The Research in Finance series: How can European asset managers meet fund selectors’ needs in the current climate?

2022 delivered poor performance for investors across a range of asset classes, leading many to question the efficacy of traditional allocation models, such as the 60/40 approach.

Surging inflation and rapidly rising interest rates pose significant challenges, with usual safe-haven fixed income investments struggling to provide portfolios with their traditional safety buffer, and the appeal of risk assets such as equities undermined as nominal yields on cash and bond holdings creep upwards. Until inflation, monetary policy, and markets settle around some sort of new equilibrium (if indeed they do), asset managers will have to continue navigating through choppy waters.

Reasons to be cheerful

One way of dealing with tough times is to listen to clients and ensure their needs are met – signposting the right products at the right time. Research in Finance recently launched the second annual wave of its European Fund Selector Study (EuroFSS), a study designed to help asset managers track brand resonance, positioning against competitors and investment trends at both the pan-European and individual market levels.

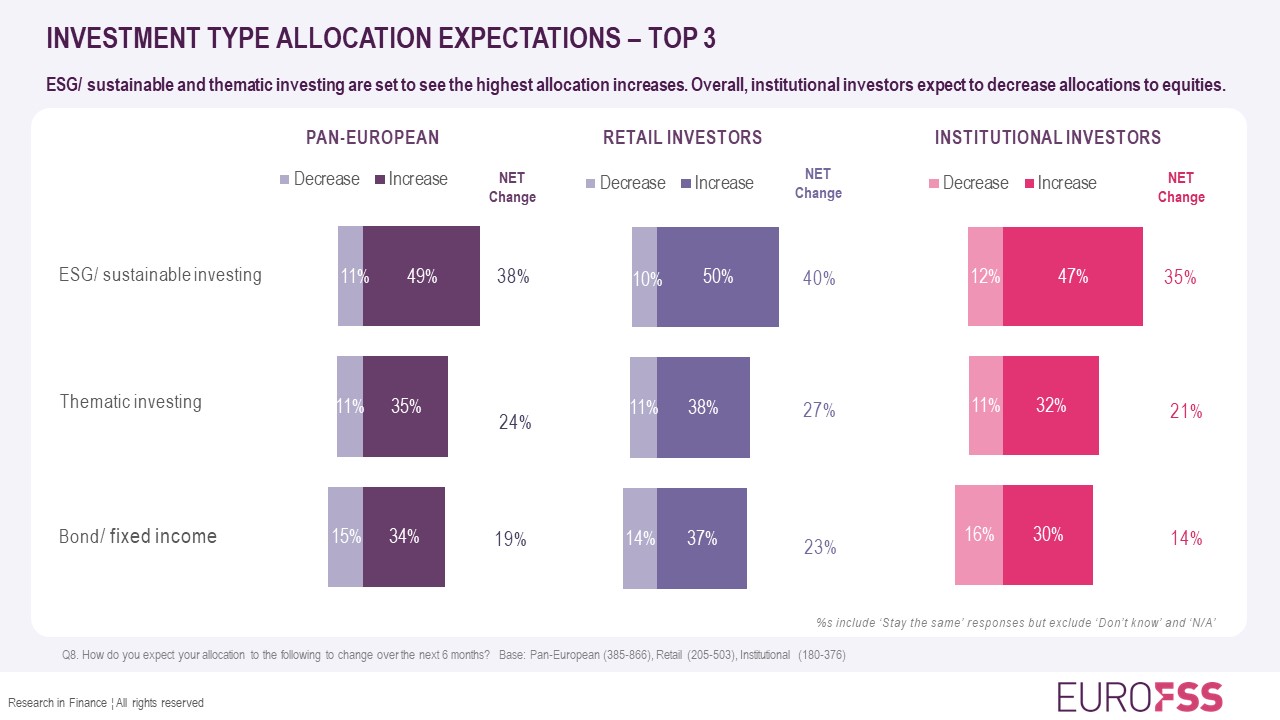

In this latest wave we reveal a rich collection of views expressed by 892 professional retail and institutional fund buyers across eight European markets in Q1 2023. Among the headline findings was some good news on selectors’ asset-allocation expectations for the following six months: Net intentions are positive for nearly all investment types, as demonstrated by the chart below.

The clear pan-European leader for new commitments is ESG and sustainability, with 49% of respondents intending to increase their exposure, versus just 11% who expect to reduce allocations (more on ESG shortly). Thematic investing is also looking popular; although the broad theme of ‘technology’ has endured volatility in the markets in recent years, specific areas with strong future potential such as artificial intelligence, robotics, and renewable energy are likely front of mind this year. Fixed income is next in line. Although the value of existing holdings has come under pressure as interest rates head higher, selectors will be locking in improving nominal bond yields, while hoping that inflation is reined in sooner rather than later, boosting real yields too.

There are some notable divergences in demand between retail and institutional selectors, and different markets. Take equities and mixed assets, where negative net allocation intentions expressed by institutional buyers are outweighed by the positivity of retail buyers.

A closer look at market-specific data reveals quite a varied picture, with a 50/50 split between markets in favour of higher or lower equity allocations, while most markets are neutral or negative on future allocations to multi-asset strategies, with the clear exception of the UK, and to a lesser extent Germany and Italy.

Catering to all ESG tastes

With the fund industry suffering total net redemptions in 2022, Europe’s sustainable funds continued to pull in net new money, according to data from Morningstar. Demand for responsible investing/ESG may be high, but the concept also appears to be encountering growing pains.

Although Europe has generally made a strong commitment to sustainable investment, uptake varies across different investor cohorts; there is confusion about the varied methods and terminology used to deliver and classify such investments (gradually being addressed through tighter regulation, e.g., the recently introduced SFDR level 2 standards); and suspicions of greenwashing remain.

Zooming out further, political debate in the US continues to intensify around the application of ESG screens to investment products and companies’ business models, with an ever-lengthening list of anti- and pro-ESG bills being submitted for consideration by lawmakers. Concerns have also been raised of global asset managers promoting ESG products in some markets while investing in countries or companies that fall foul of ESG ratings.

How can a single brand effectively present its sustainability credentials across varied geographies?

Even in Europe, not all investors and professional buyers have bought into the concept of responsible investment: one buyer interviewed for EuroFSS said “I detest ESG ideology”! But this is a minority view.

Selectors were asked to state how much demand they are seeing from clients for article 8 and 9 funds. Considering article 9 funds (those that have sustainable investment as a core objective), only 6% of retail selectors say that they see no demand, with 18% seeing a lot of demand, and 4% claiming such funds to be a ‘must have’.

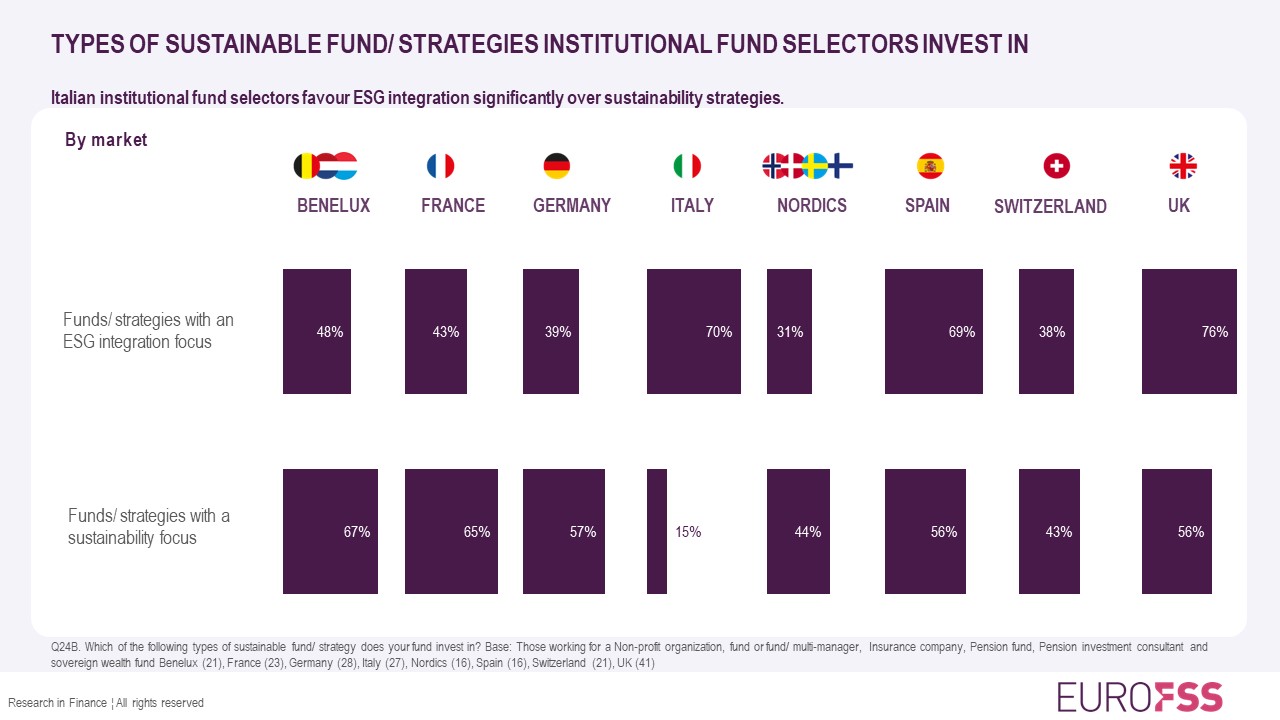

Of course, results look different when considered country by country: for example, institutional buyers’ appetite for funds focussed on sustainable objectives is generally higher than for funds that just integrate ESG factors, but the reverse is true in Spain and the UK, and especially so in Italy.

Understanding a selector’s approach to providing sustainable investments to their clients is also useful when adapting a brand to different tastes and practices.

In most markets, especially Switzerland, the most common approach is to “offer a dedicated sustainable investment service, tailored to the client’s preferences,” but in the UK, selectors are more likely to say that “ESG considerations are integrated into all of our investment products/services.”

Typically, between a third and one half of selectors in each market “offer a dedicated sustainable investment service using model portfolios/multi-asset funds,” but less than a fifth of Spanish respondents do so.

In response to a question about the asset managers considered market leaders for specific investment types, one US firm was deemed best in three of the European markets explored, while a European manager received the same accolade in another three markets. Knowing just how to plug your ESG product and service propositions into each market can pay dividends, allowing for seamless presentation of a single brand to multiple audiences.

In the next edition of IMpower Incorporating FundForum’s newsletter, we will drill down further into the asset-allocation data of EuroFSS, including a look at appetite for private markets, to help asset managers sense check current distribution strategies.

If you’d like to find out more about how we can help you with your research requirements, please do get in touch.

Research in Finance are Silver Sponsors of IMpower Incorporating FundForum 2023. Find out more about the event and agenda here >>