“We are at an inflection point” was one of the most frequently overheard statements and perhaps best summaries of Risk Minds 2022. Topics of discussion varied – from climate change to geopolitical risks to credit cycles, cyber and technology transformation – but the underlying sentiment remained the same; multiple trends were converging to create a unique risk inflection point.

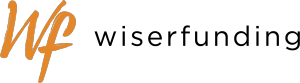

In his RiskMinds International 2022 speech, Professor Altman, co-founder of Wiserfunding, offered his unique analysis of where we are in the credit cycle. While pre-covid trends indicate a clear increase in HY default rates in the U.S., government support during the pandemic caused default rates to plummet. The pendulum is now back on the upswing though its unclear how default levels will compare to previous periods.

While some factors, such as low bond default rates, strong bond recovery rates and robust corporate earnings point to a benign credit environment, other signals confirm we are moving into an average credit cycle with strong indications of a distress cycle in the next few years. The onset of high inflation followed by high interest rates will exacerbate historically high debt levels across all borrower categories. New Issue U.S. HY Bonds (Liquidity Measure) have decreased significantly of late to about $85 billion (Oct 2022 YTD), down 76% from the record years of 2020 and 2021. This also suggests potential Refinancing risk in 2024 with a wall of debt maturities coming due around that time.

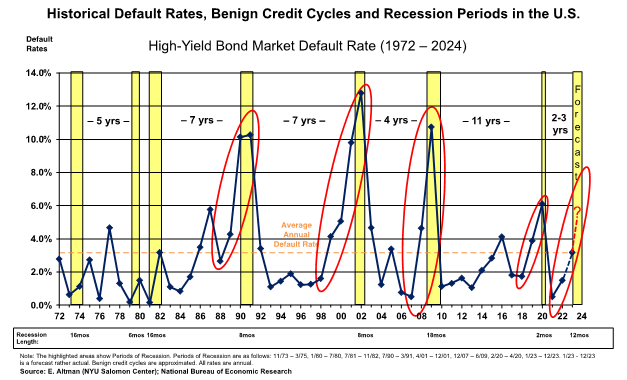

A unique factor in this current inflection point is the role of Nonbank lending and how that may evolve during this new inflection point in the credit cycle. Nonbank lending accounted for approximately twice as much lending to businesses as bank debt in the U.S. last year. This has trend has accelerated throughout the last two periods of stress and is likely to continue during this next phase as bank lending declines.

While larger corporates will be able to continue financing their balance sheet in the public debt markets, SMEs are likely to increasingly find their source of funding in the Nonbank lending markets. This trend will put even greater pressure on Private Debt funds to improve the efficiency and effectiveness of their lending practices as the tide of government support rolls away.

These broad trends are already impacting SME lending markets where lenders are deploying capital on short maturities and often only when open accounting and open banking is enabled to allow sharing of up to date and automated data feeds from the SME seeking funds. The digitisation of lending in this space will only continue to accelerate as Private Debt lenders seek out the highest quality borrowers and compete on speed and service, leaving weaker, less sophisticated SME lenders to struggle in the upcoming period.

If the above resonates with you, let’s continue the discussion here.

Jeff Courtney is Chief Operating Officer, at Wiserfunding