When organizations lack a value-based process to support strategic

portfolio management decisions, they risk treating project/portfolio evaluation

as an analytic exercise rather than as a collective conversation around value

creation, supported by analytics. Because there is no inclusive process, they

may not involve key stakeholders, resulting in lukewarm support for implementing

decisions. Even worse, results may be used to blame, punish, or otherwise hold

people accountable for performance when they have had little or no involvement

in the decision-making process.

portfolio management decisions, they risk treating project/portfolio evaluation

as an analytic exercise rather than as a collective conversation around value

creation, supported by analytics. Because there is no inclusive process, they

may not involve key stakeholders, resulting in lukewarm support for implementing

decisions. Even worse, results may be used to blame, punish, or otherwise hold

people accountable for performance when they have had little or no involvement

in the decision-making process.

In their best-selling book The Smart Organization: Creating

Value through Strategic R&D, SmartOrg co-founders David and Jim Matheson

address the topic of 'open information flow, 'which directly relates to clear

communication and learning. In a 'smart company,' they assert that 'Virtually

all information is available to whomever wants it. Information is used in

surprising ways to create value. The flow of information crosses functional

boundaries. In such an organization, people feel safe in sharing what they know

and feel obliged to contribute to information-sharing systems. They are excited

about teaching and learning.'

Value through Strategic R&D, SmartOrg co-founders David and Jim Matheson

address the topic of 'open information flow, 'which directly relates to clear

communication and learning. In a 'smart company,' they assert that 'Virtually

all information is available to whomever wants it. Information is used in

surprising ways to create value. The flow of information crosses functional

boundaries. In such an organization, people feel safe in sharing what they know

and feel obliged to contribute to information-sharing systems. They are excited

about teaching and learning.'

The decision-making process in smart organizations is dynamic,

following the principles of agile development, wherein the information that

informs decisions is routinely updated to provide feedback to adjust decisions

about further investment and changes in direction based on improved knowledge.

following the principles of agile development, wherein the information that

informs decisions is routinely updated to provide feedback to adjust decisions

about further investment and changes in direction based on improved knowledge.

When a strategic portfolio management process is in place, results

are used specifically to improve the project and develop a level playing field

to support effective portfolio evaluation and management. Uncertainties are

tracked and updated based on new evidence, and decisions are updated appropriately.

Information is gathered as needed to fill information gaps.

are used specifically to improve the project and develop a level playing field

to support effective portfolio evaluation and management. Uncertainties are

tracked and updated based on new evidence, and decisions are updated appropriately.

Information is gathered as needed to fill information gaps.

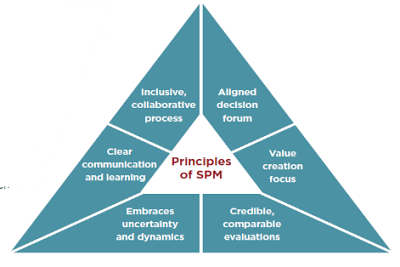

This is the last in a

series of blogs on The Six Principles of Strategic Portfolio Management.

Subsequent blogs will address each of the six principles in detail. For further

information about SPM processes and decision-support software, visit www.smartorg.com or contact info@smartorg.com

series of blogs on The Six Principles of Strategic Portfolio Management.

Subsequent blogs will address each of the six principles in detail. For further

information about SPM processes and decision-support software, visit www.smartorg.com or contact info@smartorg.com