The rise of the machines: ESG investing is next on machine learning’s path

The breadth and depth of Environmental, Social, and Governance data that investors currently have at their disposal is “a good problem to have”, as it highlights the normative sea-change over the past decade towards a now crucial commitment that companies must make to ESG transparency. Machine learning can help in discerning – and when necessary, creating - signal from noise.

Making sense of the massive amounts of ESG inputs with machine intelligence systems

The adage “a good problem to have” is apropos when looking at the breadth and depth of Environmental, Social, and Governance data that investors currently have at their disposal. Even a single company can have thousands of ESG-related data points, let alone entire industries. That’s the good part because it speaks to the normative sea-change over the past decade towards a now crucial commitment that companies must make to ESG transparency. The problem part is trying to make sense of it all such that ESG transparency amounts to real transparency. Here is where advanced machine learning techniques can have a big impact.

Advancements in the suite of novel tools and technologies we collectively call “machine intelligence” bring several key benefits to the world of ESG investing, including the ability to:

- Rapidly process the barrage of new ESG data sources that are now available

- Systematically apply the rigor of fundamental analysis to ESG investing

- Go beyond headline ESG ratings to identify materiality across industry, geography, and time

- Look through attempts by management to window-dress or “greenwash”

- Customize specific ESG solutions, such as optimizing for lower carbon while holding the pursuit of alpha constant

Voya IM’s Equity Machine Intelligence (EMI) team has long focused on exploiting these benefits to unlock value from the full mosaic of company fundamentals, sentiment and ESG data.

Discerning – and when necessary, creating - signal from noise: The next frontier of ESG investing

Not only can machine learning systems more quickly process mountains of corporate ESG data, they can do so more effectively. This means that ESG integration can go well beyond the well-known limitations of headline ratings.

Machine learning techniques such as natural language processing (NLP) can be used to gauge the sentiment of news stories, and thus tap into changing social or community perceptions of a company.

This capability is becoming a crucial one, as ESG data providers proliferate. In “ESG Ratings and Rankings: All over the Map. What Does it Mean?”1 it was noted that there are over 150 organizations offering upwards of 600 ESG data and ratings products. This has fed another problem — the lack of standardization of ESG data — a difficult issue for traditional quantitative tools to address. There are also significant methodological divergences between ratings provided by various ESG providers.2 Indeed, the average correlation of ESG ratings between different providers is only 0.54.3

By digging deep through both structured and unstructured data, machine intelligence systems can unearth signals from the noise faster, and in many cases detect signals that may have been previously unknown. These systems can also impute missing values — or fill the holes — in data sets, bringing new clarity to messy data. The goal is to integrate the best of what ESG data has to offer with the mosaic of other fundamental and sentiment data to help discover future stock outperformers.

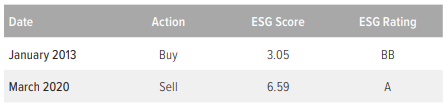

This approach can help identify opportunities that could be easier to overlook than one might imagine. For instance, Hormel Foods Corporation (ticker: HRL) was identified in January 2013 by EMI models as a potential long-term outperformer. At the time, while Hormel Foods’ ESG rating was modest according to published MSCI ESG data, the model identified the company as underappreciated and saw that key fundamental and ESG metrics were beginning to improve. The model was right; over time the company made substantial improvements and became an ESG leader (Figure 1). During the more than seven-year holding period, the company’s market cap doubled from around $10 billion to over $20 billion, and the stock outperformed the Russell 1000 index by nearly 90%.

Figure 1: Hormel Foods Corporation (HRL): ESG Ratings

Shining a light on greenwashing opacity

With this bottom-up, fundamentally anchored perspective the EMI team has been unlocking value from the deep analysis of ESG data for almost a decade. The underlying philosophy has remained consistent: to treat ESG data as a key “alternative” data source, and to use it with the same rigor of financial analysis; to unearth risks and opportunities in the same way that the system forensically analyzes company financials.

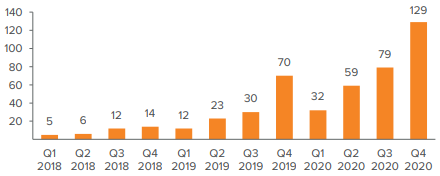

Consumers and investors alike are pressuring companies to demonstrate their ESG credentials, either through actions at the corporate level, including in the products they offer, or via the instruments they use for financing. Governments and regulators have also introduced enhanced standards and regulations to support increased disclosure and consistency of ESG reporting. This ESG push, which has been propelled by legitimate risks and concerns important to market participants, has led to an inevitable rise in the volume of “green” claims made by companies attempting to demonstrate sustainability credentials to their stakeholder base (Figure 2). However, the sheer volume of ESG marketing and labelling, in combination with nonuniform sustainability commitments and reporting, has made it increasingly difficult for stakeholders to identify which claims are trustworthy and reliable, and which are not (i.e., “greenwashed,” in industry parlance).

Figure 2: ESG Turns Mainstream

Source: FactSet. Copyright © 2021 by Standard & Poor’s Financial Services LLC. All rights reserved.

Source: FactSet. Copyright © 2021 by Standard & Poor’s Financial Services LLC. All rights reserved. Indeed, at the recent September Skybridge Alternatives (“SALT”) conference in New York, Gareth Shepherd, portfolio manager and co-head of the EMI Team, noted that some corporate treasurers and CFOs have figured out that if they can “window dress” their companies’ ESG characteristics, they will get increased investor flows, as well as higher marks from rating agencies. Such perverse incentives are why it may not be prudent to rely on just headline ratings.

Indeed, at the recent September Skybridge Alternatives (“SALT”) conference in New York, Gareth Shepherd, portfolio manager and co-head of the EMI Team, noted that some corporate treasurers and CFOs have figured out that if they can “window dress” their companies’ ESG characteristics, they will get increased investor flows, as well as higher marks from rating agencies. Such perverse incentives are why it may not be prudent to rely on just headline ratings.

Case in point: FACEBOOK

On March 17, 2018, The New York Times published an article that Cambridge Analytica used “private information from the Facebook profiles of more than 50 million users without their permission… making it one of the largest data leaks in the social network’s history”.4

On March 17, 2018, The New York Times published an article that Cambridge Analytica used “private information from the Facebook profiles of more than 50 million users without their permission… making it one of the largest data leaks in the social network’s history”.4

Prior to the scandal, Facebook’s ESG ratings5 had been improving across several different providers. After the news broke, Facebook’s stock fell more than 20% over the following two weeks from a peak earlier that year. At one point later that year, the stock was down more than 35% as the scandal widened. Ratings agencies reacted by downgrading Facebook’s ESG score6… a little too late.

Fortunately, the EMI team’s machine learning models flagged Facebook on ESG issues before the scandal came to public light, placing it in the bottom decile of companies in the U.S. universe. We believe this to be a testament to the machines' ability to go beyond headline ratings and forensically dissect underlying data without emotion or human biases.

Nowhere to run, few places left to hide

With the application of machine intelligence, there are few places left to hide. Companies tempted to prop up their ESG performance for ratings agencies and stakeholders alike are forewarned: ultimately, they will be discovered if the data does not match the rhetoric.

In our next blog, we will explore further the practical side of integrated ESG investing and how specific signals, such as the momentum of ESG, can enhance stock selection.

1 J. Hawley, 2017, TrueValue Labs.

2 “Sustainable Investing: The Black Box of Environmental, Social, and Governance (ESG) Ratings” by Subhash Abhayawansa and Shailesh Tyagi, The Journal of Wealth Management Summer 2021, 24 (1) 49-54; DOI: https://doi.org/10.3905/jwm.2021.1.130

3 “Aggregate Confusion: The Divergence of ESG Ratings” by Florian Berg, Julian F. Koelbel, Roberto Rigobon, MIT Sloan, University of Zurich, December 29, 2020

4 “How Trump Consultants Exploited the Facebook Data of Millions” By Matthew Rosenberg, Nicholas Confessore and Carole Cadwalladr, March 17, 2018. https://www.nytimes.com/2018/03/17/us/politics/cambridge-analytica-trump-campaign.html

5 Source: MSCI, Sustainalytics

6 “Facebook’s social rating take a hit after data scandal” by Attracta Mooney, March 26, 2008. https://www.ft.com/content/33048cc2-3113-11e8-ac48-10c6fdc22f03

Past performance does not guarantee future results.

The opinions, views and information expressed in this commentary regarding holdings are subject to change without notice.

The distribution in the United Kingdom of this presentation and any other marketing materials relating to portfolio management services of the investment vehicle is being addressed to, or directed at, only the following persons: (i) persons having professional experience in matters relating to investments, who are "Investment Professionals" as defined in Article 19(5) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (the "Financial Promotion Order"); (ii) persons falling within any of the categories of persons described in Article 49 ("High net worth companies, unincorporated associations etc.") of the Financial Promotion Order; and (iii) any other person to whom it may otherwise lawfully be distributed in accordance with the Financial Promotion Order. The investment opportunities described in this presentation are available only to such persons; persons of any other description in the United Kingdom should not act or rely on the information in this piece.

The Capital Markets Authority and all other Regulatory Bodies in Kuwait assume no responsibility whatsoever for the contents of this presentation and do not approve the contents thereof or verify their validity and accuracy. The Capital Markets Authority and all other Regulatory Bodies in Kuwait assume no responsibility whatsoever for any damages that may result from relying on the contents of this presentation either wholly or partially. It is recommended to seek the advice of an Investment Advisor. Voya Investment Management does not carry on a business in a regulated activity in Hong Kong and is not licensed by the Securities and Futures Commission. This insight is issued for information purposes only. It is not to be construed as an offer or solicitation for the purchase or sale of any financial instruments. It has not been reviewed by the Securities and Futures Commission. Voya Investment Management accepts no liability whatsoever for any direct, indirect or consequential loss arising from or in connection with any use of, or reliance on, this insight which does not have any regard to the particular needs of any person. Voya Investment Management takes no responsibility whatsoever for any use, reliance or reference by persons other than the intended recipient of this insight. Any prices referred to herein are indicative only and dependent upon market conditions. Past performance is not indicative of future results. Unless otherwise specified, investments are not bank deposits or other obligations of a bank, and the repayment of principal is not insured or guaranteed. They are subject to investment risks, including the possibility that the value of any investment (and income derived thereof (if any)) can increase, decrease or in some cases, be entirely lost and investors may not get back the amount originally invested. The contents of this insight have not been reviewed by any regulatory authority in the countries in which it is distributed. The opinions and views herein do not take into account your individual circumstances, objectives, or needs and are not intended to be recommendations of particular financial instruments or strategies to you. This insight does not identify all the risks (direct or indirect) or other considerations which might be material to you when entering any financial transaction. You are advised to exercise caution in relation to any information in this document. If you are in doubt about any of the contents of this insight, you should seek independent professional advice.

In addition, please be advised that Voya Investment Management is a non-Canadian company. We are not registered as a dealer or adviser under Canadian securities legislation. We operate in the Provinces of Nova Scotia, Ontario and Manitoba based on the international adviser registration exemption provided in National Instrument 31-103. As such, investors will have more limited rights and recourse than if the investment manager were registered under applicable Canadian securities laws. This commentary has been prepared by Voya Investment Management for informational purposes. Nothing contained herein should be construed as (i) an offer to sell or solicitation of an offer to buy any security or (ii) a recommendation as to the advisability of investing in, purchasing or selling any security. Any opinions expressed herein reflect our judgment and are subject to change. Certain of the statements contained herein are statements of future expectations and other forward-looking statements that are based on management’s current views and assumptions and involve known and unknown risks and uncertainties that could cause actual results, performance or events to differ materially from those expressed or implied in such statements. Actual results, performance or events may differ materially from those in such statements due to, without limitation, (1) general economic conditions, (2) performance of financial markets, (3) changes in laws and regulations and (4) changes in the policies of governments and/or regulatory authorities.

All investing involves risks of fluctuating prices and the uncertainties of rates of return and yield inherent in investing. All security transactions involve substantial risk of loss

©2021 Voya Investments Distributor, LLC • 230 Park Ave, New York, NY 10169 • All rights reserved.