Private market trends amid economic volatility

Recent economic turbulence—marked by heightened market volatility, shifting interest rate expectations, and geopolitical disruptions such as tariffs—has had significant implications for private markets. While private markets typically react more slowly than public markets due to reporting lags, proprietary data and emerging trends from State Street, one of the largest custodians of private assets, offer valuable insights into the evolving landscape of valuations, deal flow, liquidity, and capital raising.

Volatility’s impact on distributions and liquidity

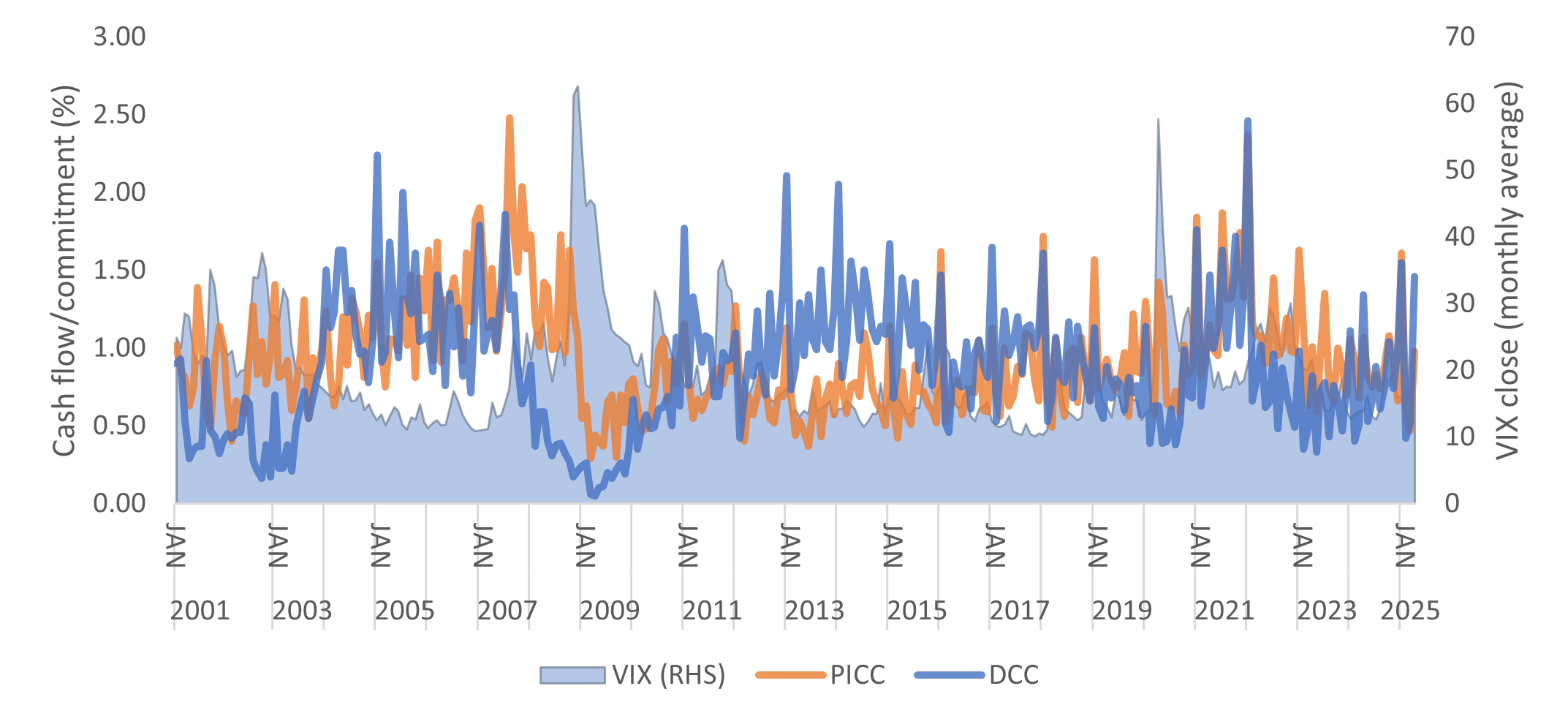

Data from State Street shows a clear negative correlation between public market volatility and private market exit activity. While the correlation between monthly Paid-In Capital over Committed Capital (PICC) and the average VIX (a measure of market volatility) is weak (6.7%), the correlation between Distributions over Committed Capital (DCC) and VIX is strongly negative (-42%). This indicates that when market volatility spikes—as it did in April 2025, when the VIX reached levels reminiscent of the 2008 financial crisis and the COVID-19 downturn—private equity (PE) firms struggle to execute exits and generate distributions (see Exhibit 1).

Exhibit 1. Private market monthly cash flow normalized by commitment (Source: State Street, as of Q1 2025.)

This downturn in exits threatens to push net cash flows (distributions minus capital contributions) back into negative territory. If current volatility persists, limited partners (LPs) may face increasing liquidity pressure, especially as general partners (GPs) reduce their reliance on subscription lines of credit and instead issue direct capital calls to LPs. This could place a heavier financial burden on LPs, many of whom are already navigating volatile public market conditions.

Valuation trends and strategy sensitivity

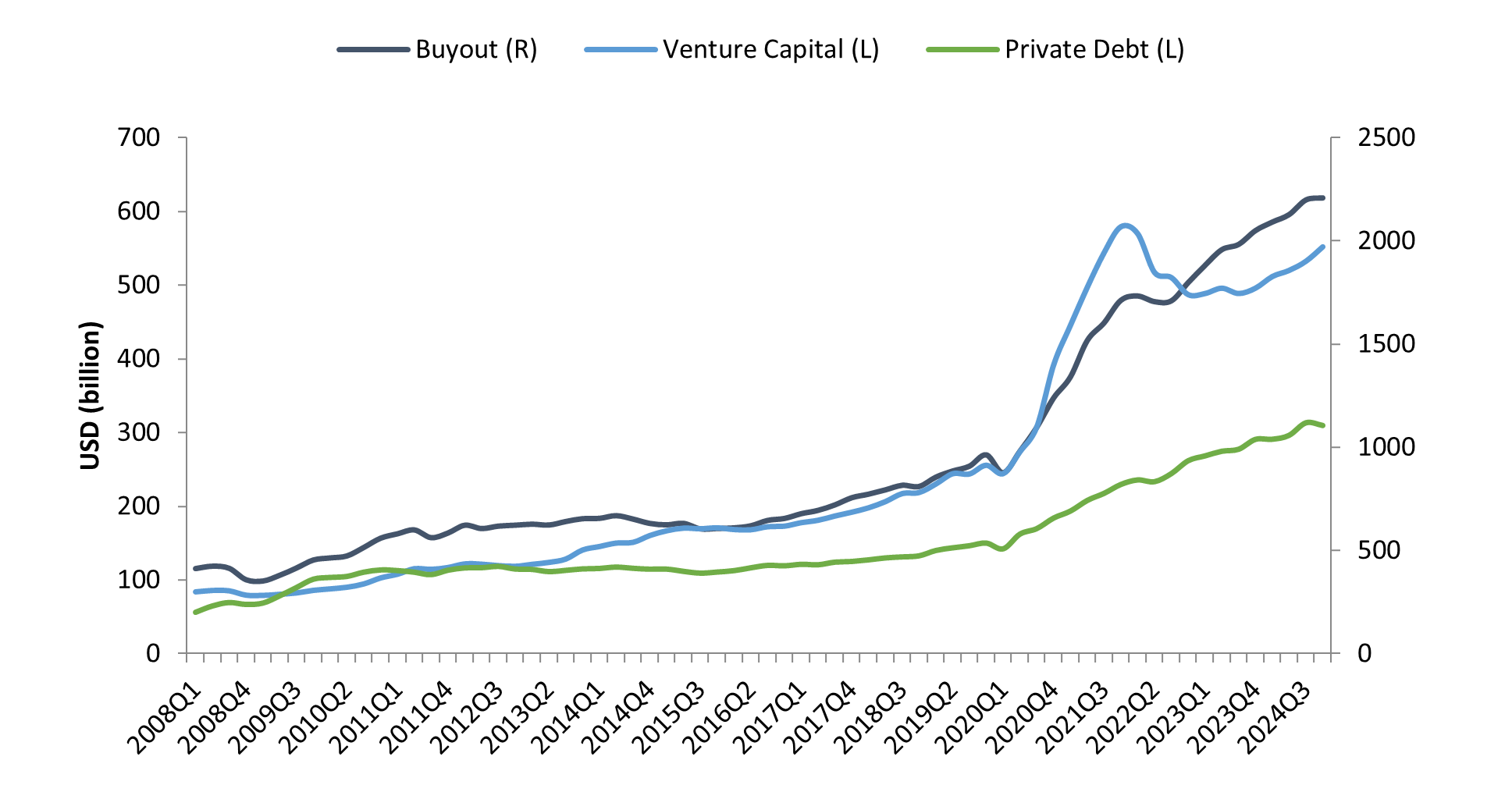

Historical data suggest that private equity net asset value (NAV) changes tend to be smoothed and delayed during periods of market stress. This pattern was evident during the 2008 financial crisis, the COVID-19 pandemic, and the 2022 rate hikes (see Exhibit 2). Different private equity strategies react differently to public market disruptions: venture capital (VC) valuations tend to be highly sensitive, while private debt strategies show greater stability.

In the current environment, the expected trajectory of PE NAVs remains cautious. Although early signs of recovery in valuations and exit activity appeared in 2023 and early 2024 following the Fed’s initial rate hikes, persistent inflation and the potential for prolonged elevated interest rates could stall further valuation growth.

Exhibit 2. Net asset value of private market fund investments (Source: State Street, as of Q4 2024.)

Fundraising downturn

Private market fundraising has been cyclical and has experienced a downturn since its peak in 2021. This decline has continued despite strong public equity market performance in 2023 and 2024, which should have alleviated the denominator effect and freed up capital for private market allocations. However, the lack of meaningful distributions to LPs and cautious investor sentiment have kept the fundraising environment subdued (see Exhibit 3).

Exhibit 3. Fundraising activities (Source: State Street, as of Q4 2024.)

Investor confidence has also been shaken by ongoing macroeconomic uncertainty, which disproportionately affects higher-risk strategies such as VC and emerging markets private equity. These segments are likely to face steeper fundraising challenges in the near term.

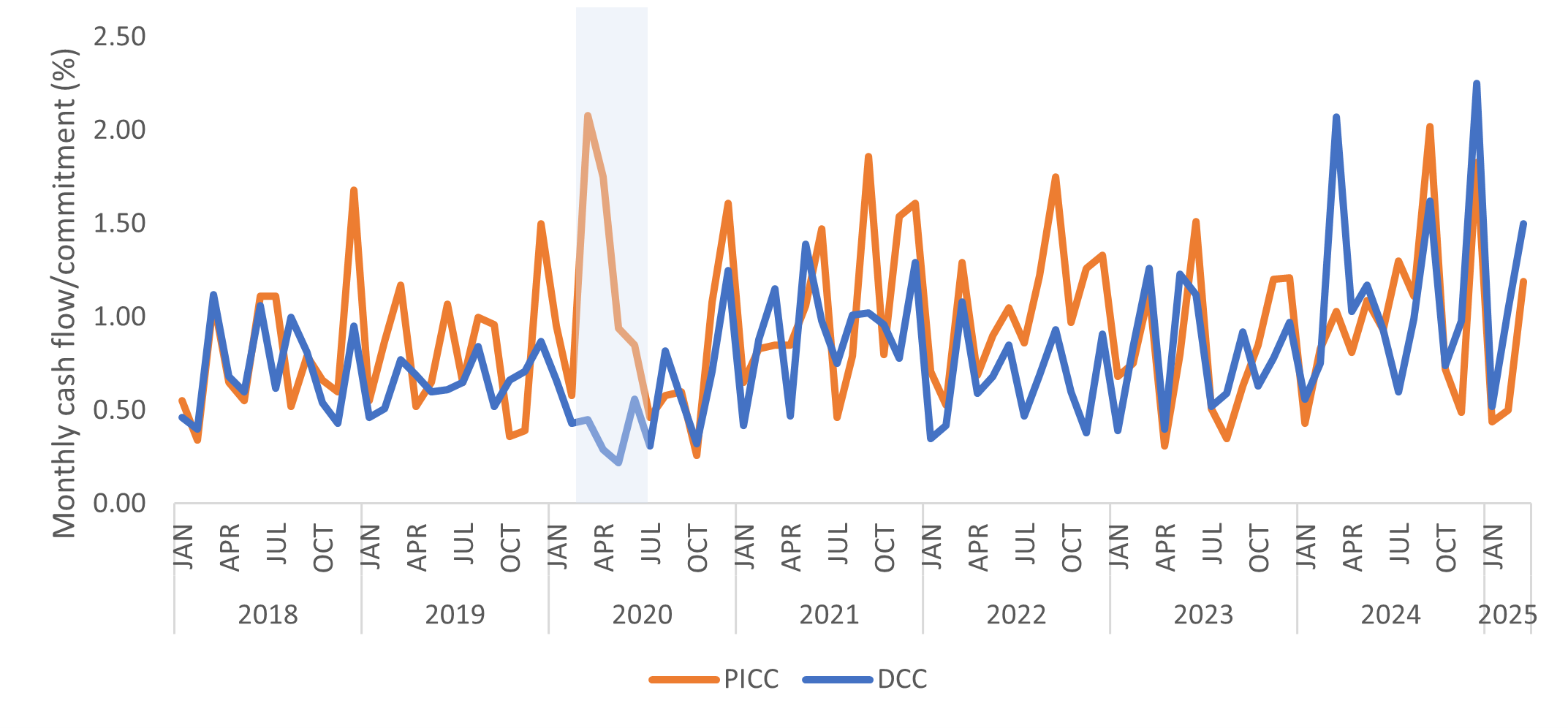

Operational challenges and private debt

Tariff-induced supply chain disruptions are creating new challenges for private companies, echoing the operational difficulties observed during the COVID-19 crisis. At that time, capital calls from private debt funds surged as companies scrambled to secure liquidity (see Exhibit 4).

Similar pressures are anticipated today as global trade faces renewed strain from rising tariffs. PE-backed companies, particularly those in manufacturing, logistics, and international trade, may again turn to private debt providers for emergency funding. This could increase stress on both companies and the funds supporting them, potentially resulting in tighter underwriting standards and higher borrowing costs.

Exhibit 4. Private debt contributions surged during COVID (Source: State Street, as of Q4 2024.)

Foreign exchange (FX) and geopolitical risks

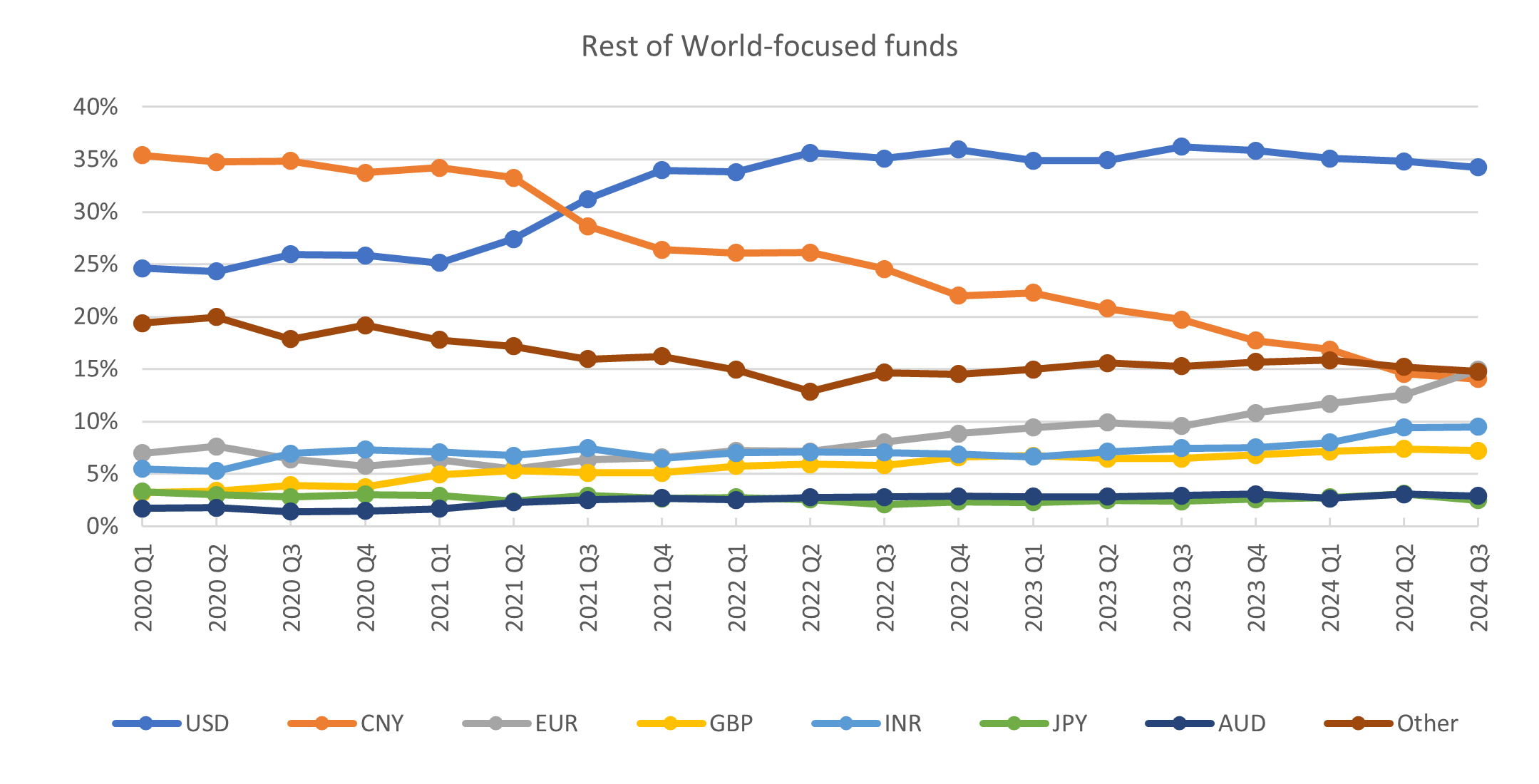

Another emerging risk is foreign exchange volatility, particularly for EUR-denominated funds. Tariff shocks can destabilize currencies, and EUR-based funds—which comprise about 14% of the State Street Private Equity Index (SSPEI) universe—may experience performance drag from unfavorable currency movements.

On a more positive note, direct exposure to China in many portfolios has declined significantly over the past five years. This shift may insulate some investors from geopolitical risks related to U.S.-China tensions (see Exhibit 5).

Exhibit 5. Portfolio company level country exposure in Rest-of-World focused funds (Source: State Street, as of Q3 2024.)

Outlook: Near-term headwinds, long-term resilience

Looking ahead over the next 6-12 months, the private markets are expected to face continued headwinds. Inflation may remain elevated, interest rates could stay higher for longer, and exits and valuations may remain subdued. These pressures will likely weigh on deal flow and investor sentiment, especially in the more volatile segments like VC.

That said, private equity and private debt remains a long-term asset class. While short-term volatility can disrupt exit timing and capital flows, it does not typically alter long-term return outcomes. Moreover, the economic transformations driven by tariffs – such as reshoring of manufacturing, increased domestic infrastructure investment, and technological innovation – could create new opportunities for private investments. Funds that focus on operational efficiency, local supply chain resilience, and next-generation infrastructure may be especially well-positioned to capitalize on these changes.

Conclusion

Private markets are navigating a complex landscape shaped by volatility, inflation, and policy shifts. Exit activity and fundraising have softened, capital calls are rising, and LP liquidity is under pressure. Still, private market’s long investment horizon and flexibility in strategy provide a cushion against short-term disruptions. While cautious in the near term, the sector is poised to find opportunity amid the challenges—particularly for managers and investors prepared to adapt to structural changes in the global economy.

Nan R. Zhang, PhD CFA, is Managing Director, Head of Product Development, Investor Data Products & Analytics at State Street. Join the State Street team at IMpower FundForum >