Research, collaboration and consistency

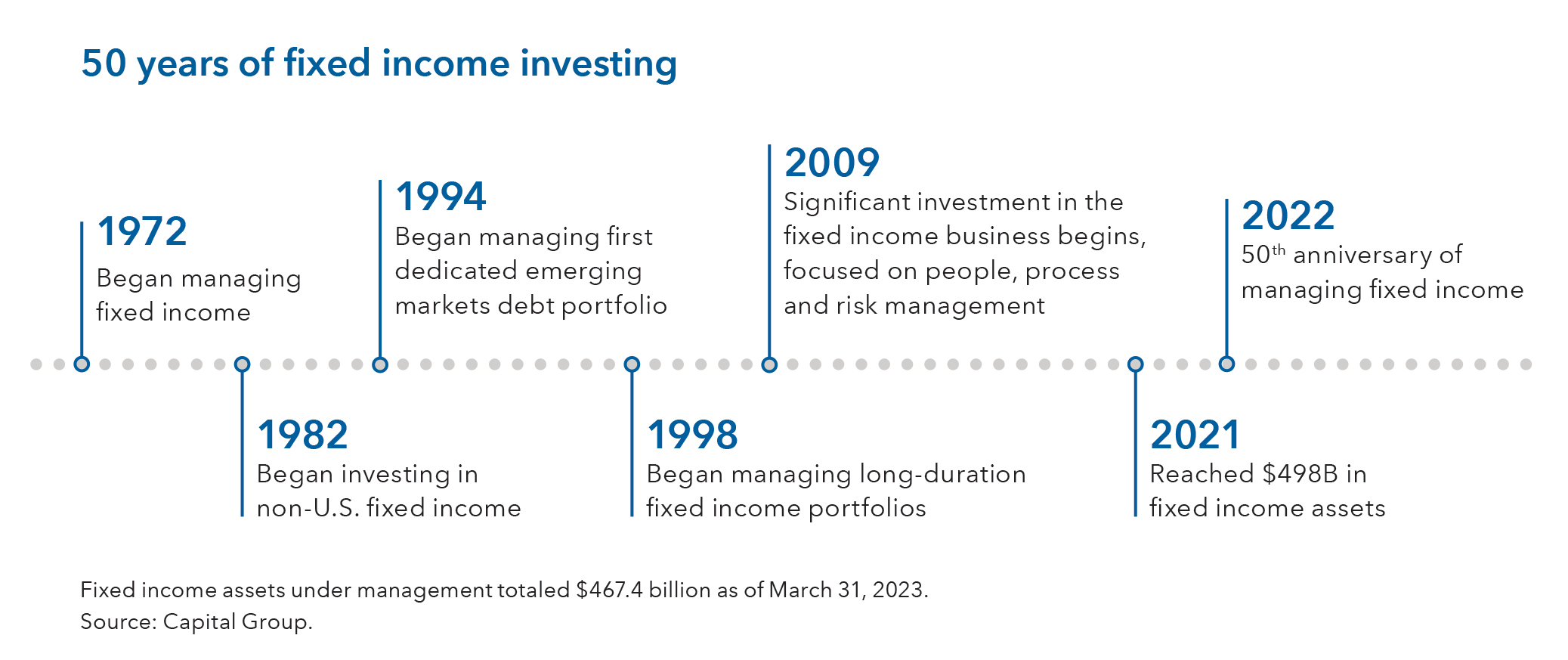

At a recent annual gathering, Capital Group’s global team of fixed income

professionals took time to reflect on the company’s first 50 years of managing

fixed income portfolios. Here, we detail the three pillars that underpin our fixed

income investment philosophy.

Pillar 1: Deep fundamental research

Proprietary, fundamental research is at the heart of our fixed income investment process. A key difference at Capital Group is that our analysts also invest alongside portfolio managers, giving them an opportunity to put their highest-conviction recommendations into action. This structure helps us attract and retain top talent. Rather than being seen as a stepping stone to becoming a portfolio manager, the investment analyst role is often a career-long position.

Analysts conduct bottom-up research across industries, geographies and fixed income sectors to assess issuers’ financial condition and risk factors, potential debt-service roadblocks and new investment opportunities around the world. Top-down perspectives from our team of macroeconomists complement this bottom-up approach. This top-down perspective is the focus of our Portfolio Strategy Group (PSG), a diverse group of seven fixed income portfolio managers and analysts (as at 31 March 2023).

The PSG receives input on the direction of the global economy and policy from the firm’s in-house team of economists and policy specialists. In addition, each fixed income sector team provides perspective on the opportunities and risks in its area.

“Having more of a top-down view helps us make sure that our portfolios are balanced and well diversified”, said portfolio manager Pramod Atluri.

Direct engagement with debt issuers adds important texture to the research. The international presence of our fixed income research and trading teams — with key hubs in Los Angeles, New York, London, and Singapore — facilitates issuer interaction and provides a global perspective.

A compensation structure plays a key role in encouraging strong

investment selection and a long-term perspective. Our portfolio managers and

analysts are compensated based on returns over one-, three-, five- and eight- year periods, with the longer periods more heavily weighted to incentivise a

long-term perspective.

Pillar 2: Highly collaborative culture and investment process

Intentional, ongoing collaboration among investment colleagues results in

differentiated insights and diversified portfolios of high-conviction ideas.

Portfolio managers and analysts frequently meet to share perspectives, with the goal of strengthening their independent investment decisions. Fixed income analysts and portfolio managers also benefit from regular interaction with their equity colleagues, who have longstanding company relationships and industry knowledge.

This collaboration gives both equity and bond investors a more complete picture, enabling them to develop differentiated insights. Discussion and debate enable individuals to cement their thesis by considering multiple perspectives. Collaboration is embedded in the firm’s multiple portfolio manager investment approach. Each strategy is managed by a team of portfolio managers that intentionally blends diverse investment styles.

We believe that, over time, this approach generates a smoother, more consistent pattern of results rather than a system where one individual investment style dominates. Although there tends to be low personnel turnover at Capital Group, this diversified approach to portfolio management also reduces “key man” risk and noise resulting from portfolio manager changes that may occur. Having analysts invest alongside portfolio managers helps ensure a deep bench of investment talent whose various investment styles are well-understood in advance.

Pillar 3: Delivering consistent outcomes

Our focus on delivering consistent outcomes aims to give clients confidence that our fixed income strategies will fulfil their intended roles in broader investment portfolios. This emphasis on strategies’ stated objectives is meant to discourage excessive risk-taking, which can expose a strategy to inordinate volatility. This is a key element of our effort to consistently deliver strong long-term risk-adjusted results in a pattern that clients expect. To pursue this goal, a multi-layered risk management process is utilised to ensure that risk exposures are intentional and aligned to each strategy's objective. The dedicated, independent risk management team assesses risk from three perspectives:

• Risk factor analysis to understand benchmark-relative exposures across rates and spreads

• Tracking error to understand how those risk factors interact and impact

portfolio results

• Scenario analysis — both historical and hypothetical — to understand how

existing risk factors may interact across market environments

“Risk management sits at the heart of what we do in fixed income”, said Mike Gitlin, Head of Fixed Income at Capital Group, who was recently named President and Chief Executive Officer of Capital Group and Chair of the Capital Group Management Committee, effective in October 2023.

Conclusion

We have been managing fixed income portfolios for 50 years and over that time we have developed and evolved our fixed income platform, making substantial investments in the asset class. All these investments are intended to support the pillars of our fixed income philosophy: Research, collaboration and delivering consistent consistency.

Capital Group are Gold Sponsors of IMpower 2023. Find out more about the agenda here >>