Protecting the perimeter: The rise of external fraud

What are the biggest external frauds on the rise, what should you be aware of and how can you mitigate against them? We are delighted to share the key results of PwC’s Global Economic Crime and Fraud Survey 2022. Read more here and download the full report below, to set you and your company up for a more resilient future.

External threats are on the rise

Preventing fraud and other economic crimes is a complex challenge, complicated even further by today’s volatile risk landscape. As organisations act quickly to navigate change, bad actors look to exploit the potentially widening cracks in fraud defenses.

46% of surveyed organisations reported experiencing fraud, corruption or other economic crimes in the last 24 months.

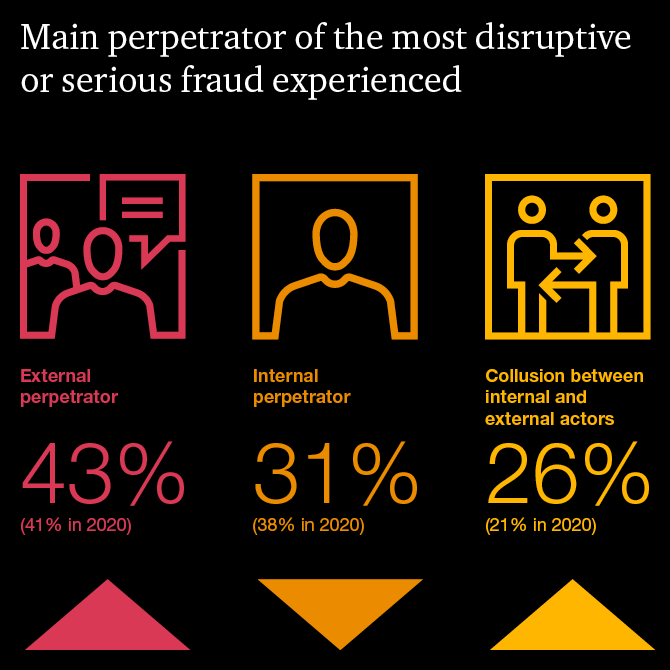

PwC’s Global Economic Crime and Fraud Survey 2022 shows good news: the proportion of organisations experiencing fraud has remained relatively steady since 2018. However, the survey of 1,296 executives across 53 countries and regions found a rising threat from external perpetrators—bad actors that are quickly growing in strength and effectiveness. Nearly 70% of organisations experiencing fraud reported that the most disruptive incident came via an external attack or collusion between external and internal sources.

The perimeter is vulnerable, and the game has changed

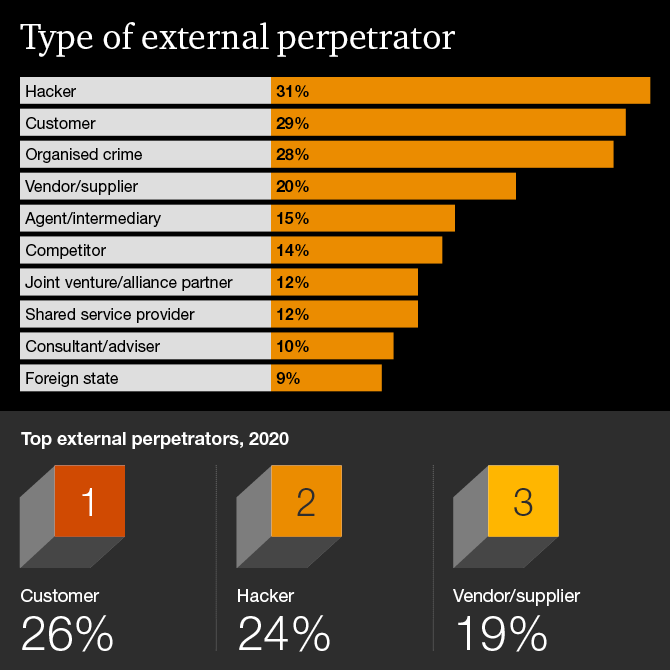

Hackers and organised crime rings are among the most common external perpetrators. Their activity rose substantially in the last two

years: 31% of external perpetrator cases were the result of hackers, and 28% were conducted by organised crime. Both numbers reflect increases from our 2020 survey.

Organised crime groups are becoming more specialised and professional, with goals, incentives and bonus structures. Bad actors are also collaborating, which increases both the volume and sophistication of attacks. Thanks to chat rooms, the dark web and crypto currency, specialists in data breach, false ID creation, attack methodology, and other nuanced areas can connect, coordinate and transact within a growing criminal economy (Listen to PwC’s podcast on the rise of ransomware attacks).

Combatting these bad actors is unlike the effort to contain internal fraud, because external fraudsters are immune to traditional fraud prevention tools such as codes of conduct, training and investigations.

Platforms are the new fraud frontier

What’s the point of entry for external fraudsters? Many are exploiting new technologies being deployed by companies. Digital platforms, such as social media, services (for example, rideshare or lodging) and e-commerce, open the door to fraud and economic crime risks that most companies are just beginning to appreciate. Of those organisations experiencing fraud in the last two years, for four in ten it was connected to the digital platforms they rely on.

40% of those encountering fraud experienced platform fraud.

The pandemic created additional vulnerability as organisations accelerated the shift to digital operations. Meanwhile, new fraud risks are emerging and new predators are gaining strength. What, exactly, is the fraud risk that companies face today? Read the full report to learn more.

PwC is a principal partner of RiskMinds International 2022. This article was first published on PwC's website.