The climate transition risks for the banking sector

The European Union action plan for sustainable finance identifies the financial sector as one of the key players in the transition to a zero net emission economy. The phenomena linked to climate change are becoming more intense and frequent, focusing European policy makers’ attention. New international agreements and standards are being translated into new banking sector rules. More recently, the ECB decided to incorporate climate change considerations into its new monetary policy strategy, presented last July, committing to contribute to a carbon neutral economy through its monetary policy decisions in addition to its supervisory activities.

The European Union action plan for sustainable finance identifies the financial sector as one of the key players in the transition to a zero net emission economy. The phenomena linked to climate change are becoming more intense and frequent, focusing European policy makers’ attention. New international agreements and standards are being translated into new banking sector rules. More recently, the ECB decided to incorporate climate change considerations into its new monetary policy strategy, presented last July, committing to contribute to a carbon neutral economy through its monetary policy decisions in addition to its supervisory activities.

Climate change risks have been classified into two main categories: physical risk and transition risk. While physical risk arises from the increasing frequency and severity of events related to climate change - both extreme events (landslides, floods, fires and storms) and gradual long-term changes - in this article we analyse transition risk, i.e. the financial loss that an institution may incur, directly or indirectly, as a result of the process of adjusting to a low-carbon economy.

But how do we measure transition risk for the banking sector?

Carbon footprint in European banks portfolios

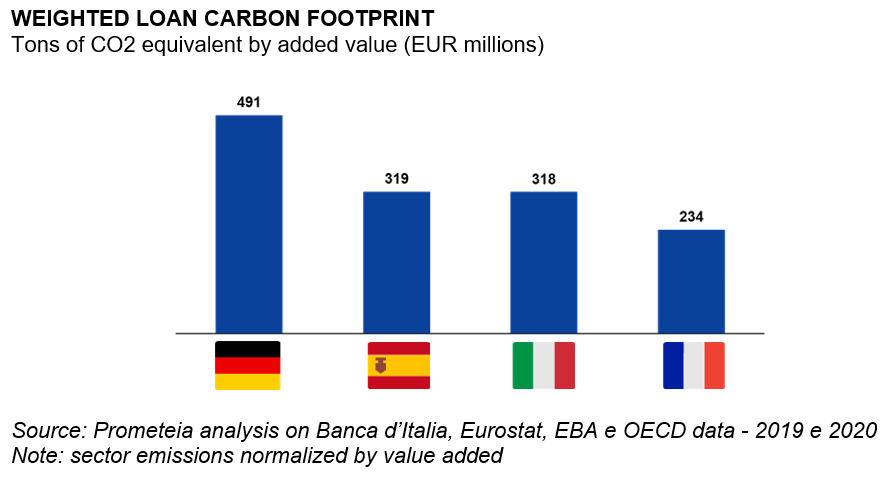

One possible measure is the carbon footprint, which represents the CO2 content of bank loans to non-financial corporations, normalised by the value added of each sector. Our analysis looks at aggregate exposures by sector, thus inevitably obtaining only a very approximate estimate of the carbon footprint, which should be normally measured for each individual exposure. That said, our estimates for the banking sectors of the main EU countries show that German intermediaries are the most exposed to transition risk, probably due to the industrial structure of its economy, which is more exposed to high-emission sectors, while the French banking sector is the least exposed. As mentioned above, the assessment is influenced by the level of aggregation used, which hides the strong heterogeneity of firms and their greenhouse gas emissions within the same sector.

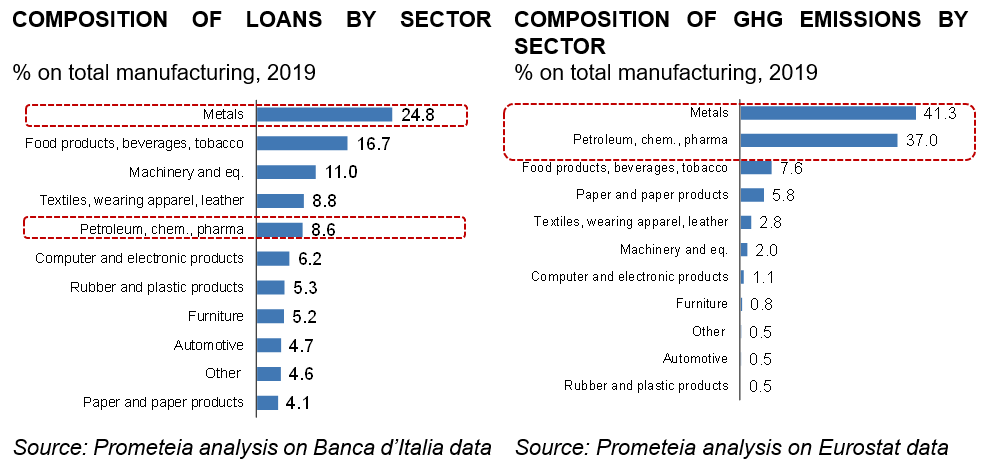

The composition of the economic structure therefore plays an important role in the climate risk exposure of the corporate loan portfolio. For instance, looking more specifically at the manufacturing sector in Italy - the sector Italian banks are most exposed to and that produces the most greenhouse gases - one can observe great heterogeneity among sub-sectors. Manufacture of metals, and of petroleum, chemicals, and pharmaceuticals alone account for 33% of manufacturing loans and 78% of greenhouse gas emissions, making them the largest contributors of the entire sector.

The exercise conducted by the European Banking Authority

In order to have a more detailed map of the climate change-related transition risks to which our economies and the financial sector are exposed, it is necessary to get more information on the structure of production activities and CO2 emissions along the entire supply chain. In May 2021, the EBA published the results of a first mapping exercise on the exposure of European banks to climate change risks (sample of 29 banks from 10 European countries, covering 50% of the total assets of the European banking sector). It is an exercise designed to test methods and tools to classify climate risks. The results show that the banks in the survey have 58% of their exposures to non-SMEs in sectors subject to high climate transition risk and an estimated Green Asset Ratio (i.e. the percentage of sustainable assets according to the European taxonomy) of 7.9% on aggregate. Despite the diversity of approaches used by intermediaries, the EBA analysis represents a "baseline estimate" for future work on climate risk assessment.

The European Commission proposal to revise the NFRD (Non-Financial Reporting Directive) with the CSRD (Corporate Sustainability Reporting Directive) of April 2021 aims at improving the quality of the climate risk information released by companies and available to the financial industry. The publication of the delegated act to Article 8 of the Taxonomy Regulation of July 2021 is another step in the same direction.

The ECB stress test on climate risk

In this evolving regulatory framework, the banking system is getting ready for the climate stress test exercise that will be conducted by the ECB in 2022. Banks will have to disclose the "green footprint" of their assets at a very high-level of detail.

This will be a major challenge for banks, which we have to learn to identify and then manage new types of risks stemming from the push coming from regulators, investors, and civil society for a faster transition to a more sustainable economy.