Conference

The 6 Principles of Strategic Portfolio Management

By: Don Creswell, Co-founder & Vice President, SmartOrg Inc.

During the

past 20 years, companies have greatly process and systems for managing the

'operational' aspects of project/portfolio management (PPM) ' budgeting, project

management, resource planning, StageGate and phase gate processes.

past 20 years, companies have greatly process and systems for managing the

'operational' aspects of project/portfolio management (PPM) ' budgeting, project

management, resource planning, StageGate and phase gate processes.

Strategic portfolio management, while practiced for many

years by leading companies in pharmaceuticals, oil and gas and aerospace, is

only now emerging as the next step in the maturity of PPM.

years by leading companies in pharmaceuticals, oil and gas and aerospace, is

only now emerging as the next step in the maturity of PPM.

How does Strategic

Portfolio Management (SPM) differ from Project/Portfolio Management (PPM) and

why does it matter?

Portfolio Management (SPM) differ from Project/Portfolio Management (PPM) and

why does it matter?

Early adopters of strategic portfolio management

characterized the difference between 'strategic' and 'operational' as 'doing the

right projects' vs. 'doing the project right.' They recognized that large

amounts of money were wasted on project/product failures (80% of more of new

products fail according to numerous studies).

characterized the difference between 'strategic' and 'operational' as 'doing the

right projects' vs. 'doing the project right.' They recognized that large

amounts of money were wasted on project/product failures (80% of more of new

products fail according to numerous studies).

Many companies have found that while operational processes

and tools have improved results, they fall short when addressing decisions

around selecting the best projects in which to invest and how best to allocate

capital and other resources to optimize the value of project and product

portfolios.

and tools have improved results, they fall short when addressing decisions

around selecting the best projects in which to invest and how best to allocate

capital and other resources to optimize the value of project and product

portfolios.

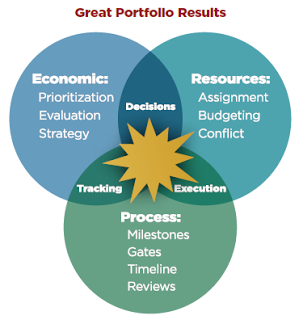

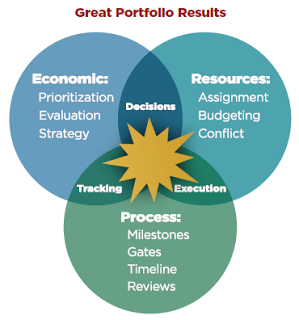

To optimize decision that drive top-line and bottom-line

value, companies need to consider three distinct areas: economic, resources and

process. The Venn diagram show how these areas relate to value creation.

value, companies need to consider three distinct areas: economic, resources and

process. The Venn diagram show how these areas relate to value creation.

Economic ' Decisions

in this area underpin strategy and relate wo what; selecting the most promising projects in which to invest,

allocating resources, and developing a balanced risk vs. reward portfolio.

in this area underpin strategy and relate wo what; selecting the most promising projects in which to invest,

allocating resources, and developing a balanced risk vs. reward portfolio.

Resources - Decisions in this area are fundamental to

'making it happen' and revolve around who:

achieving StageGate goals, allocating and managing human resources, budgeting

and dsy-do-day project management.

'making it happen' and revolve around who:

achieving StageGate goals, allocating and managing human resources, budgeting

and dsy-do-day project management.

Process ' Processes

and decision-support software in this area support how: the project/portfolio management process from ideation and

concepts to commercial launch.

and decision-support software in this area support how: the project/portfolio management process from ideation and

concepts to commercial launch.

Each of the areas within the Venn diagram involves different

decisions, decision makers, processes and tools. The challenge: bring

everything together to avoid sub-optimization of any one area to the detriment

of the whole.

decisions, decision makers, processes and tools. The challenge: bring

everything together to avoid sub-optimization of any one area to the detriment

of the whole.

In this series, we will focus on the Economic area, which sets the

foundation for creating exceptional value through strategic portfolio

management. Through research and consulting experience with dozens of companies

in a wide variety of industries, we have identified dix principles that are

basic to value creation.

foundation for creating exceptional value through strategic portfolio

management. Through research and consulting experience with dozens of companies

in a wide variety of industries, we have identified dix principles that are

basic to value creation.

1.

Aligned

Decision Forum: Include the right people at the right levels at the right

time.

Aligned

Decision Forum: Include the right people at the right levels at the right

time.

2.

Value-Creation

Focus: Focus decisions on creating value at each development stage.

Value-Creation

Focus: Focus decisions on creating value at each development stage.

3.

Credible,

Comparable Evaluations: Employ clear, transparent evaluation frameworks.

Credible,

Comparable Evaluations: Employ clear, transparent evaluation frameworks.

4.

Embrace

Uncertainty and Dynamics: Explicitly identify the impact of uncertainty on

key decision variables and track changes throughout development.

Embrace

Uncertainty and Dynamics: Explicitly identify the impact of uncertainty on

key decision variables and track changes throughout development.

5.

Inclusive,

Collaborative Process: Involve key

stakeholders from ideation to commercialization.

Inclusive,

Collaborative Process: Involve key

stakeholders from ideation to commercialization.

6.

Clear

Communication and Learning: Assess,

track, inform and continuously improve.

Clear

Communication and Learning: Assess,

track, inform and continuously improve.

This

is the first in a series of blogs on The Six Principles of Strategic Portfolio

Management. Subsequent blogs will address each of the six principles in detail.

For further information about SPM processes and decision-support software,

visit www.smartorg.com or contact info@smartorg.com

is the first in a series of blogs on The Six Principles of Strategic Portfolio

Management. Subsequent blogs will address each of the six principles in detail.

For further information about SPM processes and decision-support software,

visit www.smartorg.com or contact info@smartorg.com