RiskMinds International is one week away, and knowledge partner Credit Benchmark discuss some highlights from their upcoming white paper covering credit trends in the U.S. retail sector.

Credit Benchmark collects anonymized credit data from major banks. This gives aggregate views of credit trends across a broad range of geographies, industries and borrower types. The company will be publishing a full white paper soon covering credit trends in the US retail sector. We discuss some of the key highlights here.

The “US Retail Apocalypse” has been in the news for much of 2017. Somewhere between a quarter and a half of all U.S. shopping malls are expected to close over the next 5 years. There is no doubt that the traditional US retail sector has some challenges, but the conventional view - that e-commerce is the main cause – hides a more complex picture.

It is true that online shopping provides a cheaper and more convenient alternative to traditional bricks and mortar outlets. This “Amazon effect” is a significant factor: e-commerce is growing at annual rates of 10% - 20% depending on the segment; traditional retail growth is barely keeping up with GDP, at around 1.5%. However, the majority of US retail sales – close to 90% - still go through traditional bricks-and-mortar (or hybrid “clicks-and-mortar”) channels.

Demographics are another important driver. The suburban middle class are being squeezed; increasingly elderly rural populations have a decreasing propensity to consume; and young urban millennials who face high accommodation costs now value experiences over possessions.

e-commerce is growing at annual rates of 10% - 20% depending on the segment; traditional retail growth is barely keeping up with GDP, at around 1.5%

The picture is very mixed across the developed economies. The “Retail Apocalypse” is mainly a US phenomenon, and US chains are suffering from heavy self-imposed debt burdens which will soon be subject to rising refinancing rates. Private equity firms led a series of leveraged buyouts of traditional retailers, compounding a general over-expansion in the past two decades.

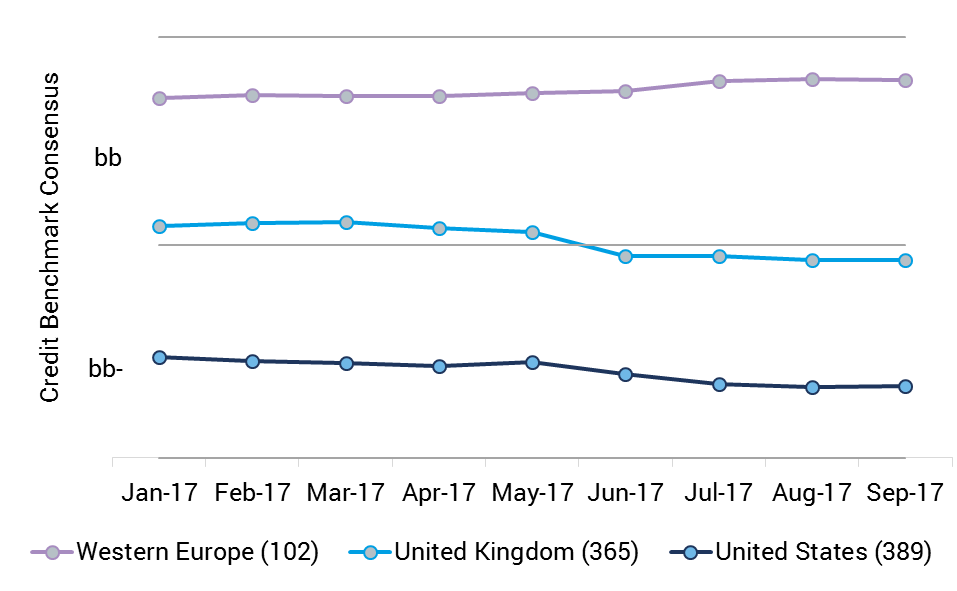

These trends are reflected in credit data. Figure 1 shows credit quality trends in the retail sector for the US, the UK and Western Europe (ex-UK).

Figure 1: Credit risk trends in the US, the UK and Western Europe (ex-UK)

Figure 1 shows that US retail credit quality is the lowest of these three groups, and Western Europe is the highest. There is a trend towards increasing credit risk in the US and the UK, rising by almost 10% over the last 9 months. Western Europe (ex-UK), by contrast, shows a decrease.

In the developing economies, the outlook for traditional retail looks more promising. This is also partly a reflection of demographics, with the global “middle class” now representing nearly half of the global population. The Wall Street Journal reports rapid mall development in China, India, Latin America and South East Asia.

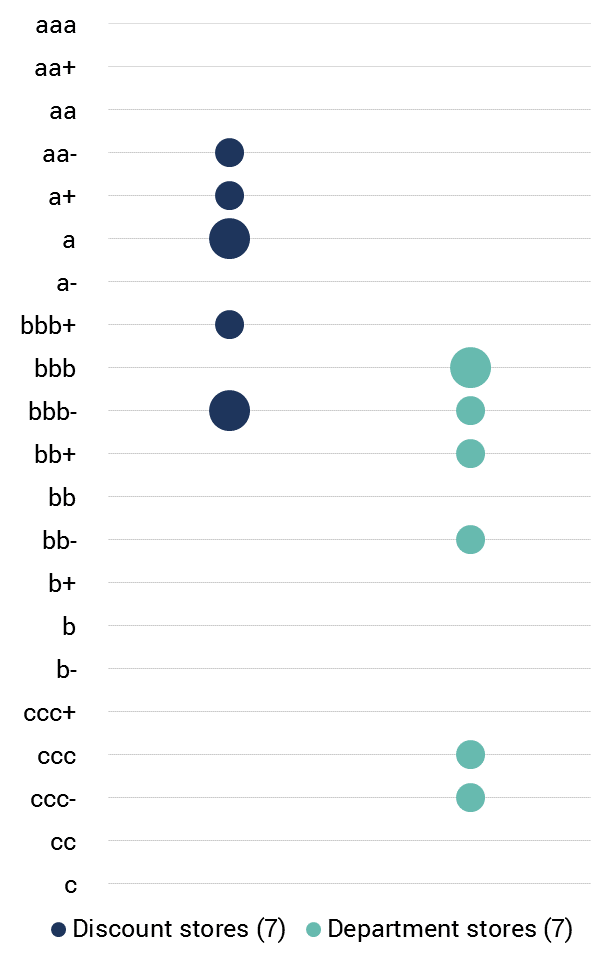

Another trend which is evident in the developed economies is the rapid growth of discount stores. Figure 2 compares the credit risk seven major discount stores and the seven major department stores in the US. (Larger bubbles indicate two companies with the same consensus rating).

Figure 2: Credit Risk of Discount Stores vs Department Stores

This shows that the credit quality of department stores is much lower than discount stores. All of the discount stores are in the investment grade category, while five of the seven department stores are viewed as non-investment grade. (It is worth noting that this pattern is also evident in the Airline sector, where discount airlines tend to have the highest credit quality).

The “US Retail Apocalypse” is a real, but complex phenomenon. It is partly driven by demographics and partly by a debt hangover. E-commerce is part of the story, but many parts of the world are likely to see major growth in traditional retail outlets.

Find out more about Credit Benchmark at the leading risk management event >>