New exit readiness study findings: How can firms overcome key challenges to finish strong?

Faced with geopolitical volatility and an evolving macroeconomic landscape, private equity firms are operating in a uniquely uncertain market causing many to slow or pause deal activity. But there are definite steps firms can take to optimise their exits when the time comes. Based on a study of 100 private equity professionals from March and April 2025, the EY Private Equity Exit Readiness Study 2025 explores key exit readiness initiatives and exit challenges, and their impacts on exit valuations, execution speed and transaction certainty.

Highlights and market context

- The EY study revealed that 78% of firms hold assets beyond their typical five-year investment horizon, with 46% exiting five or fewer assets since 2018. Last year, distributions to Limited Partners (LPs) reached a historic low – investors received just 11% of invested capital back from their PE programs, versus a long-term average of 22%. There is a strong need to return liquidity to investors through various exit routes. However, most firms are optimistic about a market recovery, with 33% planning to exit assets within a year and 55% within one to two years. Exit readiness activities are crucial for optimizing returns.

- With buyers focused on high-quality assets, firms recognise the importance of exit preparations to tell the best possible story; 88% of firms said they engaged in targeted exit readiness activities during the asset hold period, and nearly half begin exit readiness assessments 12 to 24 months before a sale.

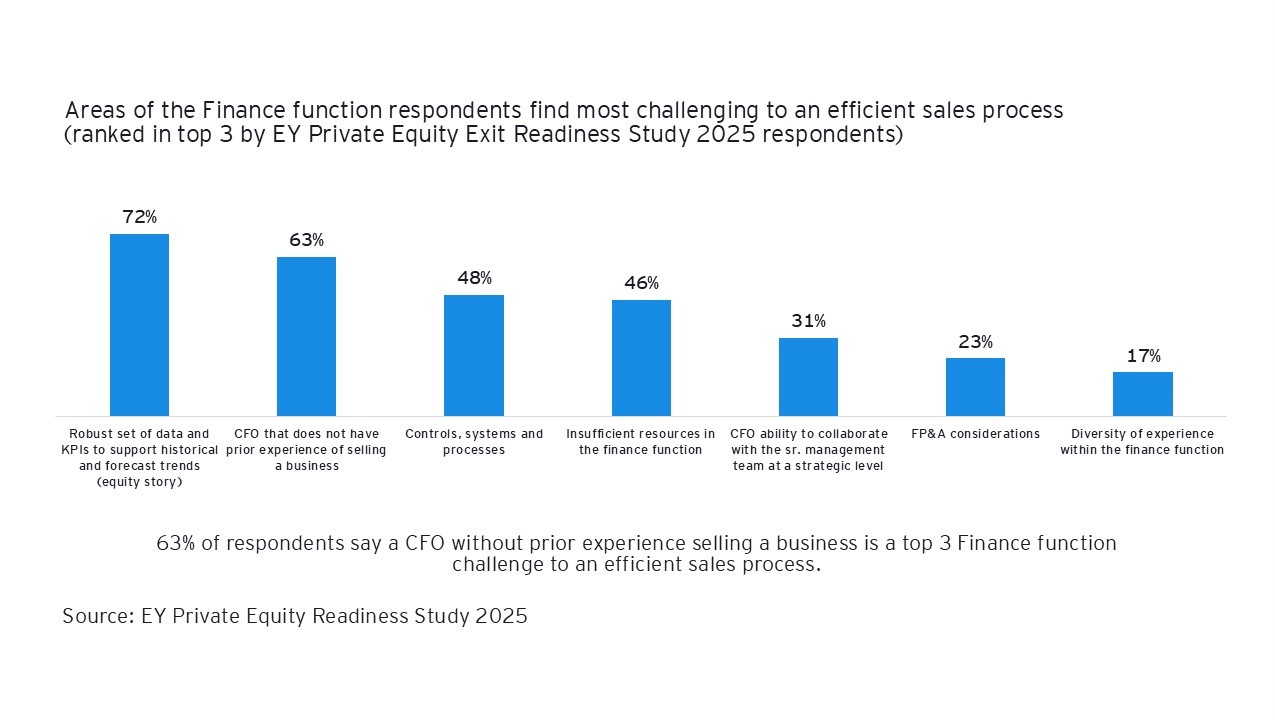

- Along with traditional issues such as capturing value creation initiatives in exit EBITDA and designing strong capital market strategies, respondents said data and talent readiness were their top exit challenges.

Although increased exit activity has been anticipated for some time, PE professionals are encountering key challenges with preparing assets for sale. One is data readiness, where firms might encounter difficulties in quantifying past value creation initiatives and growth opportunities because robust reporting systems are lacking. Another is leadership, where firms need to assess whether they have the right experience to navigate the exit process. This underlines the critical importance of comprehensive planning, inclusive of exit readiness activities, that provide practical ways to identify and mitigate challenges early.

Key exit challenge: Management preparation and CFOs with exit experience are critical to an efficient exit process.

Having the right leadership talent in place with prior exit experience can be critical to a successful sale process. This is particularly true for the finance function, with 63% of respondents citing CFO lacking prior experience with selling a business as a top challenge to exit.

There are also challenges with finance function staffing. After years of talent shortages and cost-cutting initiatives, many organizations face bandwidth challenges. Forty-six percent of respondents cited insufficient resources as a roadblock to a smooth exit process.

Four ways private equity firms can mitigate talent challenges:

- Assess where bandwidth may need to be strengthened or supplemented. Redefine roles and responsibilities if gaps or overlaps exist.

- Conduct early management rehearsals to stress test the equity story and prepare the team for potential bidder challenges.

- Quantify the operational capabilities that led to value creation in the current hold period, creating a next-owner playbook to properly aid in the next investor underwriting assumptions.

- Build financial planning and analysis capabilities around forecasting, KPI aggregation and analysis and strategic planning. Augmenting Financial Planning and Analysis capabilities ahead of an exit can also positively impact ROI.

Key exit challenge: The road to optimizing exit valuation is paved with insightful and precise data.

Portfolio companies have a lot more data today, adding to the complexity of incorporating the decisions that go into running the business. It's easy to get lost when trying to present this data for the purpose of a transaction. A sure way to impact transaction outcome is to provide the requisite level of data granularity for investors to assess the next cycle of returns.

Typical data challenges include:

- Data capabilities, often driven by under-investment in data integration across the enterprise.

- Systems and controls, the most cited reason why the right level of data granularity cannot be provided and is often driven by a proliferation of IT applications in the Finance technology stack.

When clients prepare with data readiness activities such as data cleansing and integration, they can promote exit valuations by:

- Leveraging data to craft an equity story supported by KPIs and granular data.

- Enabling detailed tracking of value creation initiatives (including their impact on EBITDA), including identifying quick wins achievable in the 12 months prior to exit.

- Reducing the work required in the deal process, with less scope for surprises during the diligence phase and bidder challenges.

Private equity firms looking to exit assets need to be ready at any moment to capitalize on transaction opportunities. Reassessing exit preparation strategies, particularly around data and talent readiness, will be critical to capturing targeted returns for investors. Firms that have applied a buyer lens to assets well in advance of an exit, have the data to underpin the equity story and a well-prepared management and finance team will invariably finish strong.

Explore more findings and insights at the EY Private Equity Exit Readiness Study 2025 page.