The COVID-19 (Coronavirus) pandemic of 2020 has contributed to market volatility and liquidity-driven price dislocations not experienced since the 2008 Great Financial Crisis (GFC). Retirees facing a 20-30% drawdown of their portfolios now must decide whether to take distributions to fund current income needs or hold off and wait for a market recovery. But how can one minimize the risk of outliving one’s retirement portfolio without having some market exposure to achieve higher potential rates of returns in a regime of low interest rates? Benjamin M. Lavine, CIO, 3D Asset Management and Sheryl O'Connor, CEO and Founder of WealthConducter give a healthy reminder to align time horizons with portfolio risks when taking distributions.

Phil Lubinski, a retired financial planner and co-founder of WealthConductor, LLC, built his practice on a retirement income strategy he developed called ‘time segmentation’ (more on that below). Facing a situation in early 2009 following the Great Financial Crisis (GFC), not too dissimilar to what many advisors may face today, Phil had the not-so-enviable task of having to manage client reactions through the crisis.

At the opening of a client meeting in March 2009, Phil recalls being taken to task by one of his clients – “Phil, you have a lot of nerve getting us all together like this when the world is falling apart.” Facing this heightened sentiment, Phil addressed his clients by first asking everyone to raise their hands if they did not receive their income check for the current month. No one raised their hand. Phil then asked if anyone’s check received for the current month was less than the one received the prior month. Again, no one raised their hand.

Phil then reminded his clients that the income they’re currently receiving has not dropped or disappeared due to the market sell-off and that was by design even if other parts of their retirement portfolios were invested in the markets. It was during the 2008 GFC that the real-life case study for time segmentation was born for the current generation of retirees.

Time-Segmentation: a more sensible approach to Retirement Income Planning

As a provider of turnkey asset management program (TAMP) services for independent financial advisors, 3D Asset Management has enjoyed an enviable position to speak with many advisors on successful and ‘less’ successful financial planning strategies. 3D had the privilege of hearing Phil’s GFC story and partnered with him to develop a financial planning tool back in 2013.

IncomeConducter® was spun out of 3D in 2017 and is now run by one of 3D’s original founders, Sheryl O’Connor, along with Co-Founders Phil Lubinski and Tom O’Connor as a SaaS offering to financial professionals around the world. Over the last ten years, 3D has encouraged our advisor partners to adopt time-segmented approaches for retirement income planning as opposed to systematic withdrawal programs which seem to be the default for most retirement income plans.

The main issue with the Systematic Withdrawal approach is the ‘sequence-of-returns’ risk (see ‘The Lifetime Sequence of Returns: A Retirement Planning Conundrum” authored by Wade D. Pfau from the American College of Financial Planning). Dollar cost averaging works for you when investing in the market but works against you when withdrawing from the market.

This is primarily due to the impact of market volatility, where contributions help smooth out its effects, but distributions lock in losses and decrease account values. These losses may impact principal to a degree where the account may never recover although the retirees continues to draw income until the account is depleted.

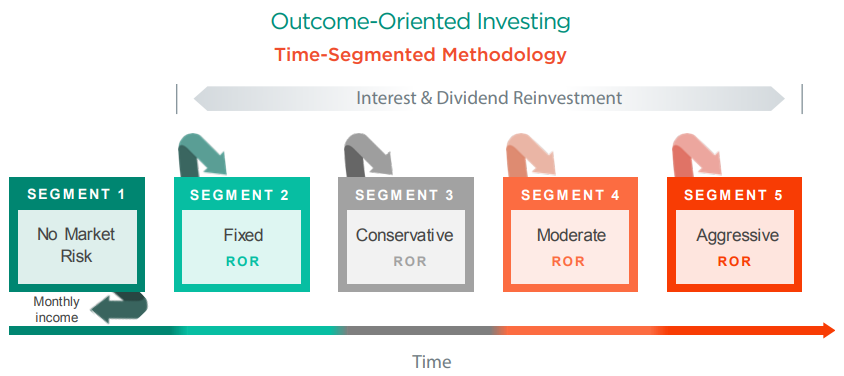

In contrast, a time-segmented approach for retirement income planning would not treat a retiree’s savings as one lump sum with periodic withdrawals subject to sequence-of-returns risk, but rather as multiple segments, or buckets, each with its own risk/reward profile appropriate for the associated time horizon.

Near-term buckets would have little to no market risk; long-term buckets would have traditional market risk associated with the client’s risk profile. Figure 1 illustrates the Time-Segmented Methodology for a basic retirement income plan.

Figure 1 – Time Segmentation Properly Aligns Investment Rates of Return (RORs) with Associated Time Horizons

Source: WealthConductor, LLC 2020 (See Disclosures Below).

A time segmented approach would call for immediate income needs (Segment 1) to be met by safe assets with little to no risk to capital. Later segments (Segments 3 and beyond) target higher growth goals such as addressing higher spending risk (i.e. medical, vacations), inflation risk, and/or intergenerational wealth transfer. These latter segments can be invested in riskier asset mixes that target higher rates of return.

Time segmentation means that current income needs are addressed with near-term buckets, invested in ‘safe’ assets, where later segments are left untouched so as to minimize the sequence of return risk by maintaining the longer time horizons that allow investors to ride out market volatility, such as the one recently experienced in March 2020, and grow assets over the long run.

Time segmentation can also be adapted to accommodate different post-retirement glide paths rather than a fixed linear glide path (a.k.a. one-size-fits-all) that is generally assumed with a “4% Rule” of thumb supported by Monte Carlo testing. Retirement research centers such as The American College have observed retirement spending curves typically follow a U-shaped glide path – an initial ‘honeymoon’ spending period followed by a steady state living situation followed by accelerating senior living care.

A proper retirement income plan should not be one built on a fixed glide path, but rather be built with multiple inputs on specific spending needs and modeling the inflation associated with different spending categories (i.e. a higher inflation rate for medical expenses versus other categories).

Frame the Retirement Income Plan around clients’ goals rather than investment products

The advisor should not be fixated on one type of investment product (i.e. insurance versus mutual fund) or wedded to a handful of providers but use products that best align with goals outlined in the retirement income plan. As such, time-segmented planning is optimal under an open architecture of investment products best suited for the clients’ needs.

The advisor’s goal is to manage his/her clients’ behavior to focus on outcomes rather than maximizing returns or safety. Time segmentation can facilitate the behavioral management exercise by framing the client’s distribution plan as planning for income now and planning for the growth of income later. It is natural for clients to experience emotions during significant market swings (fear, greed); however, a structured plan built around specific investment goals can help the advisor better manage those emotions by better aligning investment risks with time horizons.

By actively monitoring plan progress, making course corrections when needed, and de-risking later-dated segments should the opportunities present themselves, the advisor can potentially add more value managing the plan. IncomeConductor provides daily performance analytics and automated insights that help the advisor manage the plan efficiently and compliantly. With time segmentation, the advisor can manage both sequence-of-returns risk on current income and longevity risk (i.e. outliving the portfolio) for future income.

Disclosures:

Figure 1 disclosures: “No Market Risk” refers to the use of an income vehicle such as an immediate annuity, CD’s, a money market or other vehicle that is not invested in the Stock Market. Diversification and asset allocation do not assure a profit or protect against market losses and past performance is not indicative of future results. Therefore, there is no assurance that the assumed rate will be achieved or maintained.

IncomeConductor® is a product of WealthConductor LLC. This communication and its content are for informational and educational purposes only and should not be used as the basis for any investment decision. The information contained herein is based on publicly available sources believed to be reliable but not a representation, expressed or implied, as to its accuracy, completeness or correctness. No information available through this communication is intended or should be construed as any advice, recommendation or endorsement from us as to any legal, tax, investment or other matters, nor shall be considered a solicitation or offer to buy or sell any security, future, option or other financial instrument or to offer or provide any investment advice or service to any person in any jurisdiction. Nothing contained in this communication constitutes investment advice or offers any opinion with respect to the suitability of any security, and has no regard to the specific investment objectives, financial situation and particular needs of any specific recipient. WealthConductor LLC is not affiliated with 3D Asset Management.

3D disclosures. The above is the opinion of the author and should not be relied upon as investment advice or a forecast of the future. It is not a recommendation, offer or solicitation to buy or sell any securities or implement any investment strategy. It is for informational purposes only. The above statistics, data, anecdotes and opinions of others are assumed to be true and accurate however 3D Asset Management does not warrant the accuracy of any of these. There is also no assurance that any of the above are all inclusive or complete.

3D does not approve or otherwise endorse the information contained in links to third-party sources. 3D is not affiliated with the providers of third-party information and is not responsible for the accuracy of the information contained therein.

Past performance is no guarantee of future results. None of the services offered by 3D Asset Management are insured by the FDIC and the reader is reminded that all investments contain risk. The opinions offered above are as of March 30, 2020 and are subject to change as influencing factors change.

More detail regarding 3D Asset Management, its products, services, personnel, fees and investment methodologies are available in the firm’s Form ADV Part 2 which is available upon request by calling (860) 291-1998, option 2 or emailing sales@3dadvisor.com or visiting 3D’s website at www.3dadvisor.com.