Carlos Cardone, Alan Hess, Ana Chumak, Vladislav Bardalez Katyukha, Alastair Wainwright and Daniel Morris of ISS Market Intelligence explore the evolving world of cryptocurrency funds.

Across the globe, cryptocurrencies have been attracting attention since the beginning of the COVID-19 pandemic and have undergone a renaissance since their last watershed moment in 2017. Given the opportunity to innovate, numerous financial services providers globally have been taking concerted steps to provide access to this growing asset class. A dearth of regulatory frameworks, coupled with dissonant government responses to the challenges posed by decentralized finance (DeFi), have contributed to an uneven playing field, allowing some jurisdictions (Canada, most notably) to advance forward with productized ideas earlier than others.

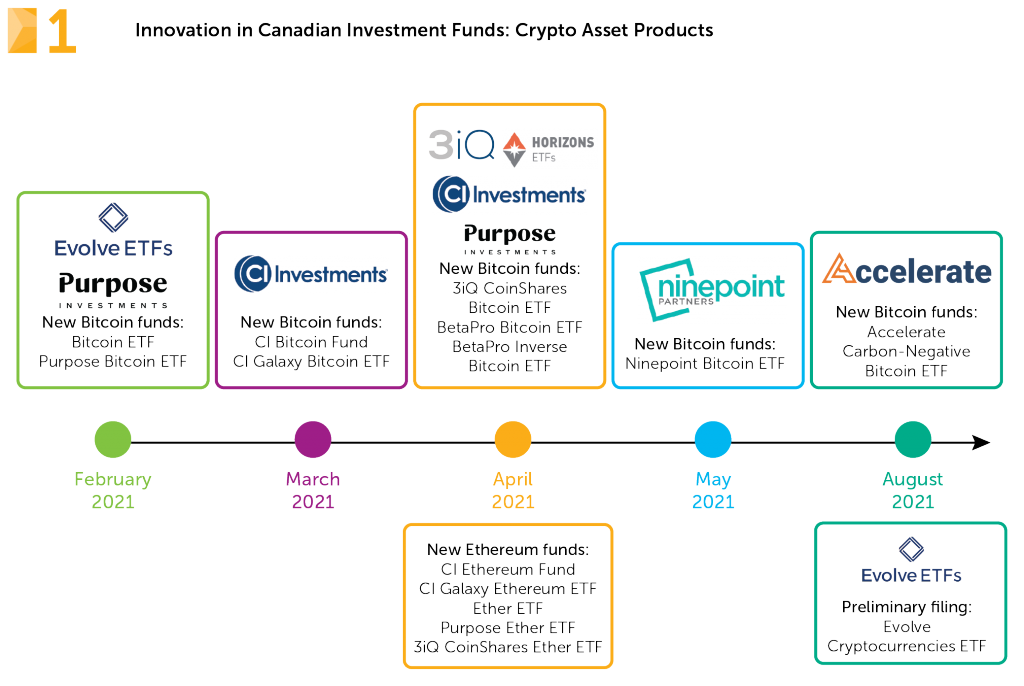

The advent of a new asset class is not an everyday occurrence, but financial innovations, pioneering product designers and new asset types emerge from time to time (see Figure 1).

Developing cryptocurrency funds involves more than packaging the underlying asset: product development teams must work assiduously to hammer out transactional, settlement and custody processes. With part of the ecosystem still conceptualizing and working toward new solutions for transaction, storage and custody of crypto assets, partnering with firms offering expertise in the cryptocurrency space was a necessary step for most asset managers venturing into the asset class. As interest in crypto assets grows, however, innovation is expected to spread beyond investment funds and cryptocurrencies.

As interest in crypto assets grows, innovation is expected to spread beyond investment funds and cryptocurrencies.

The next stage for crypto developments includes wallets for brokerages, family offices, private counsellors and institutional investors that can not only hold the more accepted cryptocurrencies, such as Bitcoin or Ether, but also other assets derived from the blockchain process underlying the crypto currency concept. That includes digital art in the form of non-fungible tokens (NFTs), tokenized securities, and crypto currencies beyond the top two. Developments are underway in custodial platforms, but advice-based distributors are treading cautiously. Our interviewees agreed that portfolio allocations to crypto are expected to remain small for now, usually at no more than 1% of assets for high net worth (HNW) investors who display interest in the category.

More funds are also coming. New entrants augur product proliferation and pricing pressures in the emerging crypto space, but additional product ideas will venture beyond providing only exposure to cryptocurrency. While the usually intense market volatility of cryptocurrency makes it difficult to think of it as a substitute for fixed income, some managers, and reportedly, some advisors, are contemplating income generation strategies with crypto assets. This can be achieved by at least two mechanisms: writing covered-call options on crypto futures and staking crypto assets in transactional pools. Staking assets in pools is akin to locking the assets in platforms that validate transactions and is a strategy that pays handsomely, given current interest- rate levels, which oscillate between 4% to 6.5% annually.

We are looking at the proverbial tip of the iceberg in terms of crypto asset developments, market acceptance and penetration of household wallets.

For the foreseeable future, regulators have expressed their intentions to only authorize products providing exposure to currencies for which a futures market has been developed—that is Bitcoin and Ether, for now. Product manufacturers are getting ready for more developments: some of them reported being as prepared as possible to file new crypto products as futures markets develop for more currencies.

Going global

Beyond Canada, the global crypto scene is also evolving fast. In mid-October, the first Bitcoin ETF was launched in the US market. Regulators, central banks and policymakers are all busy imagining digital currencies of their own, debating taxation of crypto assets and evaluating more productized ideas. The current pace of developments suggests, and our interviewees generally believe, that we are looking at the proverbial tip of the iceberg in terms of crypto asset developments, market acceptance and penetration of household wallets.

Originally pioneered in Canada, thanks primarily to a quick regulatory response, several cryptocurrency funds were introduced in a short period of time by several asset managers with a propensity to innovate.

In February 2021, Purpose Investments unveiled their Purpose Bitcoin ETF, the first of its kind for the firm and which also served as the world’s first exchange-traded cryptocurrency product. That distinction was short-lived, as 12 additional ETFs and mutual funds sponsored by CI Investments, Evolve Funds, Horizons ETFs, Ninepoint Partners, and 3iQ entered the market shortly thereafter with ETFs and even mutual funds of their own. The newly-minted crypto funds solved, using different mechanisms, the tracking error issue plaguing 3iQ’s closed-end product.

What's next?

From a fringe and niche concept to being considered a mainstream asset class, crypto currencies still have a long way to go. Price volatility, partly a reaction to regulatory and government initiatives and bans, has not helped, but as regulators and policymakers set clear rules, interest from a larger audience is likely to materialize. As platforms offering tangible services (think smart contracts) evolve, price fundamentals for at least some of the crypto currencies will slowly emerge.

Down the road, this should also result in a less volatile and more consumer-friendly environment that will benefit all.

Feel free to reach out to us directly for more information on the full report or any of ISS Market Intelligence’s Investor Economics research offerings.