The expansion of Basel requirements involves more than a simple finalisation of Basel III reforms. The updated requirements and new calculation rules are so comprehensive that they have been informally dubbed “Basel IV” and there is no industry consensus on what a future Basel regulatory scenario may look like. This is partly because evolving Basel requirements are a collection of proposals and standards that will change how Basel III is to be implemented in the future.

Financial Institutions (FIs) must keep current with this new Basel scenario and prepare for its implications. Significant automation and enhancements to data management, technology, and infrastructure are required to meet local regulatory mandates. Such mandates include producing high-quality financial, liquidity, and risk reports with consolidated views over multiple time periods. FIs must also address regulatory standards and requirements encompassed in Pillar III, FRTB, IFRS 9, BCBS 239, and other frameworks. The expansion and finalisation of BCBS requirements make flexible and adaptable data management and calculations a necessity.

Asking critical questions

To determine how to progress with their Basel roadmaps, FIs are asking themselves critical questions related to data, lineage and audit defense, and models.

Data

- Do we have complete, relevant, and accurate risk data to calculate required RWA, capital deductions, or ratios?

- Can we access our data consistently and in a timely manner?

- Are we bogged down by manual and siloed data and processes?

Lineage and audit defense

- Do we have dynamic, automated data lineage in place for our risk and regulatory data?

- Is data lineage incorporated into our audit defense processes?

- Can our professionals across functions easily access Basel-related regulatory data and reports?

Models

- Do we have transparency into our model data and calculations?

- Are our models integrated into our regulatory processes end-to-end?

- Do we have adequate information to complete an Internal Ratings-Based (IRB) versus a standardised-approach (SA) variance analysis?

Managing the model muddle

Credit risk models form the foundation of risk reporting and they are the very core of regulatory requirements such as counterparty credit risk (CCR). When executing model data calculations, most large FIs use an IRB approach in an effort to optimise capital. However, developing custom-built credit-risk models is complex. Hence, many FIs have been forced to invest heavily in the services of third-party consultancy firms that tend to monopolise a niche – developing and maintaining these closed-source language models.

FIs pay a price. Initial and recurring investment costs are high. But because the model execution process is effectively a black box, they also suffer negative impacts on decision-making due to lack of transparency, including an inability to drill down and obtain full data lineage.

Driving successful Basel IV preparation

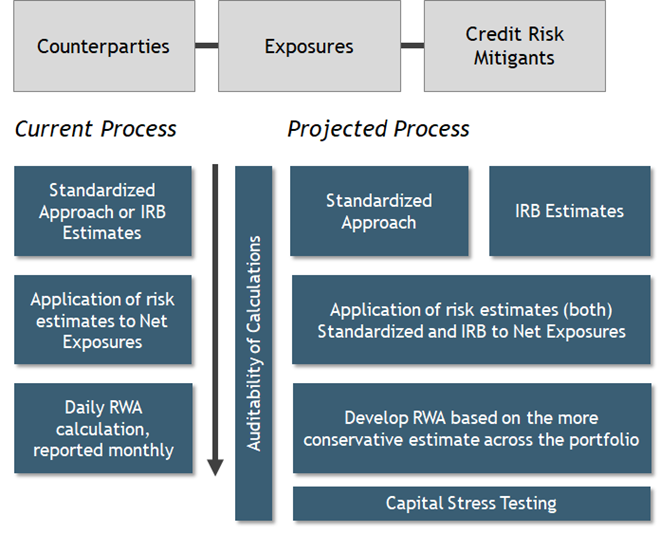

The diagram below provides an overview of the scope of work facing FIs. Changes being contemplated for Basel IV will require a rethinking of the RWA calculation process.

FIs require transparency across all processes in order to complete seamless and efficient Basel compliance. These processes include data sourcing, enrichment, aggregation, model management, pre-processing, validation, reconciliation, and reporting. Dynamic data-lineage capabilities, intuitive user-controlled workflow automation, and end-to-end user-friendly visualisation must underpin all processes.

To ensure compliance with BCBS requirements and the Basel framework, FIs must have access to flexible data dictionary architectures that enable data to be properly classified for Basel compliance. They must also accommodate seamless change management as Basel-related reporting requirements evolve. In addition to the ability to do IRB calculations, calculation histories, optimisations, granular results, analytics, and regulatory reports, FIs need powerful risk calculation architectures that provide a framework for a range of complex Basel-related capital and liquidity calculations.

Furthermore, if FIs incorporate their various models into a single risk and regulatory ecosystem, they can transparently access their model inputs and outputs. They can achieve this by strategically converting models to an open-source language. Potentially, this enables them to gain complete data lineage.

When FIs have full data lineage they can granularly asses/ identify the impact of change, better understand business requirements, maximise the value of risk and regulatory data, and deliver actionable business intelligence. This facilitates satisfying BCBS 239 expectations and fortifies the ability to defend audits.

Optimising resources

Consequently, an actionable strategy that FIs can execute in order to optimise resources is to manage models by leveraging open-source languages and an integrated architecture. Benefits include:

- Reduced total cost of ownership (TCO)

- Maximised shareholder value

- Strengthened traceability and governance processes

- Satisfaction of regulatory scrutiny through enhanced controls

- Improved time to market

Preparing for smooth sailing

If FIs can successfully answer the critical questions satisfactorily, they can direct their own successful “Basel IV” journey.

Optimisation of resources, optimisation of regulatory reporting, and optimisation of audit processes all lead to the optimisation of risk capital, and confidence while navigating these turbulent waters.