Private assets: Is demand catching up with supply?

There has been much talk of 'democratising' private assets beyond their traditional client base of institutional investors in recent years, but also, perhaps, a sense that industry expectations have been running ahead of reality. With minimum investments often in the tens if not hundreds of thousands of euros (or other local currencies), adoption of such investments is still at a nascent stage for most retail investors.

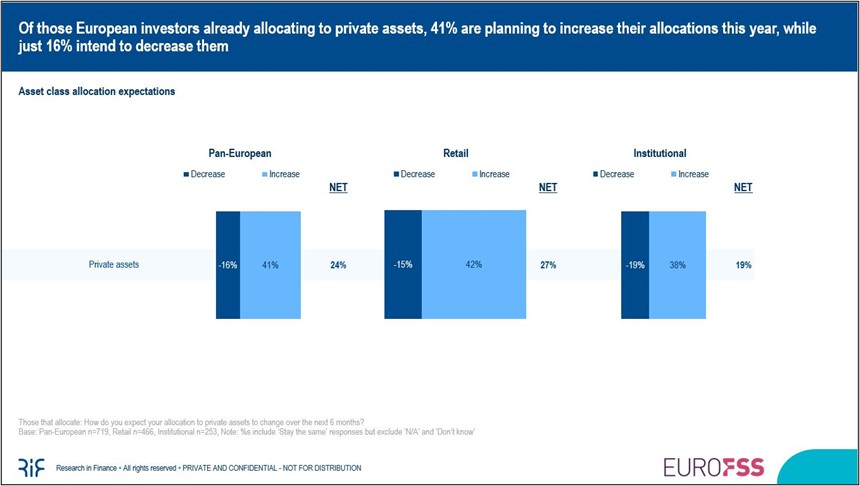

Nevertheless, general professional investor demand for several forms of private assets is looking healthy this year – and notably stronger than a year ago. According to the third annual wave of Research in Finance’s European Fund Selector Study (EuroFSS), based on the views of nearly 900 retail and institutional fund selectors and distributors gathered between March and May 2024, aggregate net allocation intentions towards private assets (among those currently allocating to this space) are positive in all of the eight markets covered by the study: Benelux, France, Germany, Italy, the Nordics, Spain, Switzerland and the UK.

Net institutional appetite for private assets appears solid, with 38% of institutional current users planning to increase allocations, while only 19% intend to decrease exposure, equating to a net +19% score. However, retail sentiment is looking even more robust, with 42% of intermediaries who already invest in private assets planning to increase their allocations, versus just 15% who intend to decrease their holdings – a net score of +27%.

Of course, private assets consist of a patchwork of differing sub-asset classes, and EuroFSS tracks demand for these too. Among investors currently using each asset class, private equity enjoys the greatest allocation intentions, with a net allocation score of +19% overall (up from +8% in Q1 2023), rising to +24% among retail investors. Of the various underlying private equity strategies and sectors, primaries and small / mid-cap buyout are deemed particularly attractive by Europe’s professional investors this year.

Nearly all other private asset classes and alternatives explored in the research are also facing net positive allocation intentions, with one clear exception: real estate. In its latest wave, the study split out this asset class into equity and debt variants, but both still face net negative intentions of -5% and -12% respectively (the combined net intentions score a year previously was -10%, suggesting little change in sentiment). Spain is an exception to the rule in 2024, with the two asset classes enjoying net allocation intentions scores of +20% and +4% respectively there, reflecting a buoyant local property market that appears to be bucking the trend in the broader Eurozone.

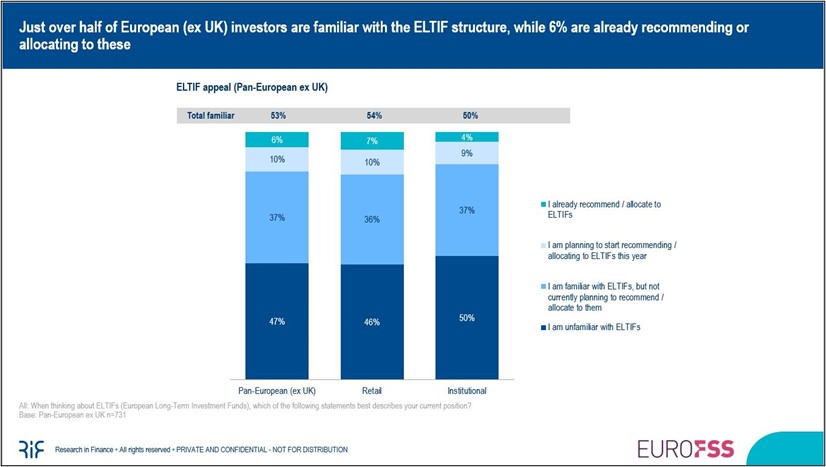

Many professional investors already have at least some exposure to private assets in their client portfolios or funds – almost 80% of retail respondents to EuroFSS and closer to 90% of institutional respondents – but there is also clear recognition of some obstacles to getting involved. Of the various barriers to investing in private markets tested in EuroFSS, ‘lack of liquidity’ is cited by 50% of respondents as a primary blocker by retail and institutional investors alike. Conversely, only 35% of investors view ‘regulatory concerns’ as a key obstacle in 2024, down from 46% in 2023. This could well be connected to a perception of greater regulatory support for investment in private markets following the introduction of the ELTIF 2.0 (European Long-Term Investment Fund) rules in the EU, and the new LTAF (Long-Term Asset Fund) structure in the UK.

Talking of ELTIFs, EuroFSS also asked investors about their current familiarity and usage of such vehicles. Excluding the UK, just over 50% of Europe’s professional investors do at least know what an ELTIF is, although that means a large part of this audience is still unaware of the structure. In terms of current usage, this is highest in Italy, where ELTIFs have enjoyed relatively good uptake thanks to their compatibility with local tax-efficient PIR (Piani Individuali di Risparmio) savings plans. As one of the keys to unlocking further retail demand for private assets in Europe, the ELTIF could benefit from greater education on its existence, use cases, and potential benefits.

If you would like to learn more about EuroFSS or Research in Finance’s broader research services, please do get in touch!