over valuations: this was listed as their top concern for the private markets industry in 2018, followed by the amount of dry powder in the industry.

Figure 1. Comparison of factors selected as extremely important to investors and consultants, perceived as extremely important by fund managers.

Is negative coverage of credit facilities warranted?

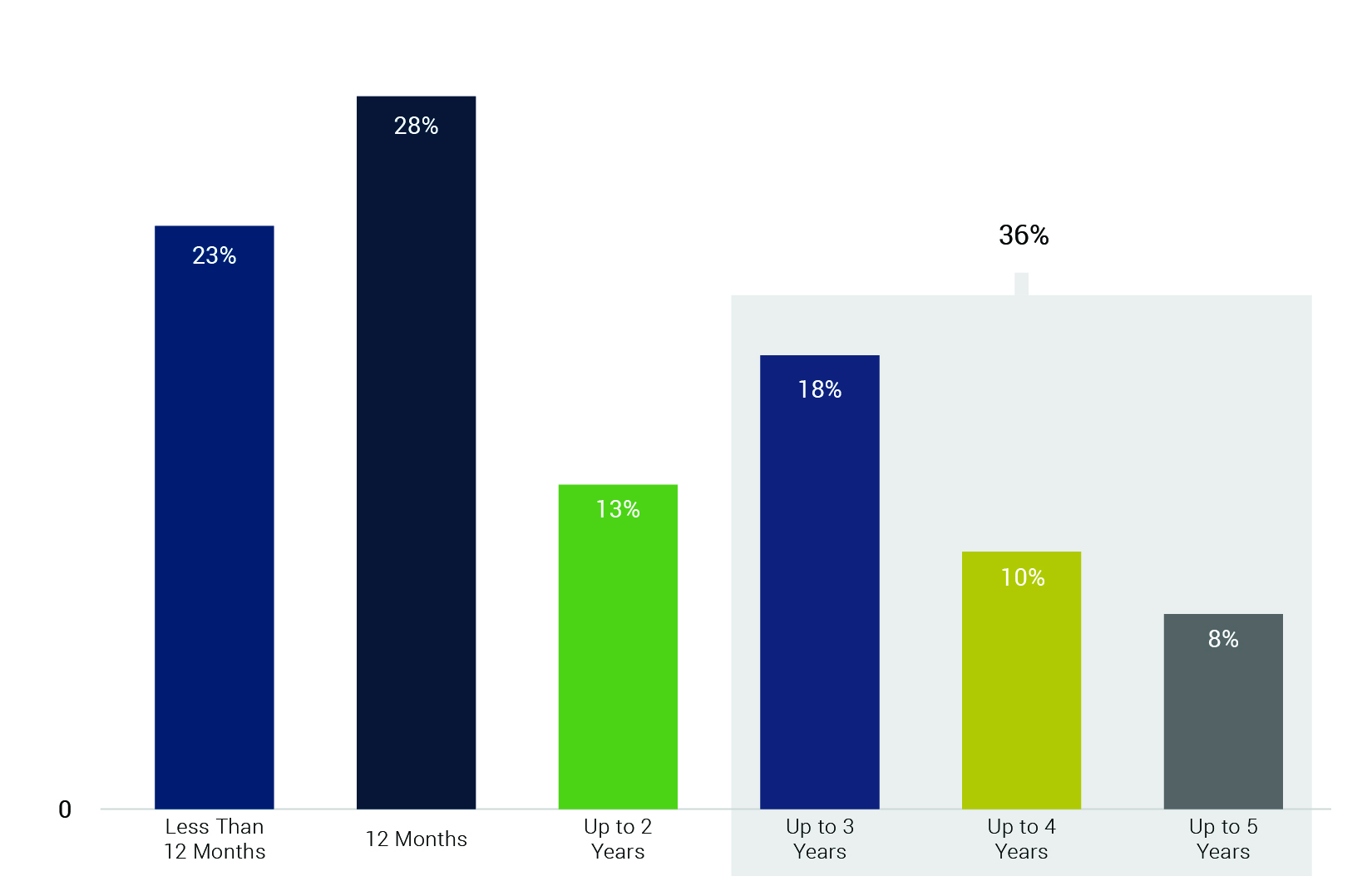

A key theme that emerged from our survey in 2017 was the proliferation of credit facilities. Consequently, this year we included questions specifically targeting this topic to explore it in further depth. We found that nearly two thirds of fund managers surveyed used credit facilities, with half using facilities of 12 months or less. However, some facilities were up to five years in length (Figure 2). Key reasons why fund managers used these facilities included the expected responses of offering greater efficiency of capital and minimizing investors administration effort, but one in four respondents did note enhancing IRR as a reason for use.

Figure 2. Private fund managers’ average term of credit facilities.

Despite a lot of negative industry media coverage on the use of credit facilities, investors and consultants were largely neutral on the use of them: only 23% of investors and consultants viewed credit negatively and coincidently the same percentage viewed them positively. Many of the opinions expressed by investors suggested they wanted to better understand the motivation and impact of credit facilities on a case-by-case basis.

Lack of standardization drives investors to increase sophistication

61% of investors and consultants stated that they find it difficult to compare one fund manager’s performance with another on a fair and consistent basis, so it came as no surprise to see that they are demanding increasingly granular performance data from fund managers than previously: 78% of fund manager respondents agreed this was their experience.

Investors and consultants are also increasingly technical in their approach to using the data once they receive it. Nearly three quarters of respondents said they would recalculate the supplied performance data more often than not. The theme of “trust but verify” was prominent throughout the findings.

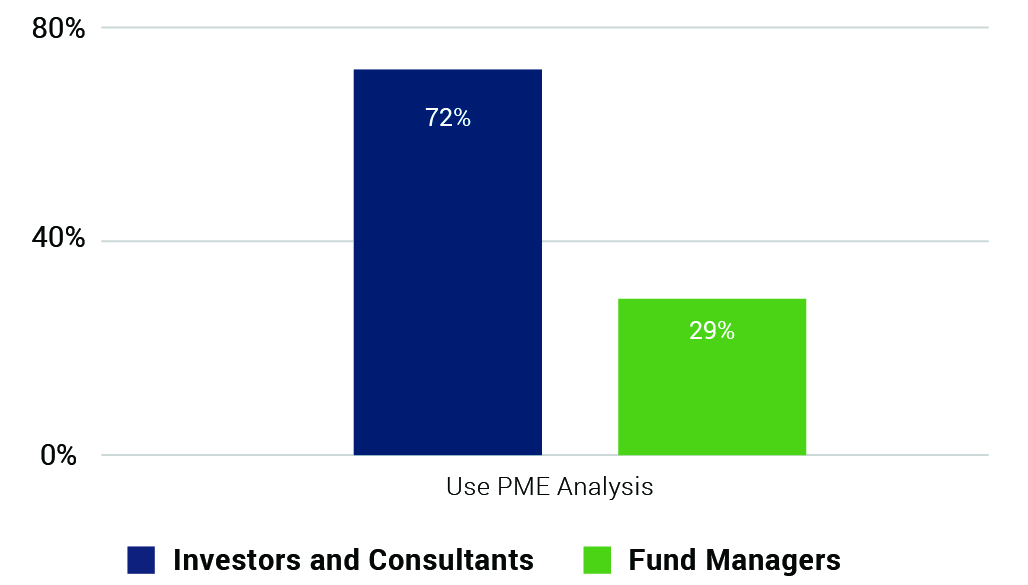

Sophisticated methods of analysis are also being employed by this group: 72% of investors and consultants said they use public market equivalent (PME) analysis (Figure 3). Surprisingly, just 29% of fund managers said they use PME analysis, which highlights a large disconnect between the two survey groups.

Investors and consultants are also tailoring their approach to PME analysis dependant on various factors: close to 50% reported using more than one index in their analysis and many stated they are varying this based on the geography and/or sector of the fund they are benchmarking

Figure 3. Use of PME analysis, split by investors and fund managers

So, what have we learnt?

The findings of eVestment’s 2018 private markets survey has highlighted that despite the desire for increased exposure to private markets funds, investors and consultants are not loosening due diligence standards. In fact, requirements for data and the analysis of it are only increasing in granularity and sophistication.

To ensure streamlined fundraising processes, managers must be prepared and equipped to provide performance data to investors and consultants in a truly transparent and efficient method to meet their requirements. Likewise, investors and consultants must ensure systems and process are in place to enable them to perform quantitative due diligence in a timely manner and meet the increasingly tight fundraising timelines of GPs.