Pioneering the future: Transforming private markets in a retail-driven landscape

Private markets are experiencing a seismic shift as retail investors increasingly seek opportunities beyond traditional investment options. Historically, the domain of institutional investors, private markets are now drawing significant interest from retail investors. This surge is driven by the promise of higher returns, enhanced diversification, and the appeal of alternative investment opportunities. As these investors look to diversify their portfolios and achieve higher returns, the landscape of private markets is being reshaped in unprecedented ways.

The rise of retail investors in private markets

Our recent research survey highlights a strong appetite for private funds among retail investors, with 97% of asset management professionals reporting significant or moderate interest. Private equity (67%) and real estate (55%) are leading the way, reflecting the growing demand for these asset classes. Additionally, 86% of respondents expect alternative investments to make up a significant portion of a retail investor’s portfolio within the next five years.

This shift marks a departure from the historical dominance of institutional investors in private markets. Retail investors are increasingly recognising the potential for higher returns. For instance, private equity buyout transactions have outperformed public equities in every vintage year - when a fund first starts making investments - by an average of 1,079 basis points (bps). Similarly, private credit has beaten public leveraged loans in every vintage year since 2000 by an average of 625 basis points. This trend underscores the growing sophistication and appetite of retail investors for alternative asset classes.

Overcoming barriers to entry

Despite increasing demand, retail investors face persistent barriers to entry, including regulatory restrictions, high investment thresholds, and liquidity challenges. Collaboration between industry players and regulators is essential to address these issues. Initiatives like the revised European Long-Term Investment Fund (ELTIF 2.0) are paving the way for greater retail participation, creating more inclusive frameworks to facilitate access.

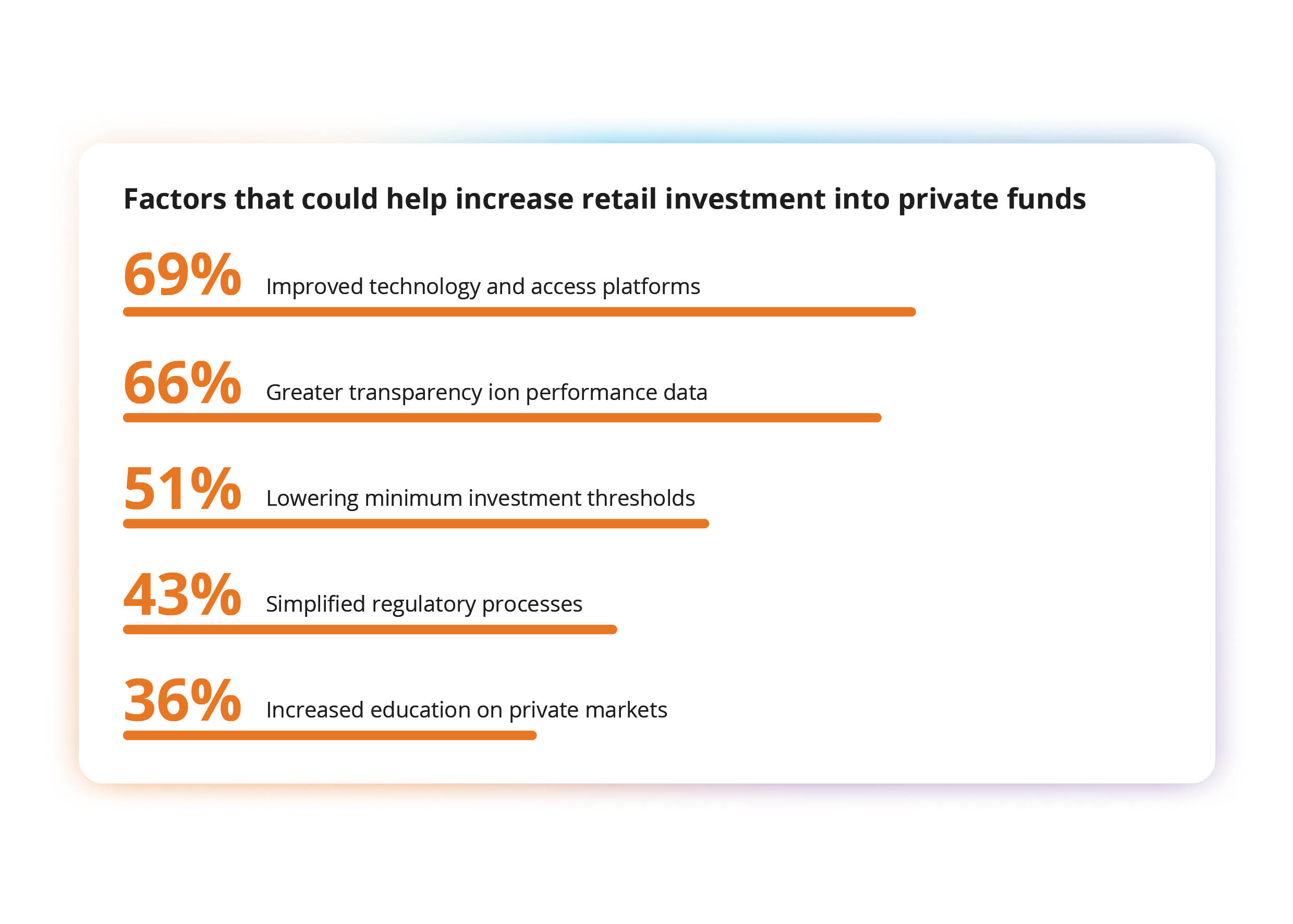

In the U.S., regulatory frameworks such as SEC rules 506(b) and 506(c) continue to restrict private offerings to accredited investors with high net worth and income levels. To truly democratise private markets, regulatory reforms must lower these barriers while preserving investor protection. According to our industry survey, 51% of firms believe reducing minimum investment thresholds is critical to driving retail adoption. Innovative products that enhance liquidity while offering smaller minimum investments are already emerging to bridge the gap.

Technology and tokenisation: Transforming private markets

Technology, particularly blockchain and tokenisation, is revolutionising private markets by breaking down traditional barriers and creating new opportunities for retail investors. Blockchain’s decentralised ledger ensures transparency and trust by allowing investors to track the lifecycle of their investments in real-time. Tokenisation further democratises access by enabling fractional ownership, where assets are converted into tradeable digital tokens. This empowers smaller investors to participate in high-value opportunities that were once exclusive to institutional players.

The liquidity challenge, a key deterrent for retail investors, is being addressed through tokenised assets. Secondary markets enable seamless trading of fractional shares, offering flexibility and reducing the illiquidity historically associated with private markets. Additionally, smart contracts powered by blockchain streamline administrative processes and eliminate intermediaries, reducing costs and making investments more accessible to retail investors.

Improved digital platforms are also facilitating broader access. According to our research, 69% of respondents cited improved technology and access platforms as critical to expanding retail participation, while 58% highlighted blockchain and tokenisation as key enablers. By integrating these advancements, wealth managers are reshaping private markets into a more inclusive investment environment.

Outsourcing and lift-out strategies

In parallel with the technological shift, outsourcing is emerging as a key trend in private market operations. Over the past three years, 76% of firms have adopted outsourced services to streamline their operations. The key benefits of outsourcing include time savings (71%), cost efficiency (70%), and scalability (54%), according to surveyed firms.

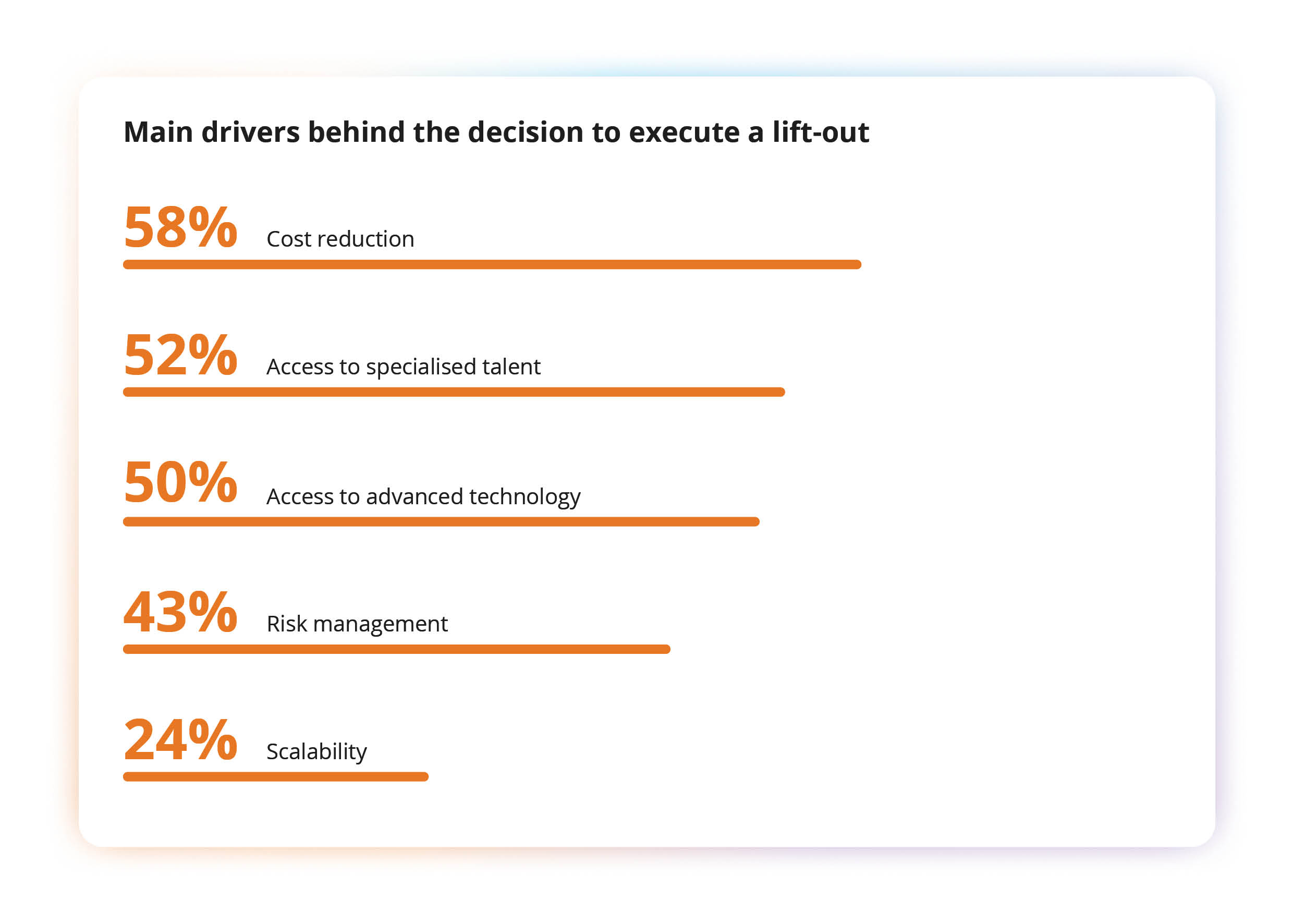

Lift-out strategies, where fund managers transfer operations to specialised third-party providers, are also gaining traction. These strategies allow firms to maintain expertise while leveraging advanced technologies for operational efficiency. As private markets continue to evolve, outsourcing and lift-out strategies will play a crucial role in meeting the demands of retail investors while maintaining competitive advantages.

Future growth and opportunities

The transformation of private markets is far from over. With advancements in regulatory frameworks, technology, and product development, the sector is poised for substantial growth. By addressing barriers to entry and embracing innovations like blockchain and tokenisation, private markets are becoming more accessible to retail investors, offering diversified and resilient portfolios.

The integration of private markets into mainstream investment strategies will be a key driver of future growth. Industry professionals expect a significant increase in private market distribution to wealth managers, with 94% of surveyed asset managers predicting strong growth in this area. The collaboration between industry players and regulators will be crucial in ensuring a smooth transition and fostering a favourable environment for retail investors.

By dismantling barriers and embracing technological advancements, private markets are developing into an inclusive space for investors of all backgrounds. Blockchain and tokenisation, in particular, stand out as transformative forces, enabling unprecedented access, efficiency, and liquidity.