Michael Steinhardt once said, “nothing gives a better feeling to a money manager than making money for his or her client when almost everyone else is losing.” Unless your strategy involves losing money when everyone else is making money, then making money when everyone else is losing is very difficult, if not impossible.

There are many reasons why this is the case, most notably that it’s harder to be a bear in a bear market than it is to be a bull in a bull market.

Bears cover their shorts

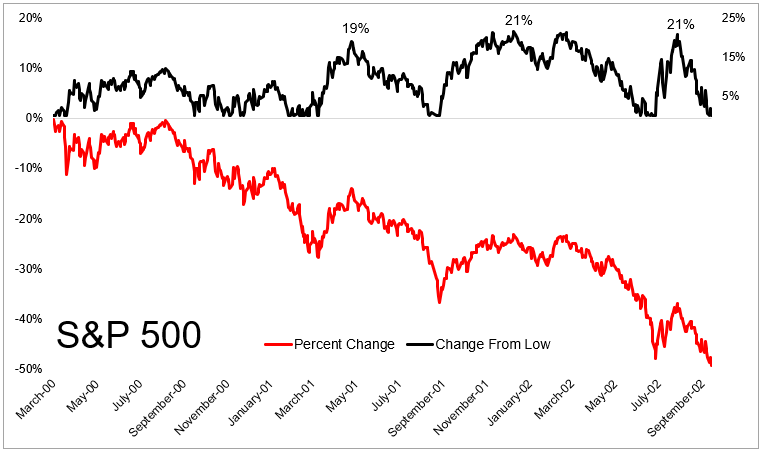

Let’s take a look at what happened on the other side of the tech bubble, as an example. The S&P 500 hit a closing high in March 2000 and entered 'correction territory' fifteen sessions later. By September 1, all the losses were recouped. Bulls likely breathed a sigh of relief while bears probably covered their shorts, having been burned so many times over the years.

"...Making money when everyone else is losing is easier said than done."

In the following seven months, the S&P 500 officially entered a bear market, falling 20% from its high a year earlier. The selling would last for another seventeen days before a respite. On April 5, the selling stopped on a dime and the market roared 4.4% on 'everyone-back-in-the-pool' type of buying. Over the next 32 days, the S&P 500 was 19% off its lows. Again, it’s likely that most bears covered their shorts.

This scene of a falling market punctuated with nasty bear market rallies occurred on several occasions between 2001 and the ultimate bottom in 2002.

This can be seen in the chart below, which shows the percent change from the top (in red) and how far bounces go from the bottom (in black). You could have thought this - knowing that the market was wildly overvalued - but making money when everyone else is losing is easier said than done.

Making money on the short side when stocks are going down, as I have just shown, is no walk in the park. Making money on the long side in a rising market is no walk in the park either.

Investors have to deal with a cacophony of noise and combat their own biases, namely the difficulty of letting your winners run. There is no more certainty in a bull market than there is in a bear market, but stocks are less volatile in the former than they are in the latter.

The end of 'easy money'?

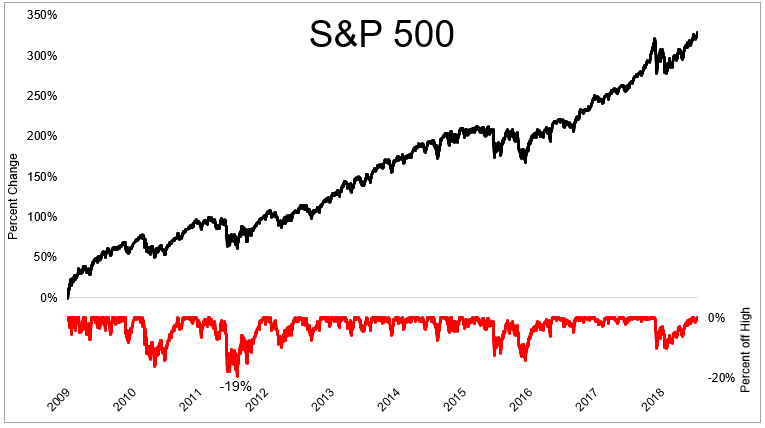

As you can see in the chart below, from 2009 through the top in September, there wasn’t a single 20% decline in the S&P 500 on a closing basis. (I know, this is semantics. Stocks fell more than 20% in October 2011 intraday, and I have argued that the bear market in stocks from 2015-2016 didn’t show up in the large cap index.)

The 'easy money' has never and will never be made. There is simply too much competition for this to exist. Rather than trying to beat the market, most investors would be better served on putting together a plan that allows them to participate in the upside without panicking when the downside shows up. Absent a plan, there is no course to stay on. With no course to stay on, you will get lost.

"There is no more certainty in a bull market than there is in a bear market, but stocks are less volatile in the former than they are in the latter."

Hindsight might fool us into thinking that bull markets are easy, but there is no mistaking the fact that bear markets are simply brutal for all involved. It might feel good to make money when everyone else is losing, but be careful what you wish for.

Michael Batnick is Director of Research at Ritholtz Wealth Management and the author of 'Big Mistakes: The Best Investors and Their Worst Investments.' He also has a well-established blog and can be found tweeting at @michaelbatnick.