Unsustainable long-term trends

We’re already experiencing major disruptions in our day-to-day lives, but we can expect more to come in the near future. Various reports have put climate change, the rise of populism, and technological advances on our radar, but those are only a few of the risks we need to keep an eye on. FirstRand Bank Chief Risk Officer Jaco Grobler observes the upcoming changes in his book Here comes a big paradigm shift, and this excerpt provides a holistic overview of the risks ahead of us.

“I used to think the top environmental problems were biodiversity loss, ecosystem collapse, and climate change. I thought that with 30 years of good science we could address those problems. But I was wrong. The top environmental problems are selfishness, greed and apathy… and to deal with those we need a spiritual and cultural transformation… and we scientists don’t know how to do that.” – Gus Speth

There are several long-term trends that are no longer sustainable pointing to an inevitable series of paradigm shifts, most likely with chaotic transition periods. These trends have received significant coverage in various research and risk reports, reference links to some of the more noteworthy publications have been provided at the end of this book. It is however worthwhile to summarise some of the most important take-outs below.

---

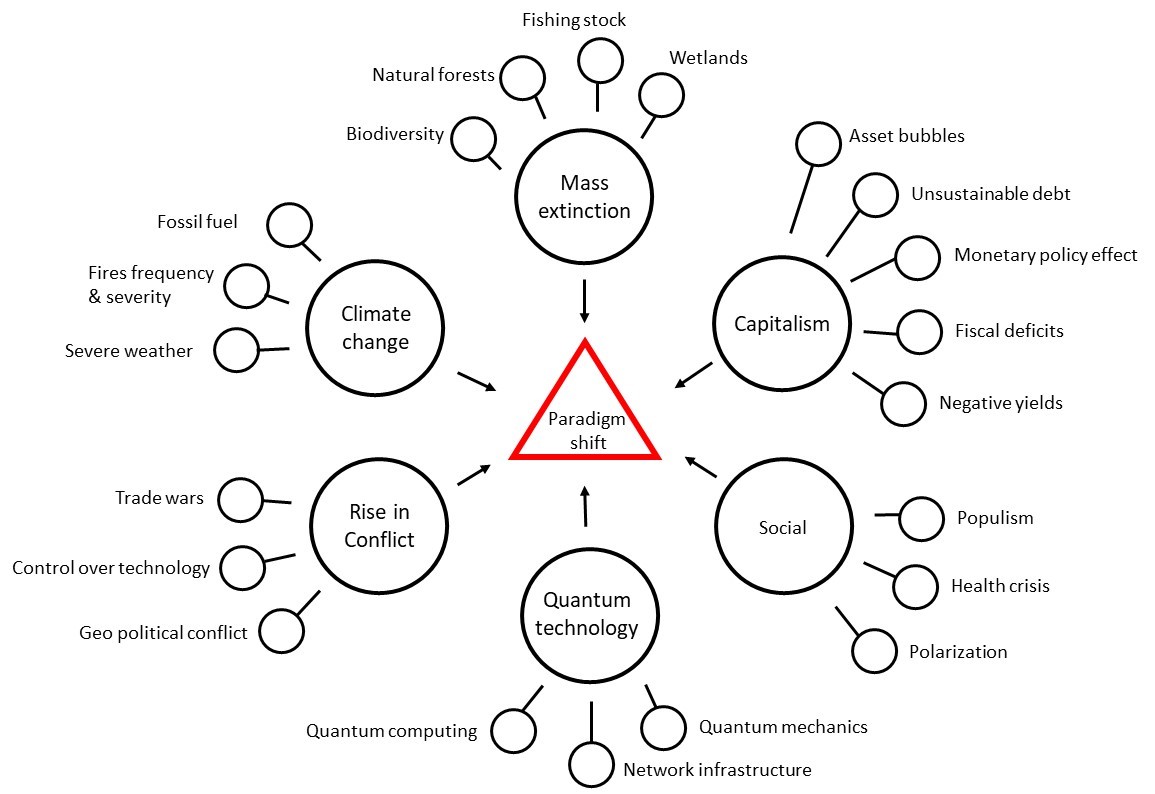

Illustration of the major trends influencing a paradigm shift in human consciousness.

Illustration of the major trends influencing a paradigm shift in human consciousness.

---

These long-term trends fuel the dangerous cocktail where politics, populism, resource scarcity, conflicts, and various societal pressures intersect with each other in a negative feedback loop to further re-enforce geopolitical risk and growing social instability. History has taught us that scenarios like this represent the make-up of a perfect storm that eventually results in a paradigm shift.

Capitalism

There are several long-term capitalist trends that are starting to reach the end of what is sustainable. The game of Monopoly is often held up as a good example of how capitalism works. We play the game to teach our children about money management and capitalism, however, few realise that when you play Monopoly to the end, you reach a situation where one player ends up with all the property and the money, and the other players don’t want to play anymore.

We are living in times where interest rates are at record lows, last seen during World War II and the 1619 Thirty Years’ War in Europe. Debt levels are at record levels last seen during World War II. Geopolitical conflict is rising everywhere, and we see conflict playing out in the form of trade wars, a light version of cyber warfare, and conventional military tension building in a number of regions.

Clearly, we are living in unprecedented times. The current economic system must adjust in a way to a model that is more conducive to the wellbeing of the entire ecosystem. This adjustment should be viewed from the analogy of a person (business leadership and politicians) having to realise that the current consumption lifestyle of lots of fast food and stimulants (resource exploitation and loose expenditure and easy monetary policy) is introducing serious health risks. The person has to adopt a healthy diet and lifestyle to manage the risks proactively or be forced to do so through a shock to the system, such as a heart attack or cancer (severe economic shock). Given the current trajectory of poor leadership and limited political will, we will most likely end up with a scenario where the system will be forced to adjust by means of a shock to the system, most probably prolonged. The following are some of the most notable unsustainable trends in capitalism.

Debt cycle

Sovereign and corporate on-balance sheet debt (someone else’s asset) and off-balance sheet debt (unfunded social commitments) are at record levels and continue to increase to unprecedented levels.

Pension and healthcare liabilities

Unfunded pension and medical liabilities continue to grow and will become increasingly due as populations are aging. This increases the risk of governments and institutions defaulting on these obligations as it is unlikely that they will have sufficient resources for these commitments, providing a further feedback loop to rising social tension and populism.

Monetary policy

Central banks continue to buy financial assets (bonds and equities) as part of monetary stimulus in their futile attempt to stimulate economic activity and increase inflation. Instead, asset bubbles are being created whilst the prospect of future returns are reducing. No real economic benefit is obtained through the process whilst the effectiveness of monetary policy is disappearing.

Negative yields

The amount of sovereign debt yielding negative interest rates has reached staggering proportions and continue to grow. This phenomenon of negative yielding debt poses significant risk to financial services institutions as it erodes profitability of banks and destroys the very foundation of banking.

Fiscal deficits

Large government deficits will continue to increase over time. There is no clear idea how this will be funded in future, other than central banks printing money. In the long run, this trend threatens the viability of the very foundation of currency as store of wealth and mechanism of exchange of value.

Asset bubbles

Asset bubbles exist in all areas of the economy, due to cheap and easy money. In addition, lower than required tax rates, loose fiscal expenditure, and ultra-low interest rates further artificially inflate the values of the assets. The other side of the coin resides on the governments balance sheet in the form of sovereign debt. When governments are eventually forced to adjust policies to manage unsustainable levels of debt, assets prices will inevitably adjust. This has happened many times in history during previous debt cycles.

Social

We are living in times where the population growth has reached levels where the planet can no longer support humanity’s prosperity with the current model of consumption. Rising inequality and a number of other factors are fuelling populism and social tension, thereby complicating the political landscape tremendously.

Population growth

Since 1970 the global human population has more than doubled (from 3.7 to 7.6 billion), rising unevenly across countries and regions.

Rise of populism

Populism used to be observed infrequently in emerging markets and almost non-existent in developed countries for several decades. However, during the past decade, the phenomenon of populism has risen significantly across the world and are approaching levels last seen pre-World War II. Populism is not only having a significant impact on politics but also brings about dangerous levels of polarisation, xenophobia, militarism, protectionism, and extremism in society. Many of the unsustainable trends mentioned here fuel populism in self-reinforcing ways.

Health crises

Irrespective of great advances in biochemistry, we continue to see exponential increase in mental health and other forms of chronic disease. Some notable trends are:

- Approximately 1 in 5 adults have been diagnosed with some form of mental health condition, and its prevalence amongst children is increasing rapidly. The Covid-19 pandemic and resulting social distancing significantly worsens this further.

- Prescription drugs is a leading cause of death world-wide, reaching epidemic proportions.

- Around 7 million deaths a year can be attributed to air pollution.

- Cancer in all forms continue to grow in prevalence. These days everyone has a close friend or family member who has been affected by cancer.

- Antibiotic resistance is a ticking time bomb and being further aggravated by farming and food production practices that use antibiotics irresponsibly.

Polarisation

Polarisation is occurring at all levels of society across a number of countries. The rising wealth gap is a key driver of polarisation. However, the phenomenon is greater than the wealth-gap effect. This is evident in areas such as a decrease in religious tolerance, rise in xenophobia, anti-semitism, rise in opposing ideologies, and broad-based conflict within societies.

Productivity

Productivity is profoundly impacted by the 4th industrial revolution of technology where numerous jobs are being automated and replaced with technological innovations giving rise to more social tension.

Quantum technology

The past, present, and future discoveries of quantum technology will have a more profound impact on humanity than any other significant scientific discovery in history. Not only do we see some of these developments such as the internet, lasers, GPS, and network technology already having a very significant impact on how we engage as humans, but the principles of how quantum technology works profoundly challenge our understanding of human life, too. For example:

- Quantum theory works on the premises that everything is connected to everything else independent of space and time. Also referred to as the concept of quantum entanglement.

- All probabilities for manifestation exist simultaneously at the same time, until observed. Also referred to as the observer effect.

Discoveries and application of quantum mechanics not only form the foundations of the 4th industrial revolution of technology development, but also forms the foundation of understanding how the mind-body connection works, and how it enables us to re-programme our “software”.

Rise in conflict

There are several conflicts simmering across the globe that has the potential to escalate into broader geopolitical and proxy conflicts. We are observing ever increasing trade war friction; cyber warfare is in a reconnaissance phase with sporadic information manipulation incidents; and as far as conventional warfare is concerned, leadership have to date demonstrated some constraint despite some very tense situations in the Middle East. The past decade has seen a significant build-up of weapons and military presence by a number of leading nations. An arms race for new hypersonic nuclear and other weapons are also under way. The arms build-up is not only limited to the large superpowers, as an example, it is estimated that Hezbollah has at least 10 times more weapons stockpiled in Lebanon than prior to the pervious 2006 major conflict. Many of these weapons are now enabled with precision guided technology.

There is an old Russian saying:

If you write a gun into the first chapter of a book, you will have to use the gun before the book is finished.

Those who are in control of the weapons would forever be tempted to use the weapons at some point.

Geopolitical conflict

Geopolitical risk has been growing for more than a decade, without manifesting into an international crisis. This may very well change as other trends such as resource constraints, reversal of globalisation, and conflict over technology dominance intersect with the geopolitical risk dynamics. Some of the more notable flashpoints across the globe include: Middle East, Lebanon, US-China, Russia-Ukraine, North Korea, Russia-NATO, Kashmir, China-Taiwan, China – India, Latin America, Russian military build-up across Africa, European fragmentation and growing Islamic militancy in Africa and other parts of the world.

Control over technology

Conflict over technology is a major factor influencing the trade wars and geopolitical risk landscape. The rise of China as a world power with strong technological advances is in some way similar to the rise of Japan challenging US dominance pre-World War II.

Trade wars

Divergence between the US and China is resulting in irreconcilable differences being amplified. Any form of trade deal announced should be seen as political positioning rather than dealing with the deep-seated conflicts that underlies the tension. These tensions are unlikely to be resolved anytime soon.

Climate change and environmental

Climate risk has been elevated considerably as an area of focus during the past few years and most leaders understand this is becoming a systemic problem. Temperatures are rising faster than the ability of natural systems and human-made infrastructure to adapt. Impacts are already being felt and are likely to grow, intensify and multiply. In addition, there will be a significant self-re-enforcing feedback loop with socio-economic and political dynamics. Some of the most notable impacts are:

Fossil fuels

Fossil fuels are very rapidly falling out of favour with investors, lenders, and insurers. This has a significant impact for economies that have a heavy reliance on fossil fuel technology for energy production as well as those who rely on revenue from fossil fuel mining and related industries. The paradigm shift in the energy sector is enormous and will be very disruptive for a number of players as well as for certain countries and regions.

Wild fires

Wild fires are increasing rapidly in both frequency and severity globally. This illustrates very clearly that the impacts of climate change are already being felt and it’s no longer just something to only worry about in the future. For example, California now view wildfires as an annual expected event whereas a few years ago it may have been seen as a 1 in 10-year event.

Severe weather

Further warming is unavoidable for at least a few decades, even if aggressive action is taken now. This will increase the frequency and severity of weather conditions such as lethal heatwaves, extreme precipitation, hurricanes, drought, heat stress, and rising sea levels. Countries with lower per capita GDP are more exposed, giving rise to more inequality, migration, and geopolitical risk in future.

Degradation of water systems

Chemical, sewage, plastic, and other forms of pollution is resulting in systemic degradation of lakes, rivers, oceans, aquifers, and groundwater across the planet.

Mass extinction: The loss of biodiversity and nature

The planet is now facing its sixth mass extinction, with consequences that will affect all life on Earth, both now and in the future. This threatens food security, human health and well-being, societal resilience, social stability, and services worth an estimated USD 125-140 trillion per year. Exploitation of natural resources combined with climate risk introduces profound risk to the human habitat and way of living. Some of the key trends include:

- Natural forests declined by 6.5 million hectares per year between 2010 and 2015 (in total, an area larger than the UK).

- Natural wetlands declined by 35% between 1970 and 2015.

- Over 30% of corals are now at risk from bleaching.

- 60% of vertebrate populations have disappeared since 1970 and 40% of insect species are declining rapidly.

- By 2050, Africa is expected to lose 50% of its birds and mammals, and Asian fisheries will completely collapse.