By: Don Creswell, Co-founder & Vice President, SmartOrg Inc.

When it comes to portfolio management, it can be easy ' in

many cases, too easy ' to explore the theory side of the equation without

looking at hos companies in the real world are living the principles of value

creation. Let's take a look at how one of the largest petroleum companies

benefited from implementing them.

When it comes to portfolio management, it can be easy ' in

many cases, too easy ' to explore the theory side of the equation without

looking at hos companies in the real world are living the principles of value

creation. Let's take a look at how one of the largest petroleum companies

benefited from implementing them.

The managers of R&D/technology portfolios were pressured

by management to accelerate the deployment of technology to business

opportunities. The business needs for technology were not being met in a timely

fashion while at the same time corporate growth bottom-line objectives were

demanding more for less money. Projects were being kept alive too long, and

there was an inconsistency in how projects were evaluated. Senior managers were

having difficulty comparing projects of different types and the company was

experiencing significant limitations of a subjective 'thumbs-up/thumbs down'

approach to prioritization of projects in the development portfolio.

by management to accelerate the deployment of technology to business

opportunities. The business needs for technology were not being met in a timely

fashion while at the same time corporate growth bottom-line objectives were

demanding more for less money. Projects were being kept alive too long, and

there was an inconsistency in how projects were evaluated. Senior managers were

having difficulty comparing projects of different types and the company was

experiencing significant limitations of a subjective 'thumbs-up/thumbs down'

approach to prioritization of projects in the development portfolio.

The existing portfolio management process was primarily a

roll-up of business cases to justify projects, which as noted above, led to

inconsistent project evaluation, making it quite difficult to objectively

compare projects with the portfolio. The process was competitive and

adversarial, supported by little quality data.

A senior manager of a major technology portfolio decided to

meet the challenges by implementing SmartOrg's value-based management process,

supported by Portfolio Navigator' software. The new process made project

evaluations transparent to all team members, clearly identifying key value

drivers and addressing the impact of uncertainty on the NPV of each project.

'

A peer and expert review process emphasized

transparency, creditability and comparability.

A peer and expert review process emphasized

transparency, creditability and comparability.

'

Uncertainty tracking included baseline

assessments of the ranges of uncertainty around each factor in the model.

Updates were based on evidence and learning as projects moved through

development.

Uncertainty tracking included baseline

assessments of the ranges of uncertainty around each factor in the model.

Updates were based on evidence and learning as projects moved through

development.

'

The transparent process helped address 'garbage

in, garbage out' concerns, which had historically been one of the most

challenging issues.

The transparent process helped address 'garbage

in, garbage out' concerns, which had historically been one of the most

challenging issues.

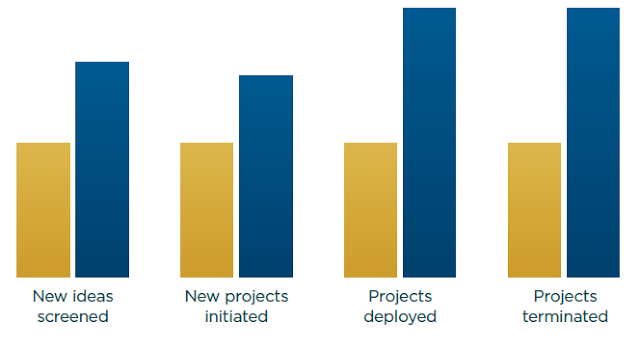

Within one year following implementation of value-based

management, the portfolio manager reported a 60% increase in new ideas

screened; a 50% improvement in new project initiated and a 100% increase in

projects deployed and projects terminated. By stopping one project a year

earlier, funding and resources were made available to accelerate development of

more promising projects, adding $10 million in value to the portfolio ' 30% of

the annual budget.

management, the portfolio manager reported a 60% increase in new ideas

screened; a 50% improvement in new project initiated and a 100% increase in

projects deployed and projects terminated. By stopping one project a year

earlier, funding and resources were made available to accelerate development of

more promising projects, adding $10 million in value to the portfolio ' 30% of

the annual budget.

An additional benefit: credible, comparable evaluations

allow every member of the team to view the importance of his/her contribution

to creating value and to develop understanding and accept decisions that may

reject their pet projects when other projects can be shown to have higher value

potential for the organization.

allow every member of the team to view the importance of his/her contribution

to creating value and to develop understanding and accept decisions that may

reject their pet projects when other projects can be shown to have higher value

potential for the organization.

Key ' yellow: before Value-Based

Evaluation ' blue: after Value-Based Evaluation

Evaluation ' blue: after Value-Based Evaluation

This

is the fourth in a series of blogs on The Six Principles of Strategic Portfolio

Management. Subsequent blogs will address each of the six principles in detail.

For further information about SPM processes and decision-support software,

visit www.smartorg.com or contact info@smartorg.com

is the fourth in a series of blogs on The Six Principles of Strategic Portfolio

Management. Subsequent blogs will address each of the six principles in detail.

For further information about SPM processes and decision-support software,

visit www.smartorg.com or contact info@smartorg.com