Six steps to managing financed emissions

As society continues to address climate risk, banks play a critical role shifting to a lower-carbon global economy through their ability to facilitate the growth of green alternatives and helping companies decarbonize. Through allocating capital and supporting their clients, banks have the potential to lead the transition of financed emissions to align with a net-zero pathway.

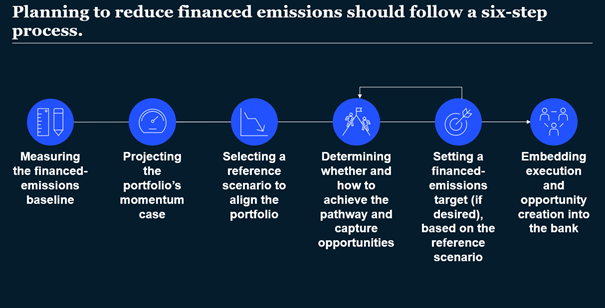

The process of assessing and setting targets for financed emissions is far from simple, but opportunities exist in the decarbonization transition using a six-step process to create and understand financed emissions.

Step 1: Measuring the financed emissions baseline

To start, create a baseline, measuring emissions during a specific time. A robust, accurate and consistent baseline is critical to understand the current state of a bank’s business.

This emissions baseline requires clear definitions for measurement, including breadth of sector coverage; asset class coverage; value chain emissions source; all greenhouse gases; scope of emissions; time period for baseline understanding if there were any major deviations (i.e. COVID-19); legal entities and sector attribution; and identifying the best possible data sources and deciding how emissions are attributed.

Step 2: Projecting the portfolio’s momentum case

Banks should build a momentum case. This is an analysis of what its financed emissions in subsequent years would be if the bank continued to offer financing at the current rate. As its basis, it takes into account counterparties’ announced targets and aspirations, industry and asset-level forecasts, and government policies and targets.

A good momentum case needs a realistic assessment of how quickly a sector or counterparties will decarbonize or if plans end up delayed by macroeconomic impacts, supply chain challenges and regulatory changes. In some instances, the momentum case needs to grasp the rise of near-term technologies, which is where banks should start to build insight and expertise.

Step 3: Selecting a reference scenario to align the portfolio

The next step would be to model what it would take to align the portfolio with the Paris Agreement. Various organizations have published a range of reference scenarios to the Agreement. For instance, the Paris Agreement expresses an objective to keep global temperatures “well below” 2 degrees Celsius higher than pre-industrial levels – and ideally just 1.5 degrees higher. A bank’s choice of its temperature ambition has huge implications for the speed of transition required across its portfolio. Banks should choose appropriate scenarios for each their targeted sectors.

Step 4: Determining whether and how to achieve the pathway and capture opportunities

At this point the bank has the information it needs to start making decisions. It is critical for banks to assess how they can align with a net-zero pathway knowing the constraints they face, but also taking account of opportunities.

In terms of constraints, banks need to assess what it would take, in terms of emissions reductions, new green and decarbonization finance, and P&L impact, to achieve the reference scenario. Banks must also consider capital allocation constraints, sector and counterparty concentration limits, and credit risk performance. Finally, banks also need to build a detailed approach to achieve targeted emissions reductions.

In terms of opportunities, the McKinsey Global Institute has estimated that achieving net zero will require about $9 trillion per year of capital expenditure until 2050 [1].

Banks that move quickly to embrace net zero will be best placed to capture share. Banks will also need a perspective on counterparty use of carbon credits.

Step 5: Setting a financed emissions target (if desired), based on the reference scenario

Banks can now decide what the target should be. Banks can choose from among four commonly used metrics for financed emissions: Absolute emissions (reduction in sector-level financed emissions); physical intensity (reduction in emissions per unit of activity); economic intensity (reduction in emissions per unit of revenue); and absolute financing (reduction in exposure to a sector over time). In making a choice, considerations should include the metric’s potential impact on ability to finance clients and grow the portfolio, robustness in terms of outcomes for the environment, ease of tracking and measurement, levers available to meet the target, guidance from standard setters, and relevance to the sector’s decarbonization pathway.

Step 6: Embedding execution and opportunity creation

Reaching targets requires embedding net-zero commitments into operations. This involves: Embedding targets into credit policies, data, and incentives; measuring, reporting, disclosing, and adjusting; optimizing the balance sheet for emissions; exercising leadership in hard-to-abate sectors by collaborating on solutions and standards; tapping leadership and board expertise; acquiring and retaining talent; new capabilities; obtaining and managing climate data; and building client engagement.

Following these six steps can help banks truly be leaders and play a vital role in helping their clients stem the rise in global warming.

To read the full article, “Managing financed emissions: How banks can support the net-zero transition,” visit www.mckinsey.com.

References:

[1] The net-zero transition: What it would cost, what it could bring,” McKinsey Global Institute, January 2022.