BEI

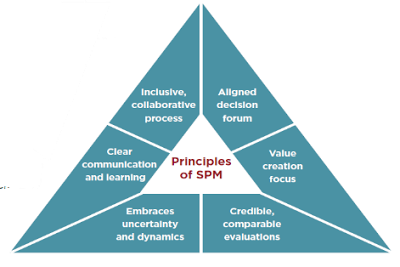

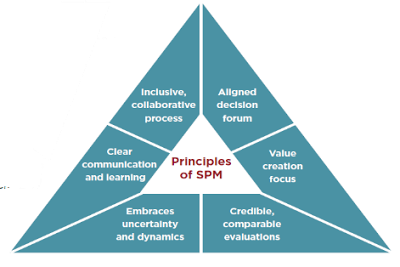

The 6 Principles of Strategic Portfolio Management: Embracing Uncertainty & Dynamics

By: Don Creswell,

Co-founder & Vice President, SmartOrg Inc.

Co-founder & Vice President, SmartOrg Inc.

In the business world, we strive to make sound decisions. We

want to be confident that we have done all of our research and that by the time

we are launching a new product, we have addressed every aspect of it to ensure

its success. During the product development cycle, things change that make

updating and tracking our assessments a vital part of the process. It requires

that we address the uncertainties that arise. Whether we are experiencing

fluctuations in our market, there is instability in the economy, or consumer

trends are changing before our product reaches them, we must carefully examine

all of the uncertainties. By embracing uncertainty rather than fighting against

it, we put ourselves in a better position to achieve successful outcomes. This

is what we mean when we refer to dynamics.

want to be confident that we have done all of our research and that by the time

we are launching a new product, we have addressed every aspect of it to ensure

its success. During the product development cycle, things change that make

updating and tracking our assessments a vital part of the process. It requires

that we address the uncertainties that arise. Whether we are experiencing

fluctuations in our market, there is instability in the economy, or consumer

trends are changing before our product reaches them, we must carefully examine

all of the uncertainties. By embracing uncertainty rather than fighting against

it, we put ourselves in a better position to achieve successful outcomes. This

is what we mean when we refer to dynamics.

A Case Study

A Fortune 100 company acquired several smaller companies

that each had good products in the market, but there was an apparent lack of

new concepts in the R&D pipeline. The company established a new R&D lab

with the goal of researching their way to become a world-class firm. Since the

lab was new and the technical areas they were researching were cutting edge,

they picked easy targets to fast-track their way onto the map. But was that

sustainable? Was the lab on track? Would that method generate the hits they

needed to fill the pipeline?

that each had good products in the market, but there was an apparent lack of

new concepts in the R&D pipeline. The company established a new R&D lab

with the goal of researching their way to become a world-class firm. Since the

lab was new and the technical areas they were researching were cutting edge,

they picked easy targets to fast-track their way onto the map. But was that

sustainable? Was the lab on track? Would that method generate the hits they

needed to fill the pipeline?

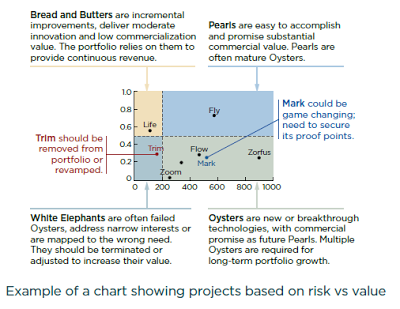

A quantitative evaluation of the lab's procedures revealed

they had a lab full of 'white elephants' (refer to chart) and

'bread-and-butter' product projects.' They lacked 'oysters' to give them a

chance to create breakthrough products ('pearls'). Given this knowledge, they

developed a strategy to identify additional valuable, though risky targets,

redirected or killed the white elephants and re-balanced their portfolio to

improve the overall odds of winning.

they had a lab full of 'white elephants' (refer to chart) and

'bread-and-butter' product projects.' They lacked 'oysters' to give them a

chance to create breakthrough products ('pearls'). Given this knowledge, they

developed a strategy to identify additional valuable, though risky targets,

redirected or killed the white elephants and re-balanced their portfolio to

improve the overall odds of winning.

Dangers of

Deterministic Thinking

Deterministic Thinking

In mathematics and physics, a deterministic system

is a system in which no randomness is involved in the development of future

states of the system. A deterministic model will thus always produce

the same output from a given starting condition or initial state.

is a system in which no randomness is involved in the development of future

states of the system. A deterministic model will thus always produce

the same output from a given starting condition or initial state.

When we allow deterministic thinking and aversion to risk to

drive the quest for certainty, assumptions tend to be made to defend a position

and the ability to confirm information is suppressed. This leads to assumptions

comingling discussions about knowledge, commitments and aspirations into point

estimates.

drive the quest for certainty, assumptions tend to be made to defend a position

and the ability to confirm information is suppressed. This leads to assumptions

comingling discussions about knowledge, commitments and aspirations into point

estimates.

However, when we embrace uncertainty and dynamics, and

address the uncertainties explicitly over time, we create an opportunity for

robust thinking about upsides, downsides and options. There is more of a

willingness to take prudent calculated risks. Discussions around uncertain

factors area separated from discussions about commitments and aspirations.

Information is represented in terms of ranges and probabilities, with

supporting rationales for the assessments.

address the uncertainties explicitly over time, we create an opportunity for

robust thinking about upsides, downsides and options. There is more of a

willingness to take prudent calculated risks. Discussions around uncertain

factors area separated from discussions about commitments and aspirations.

Information is represented in terms of ranges and probabilities, with

supporting rationales for the assessments.

Even the best researched decision making can result in

failure. No matter how you try to control uncertainty, things do not always

work out. If you are intolerant to uncertainty, you may create unnecessary

stress and anxiety for yourself and your colleagues. If, instead, you recognize

that uncertainty is a normal condition, factor it into your analyses and adapt

as changes arise, you will find that you are in a better position to make and defend

your decisions.

failure. No matter how you try to control uncertainty, things do not always

work out. If you are intolerant to uncertainty, you may create unnecessary

stress and anxiety for yourself and your colleagues. If, instead, you recognize

that uncertainty is a normal condition, factor it into your analyses and adapt

as changes arise, you will find that you are in a better position to make and defend

your decisions.

This is the fifth in a

series of blogs on The Six Principles of Strategic Portfolio Management.

Subsequent blogs will address each of the six principles in detail. For further

information about SPM processes and decision-support software, visit www.smartorg.com or contact info@smartorg.com

series of blogs on The Six Principles of Strategic Portfolio Management.

Subsequent blogs will address each of the six principles in detail. For further

information about SPM processes and decision-support software, visit www.smartorg.com or contact info@smartorg.com