R&D: A long-term investment

Investments are made for the long term. Wouldn’t it be nice to know that companies have the same focus on the future? Innovation can fuel a company’s growth, but it doesn’t happen overnight. Rather, it is the result of a disciplined approach of planning, investing in and executing strategic plans. Innovation takes time — very often years — and can be expensive.

One way to measure a dedication to innovation is to look at the investment in research and development (R&D) that companies make. For accounting purposes, R&D investment can be a drag on earnings in the year the investment is made, but companies hope that commitment to development will result in higher sales and profitability down the road.

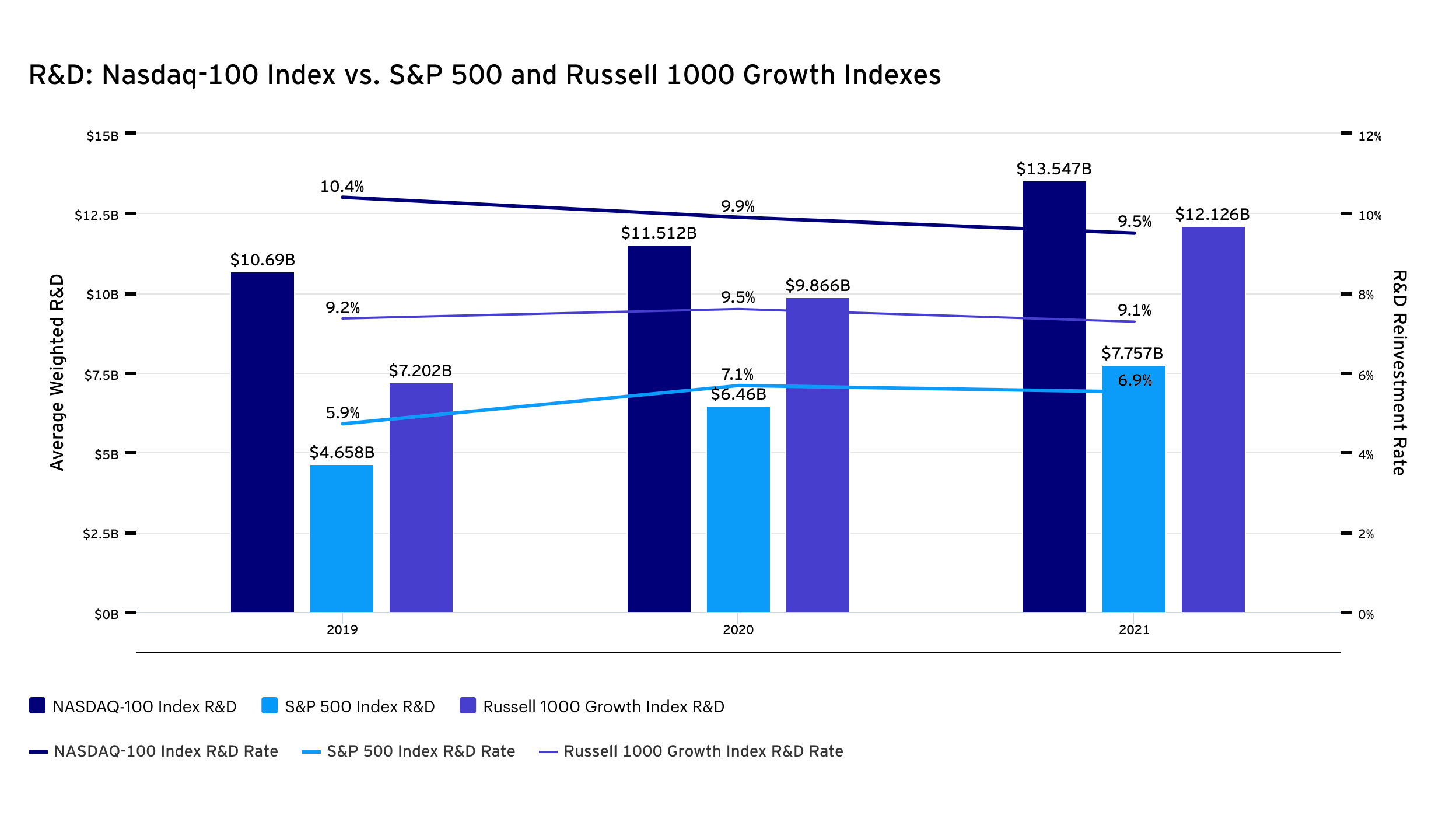

Ironically, one way to increase profitability in the current year is to cut R&D investments. However, this likely does not help the firm over the long term. Comparing Invesco QQQ’s underlying index, the Nasdsaq-100, to the S&P 500 and Russell 1000 Growth indexes shows that companies held in Invesco QQQ offer higher total dollars spent on R&D, as well as a larger percentage of sales reinvested back into the companies via R&D.

Source: Bloomberg L.P, as of March 31, 2022.

The constantly changing environment has placed the spotlight on a company’s ability to innovate. Recently, the COVID-19 Pandemic turned the world on its head, people needed to immediately adapt the ways in which they conducted business, how they interacted with their teams and even the ways they kept up with family and friends. The need for connectivity was paramount and allowed for interaction from a safe distance as the world tried to stem the spread of COVID.

However, these trends did not arrive out of the blue. Many of these themes had been building for years, and the pandemic forced a rapid acceleration of adoption. In many cases, the commitment to R&D shown by QQQ holdings companies laid the groundwork and infrastructure for these capabilities. When demand for these products and services rocketed higher in an instant, the companies that had spent considerable time, effort and money on developing these solutions were able to handle the demand almost seamlessly.

Innovation is not solely about spending money on R&D, it is imperative to have a culture and a framework that cultivates new ideas and fosters their development.

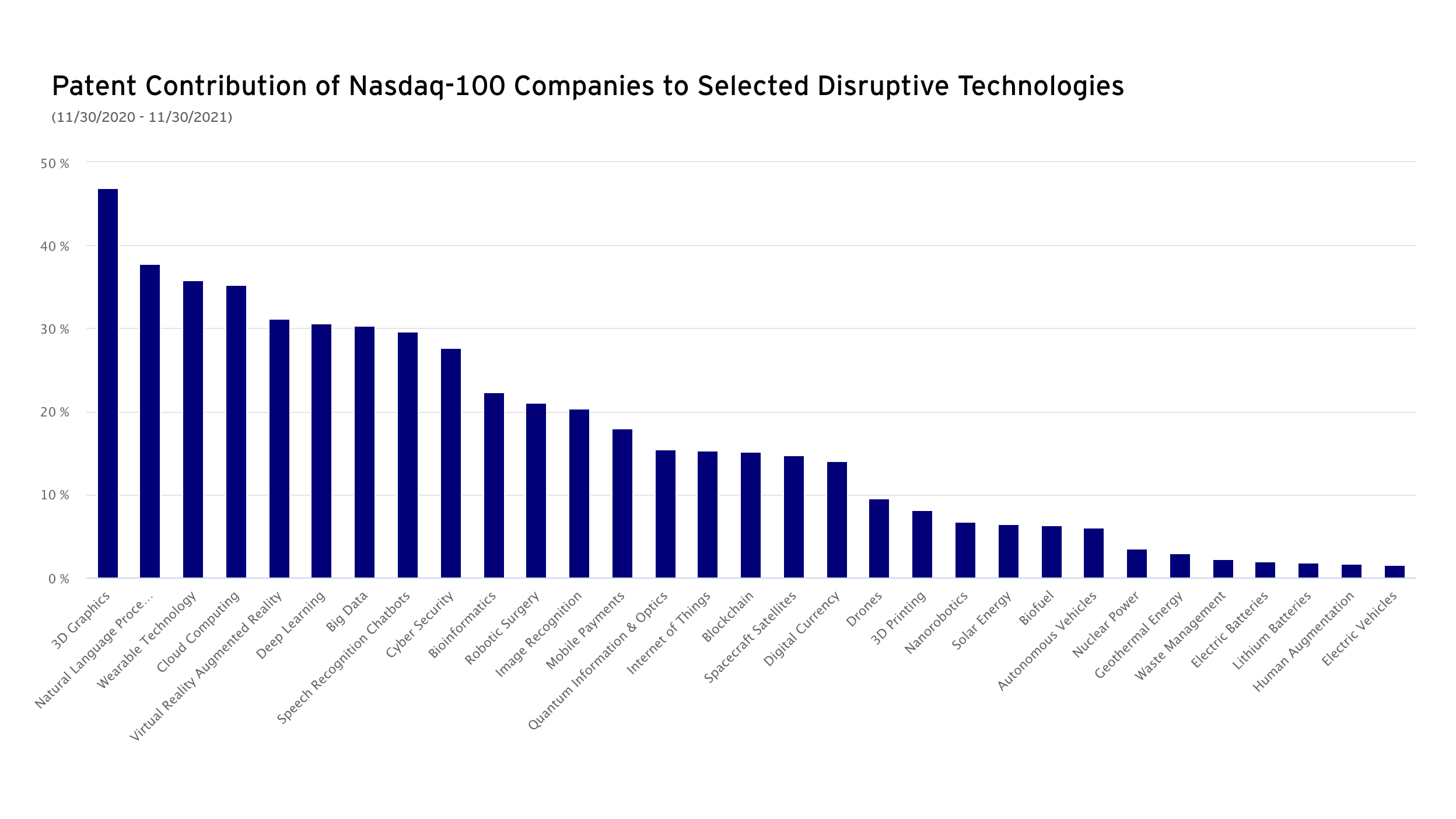

We believe most companies held within QQQ have established their innovation culture, and that their commitment to R&D has led to considerable exposure to a number of growing, transformative themes. The chart below outlines patent contributions from companies in QQQ’s underlying index, The Nasdaq-100, in the 12-months ended November 30, 2021, across 35 different disruptive technologies.

Some of these themes have been widely adopted, some of these themes are still in their infancy, but these companies’ cultures of innovation have allowed them to stay ahead of the curve and expand their, horizons into improving existing products and services while exploring creative new ideas.

Source: Nasdaq, as of December 31, 2021; Yewno Data as of Nov 30, 2021, Constituents as of Dec 31, 2021. Most current available data available.

No matter how much our environment changes, the desire and need to innovate remains constant. As we turn the page on an unprecedented year, companies will continue to lay the groundwork for better products and new services as innovation continues to push us to the future.

Disclosures:

The Nasdaq-100 Index comprises the 100 largest non-financial companies traded on the Nasdaq.

The Russell 1000® Growth Index, a trademark/service mark of the Frank Russell Co.®, is an unmanaged index considered representative of large-cap growth stocks.

The opinions expressed are those of the authors, are based on current market conditions and are subject to change without notice. These opinions may differ from those of other Invesco investment professionals.