With the ever-changing regulatory environment and the strain regulatory change has on internal resources, there are a few areas of focus that will help you prepare for the UCITS KIID to PRIIPs KID transition whether the date stays 31 December 2021, or if it is delayed further into 2022 (which seems to be the unofficial consensus now).

Financial firms need to closely monitor the outcomes of the ongoing review of PRIIPs KID requirements, in particular of performance scenarios. Firms should also continue to keep an eye on the impact of Brexit and any proposed UK divergence from the EU PRIIPs requirements. There might also be ESG-related considerations. For the time being, the UCITS KIID was excluded from the list of pre-contractual documentation that, under the Sustainable Finance Disclosure Regulation, will have to contain ESG-related disclosure. The issue of ESG disclosures in PRIIPs KID was instead tackled on an ad-hoc basis with a joint technical advice of the ESAs already in 2017.

Understanding the main differences between UCITS KIID and PRIIPs KID

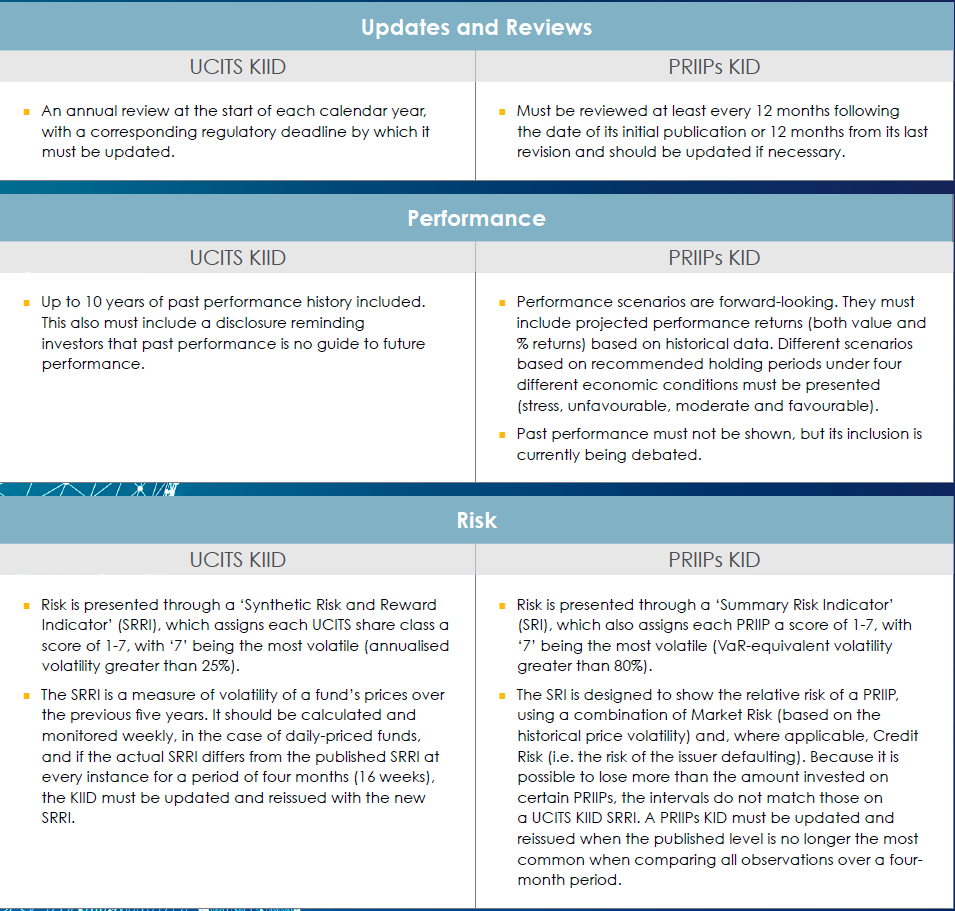

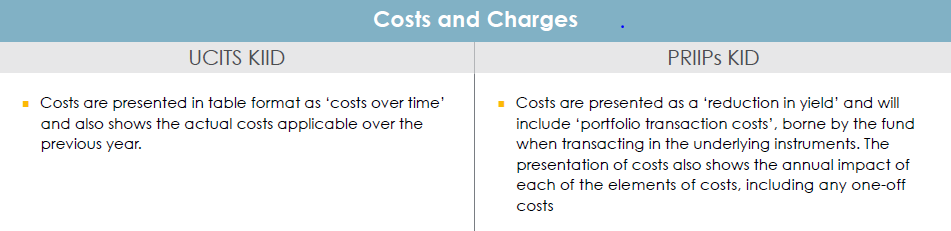

UCITS KIIDs (2 A4 pages) and PRIIPs KIDs (3 A4 pages) are both pre-contractual documents that offer investors information required by law. However, there are some main differences between the two documents and the methodologies being used to calculate the performance scenarios and ongoing costs.

UCITS KIIDs are made up of 6 sections, covering:

1. Fund/share class and management company details

2. Objectives and Investment Policy

3. Risk and Reward Profile

4. Charges

5. Past Performance

6. Practical Information

PRIIPs KIDs offer up 8 sections:

1. PRIIP manufacturer details

2. What is this product?

3. What are the risks and what could I get in return?

4. What happens if the PRIIP manufacturer is unable to pay out?

5. What are the costs?

6. How long should I hold it and can take money out early?

7. How can I complain?

8. Other relevant information

What do firms need to be doing now?

Allocate resources

A practical next step will be to form a project team to manage the transition from UCITS KIIDs to PRIIPs KIDs.This team will need to decide whether to prepare the PRIIPs KIDs in-house and/or to use external providers either to produce them on an ongoing basis or to assist with the transition. There will be a cost involved in switching to PRIIPs KIDs and automating the process, so budgeting will be essential, especially when thinking of how to scale to meet demand and leveraging the same technology for other document production requirements and regulations in the future.

Build a transition project plan

The transition project plan will need to ensure that each aspect of the transition is managed and delivered on time. Start with the date you want to produce and distribute your first PRIIPs KIDs documents and work backwards to determine the time needed for implementation.

The transition timeline should factor in the following variables:

- Size of product suites (e.g. how many documents need to be factored into the transition?)

- Decisions taken on outsourcing vs. insourcing

- Sufficient time to acquire the required data/content, both numerical and textual

- Whether third-party vendors are involved in custom aspects of the process (e.g. for calculation purposes)

- Whether PRIIPs KIDs will need to be provided in foreign languages - this could vastly increase the size of the suite of PRIIPs KIDs and time may need to be factored in to obtain the necessary translations

- Dissemination – ensure the resulting PRIIPs KIDs can be pushed out to relevant distribution partners and data providers.

Build or buy technology

Other considerations that need to be made is whether firms want to build or buy technology. Technology builds will be needed to meet the transition to the PRIIPs KID. Some firms may look to build this technology in-house, but expect most firms to use a third-party service provider – especially one that can consolidate disparate operations, technology and data to help lower total cost of ownership and mitigate risks.

Identifying an appropriate provider is important, in particular given the FCA’s increased focus on operational resilience for the technology supporting a firm’s business services.

Data management

Finally, you need to be thinking about the data sources you will need to meet the PRIIPs standards, including:

- Transaction data going back three years – including population and record of arrival-timestamp for each transaction

- Pricing frequency for each product and the available price history length

- OGC (on-going costs)

- Proxies if insufficient data

- Performance scenarios