What asset managers should know about what's next for energy transition

As investors increasingly position their portfolios to reflect the economy of tomorrow, one theme had a particularly phenomenal year in 2020: the energy transition. Steven Billiet, Head of Stewardship, APAC. BNP Paribas Asset Management discusses the narrative of this transition in this latest thought leadership.

We believe we are only on the cusp of a multi-decade journey. The energy transition is a USD90 trillion opportunity from 2019 to 2050[1], where with every year of further technology innovation and policy support, the investment opportunity set continues to improve as some growth opportunities are de-risked, and new growth stories emerge.

What is energy transition?

In my view, energy transition consists of three pillars, each requiring massive investments over 2019-2050:

- Renewable energy production

- Energy efficiency, technology and materials

- Energy transportation and infrastructure

Each pillar forms a crucial part of the answer when trying to solve the following question; this begs the question on how do we meet the world’s growing energy needs whilst reducing global carbon dioxide emissions?

With carbon dioxide emissions from energy use today representing nearly 70% of the global total, new solutions to reduce the carbon intensity of energy production are imperative if we wish to achieve or exceed the Paris Agreement targets. To put this in perspective, we need to reduce global energy related CO2 emissions from nearly 35 Gt/year today to less than 10 Gt/year by 2050 to target a temperature rise of closer to 1.5°C. This challenge is made harder by energy demand growing significantly over coming decades due to global population growth and rising per-capita energy consumption.

And while trying to achieve the same goals, each of the three pillars have different macro, regulatory and industry drivers. And, as such, within each pillar, there are many different and varied investment opportunities.

Energy transportation and infrastructure: only the beginning of the electric vehicle revolution

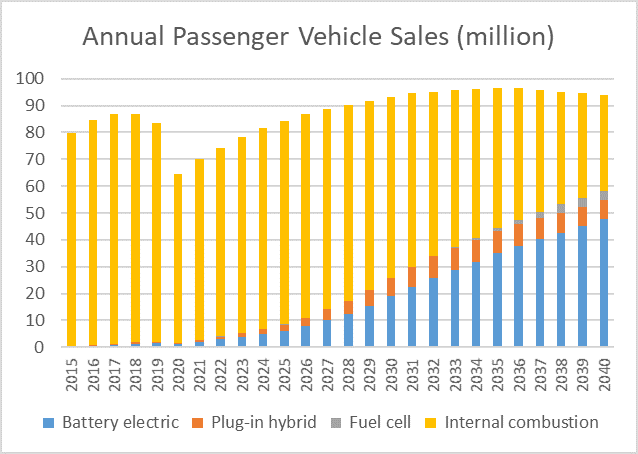

Electric Vehicles (EV) hit an inflection point last year as costs continued to decline and car manufacturers released new models. Sales were up 43% year on year despite the pandemic and EVs made up 4.2% of new global car sales, up from 2.5% in 2019[2]. BNEF sees EV sales more than tripling by 2025, with penetration rising to 50% of new sales by 2037[3].

We are only at the start of the electric car journey.

The continued decline in wind and solar costs accelerated the disruption of traditional infrastructure in 2020, and this trend shows no sign of abating. In fact, renewable capacity additions are expected to have accounted for almost 90% of the increase in total power capacity globally last year![1]

Throughput 2020, there has been a lot of interesting developments which could shape the course of technology and investment for years to come. For EV, 2020 was the first year to see some battery pack prices drop below $100/kWh, the price generally viewed as offering cost parity for Electric Vehicles with their internal combustion engine counterparts[5].

Increasing policy support

2020 also saw an underpinning and strengthening of some of the key regulatory and policy drivers of the energy transition. The election of Joe Biden as US President and his “Clean Energy Revolution” could see the US embark on a legislative path to achieving net-zero emissions by 2050[6].

In Europe, the European Green Deal has underpinned the EU’s desire to be the first climate-neutral continent. China has pledged to become carbon neutral by 2060. These long term aspirations are being supported by more targeted policy initiatives which are helping to enable the roll-out of new technologies.

The energy transition opportunity looking ahead

This is only the beginning of a multi-decade investment opportunity for energy transition. While investors were presented with a multitude of solutions related to this theme last year, it was BNP Paribas Asset Management’s energy strategy (which generated an impressive return of 167% in 2020 and grew from below USD200mn of assets at launch to more than USD3bn[7]) that emerged the top-performing fund available for sale in Asia, benefiting from the stronger spotlight the coronavirus pandemic has shone on sustainability.

In the short term, some pockets have certainly seen valuations become more extended than others. But thanks to its superior growth prospects, the broad universe of companies involved in the energy transition still has a price-to-earnings growth ratio below 1 over the next 3 years[2]. We think 2021 will be a year which rewards those companies best placed to benefit from the underlying regulatory, macro and industry drivers, putting an increasing emphasis on top down thematic knowledge, technical know-how and stock selection.

[1] IRENA, Global Renewables Outlook, Energy Transformation 2050, April 2020.

[2] EV-volumes.com and The Guardian, Global sales of electric cars accelerate fast in 2020 despite pandemic, January 2021.

[3] BNEF Electric Vehicle Outlook, May 2020.

[4] IEA Renewables 2020.

[5] CLSA, Global Electric Vehicles 2021 outlook.

[6]Joebiden.com, The Biden plan for a clean energy revolution and environmental justice, January 2021.

[7] Ignites Asia, “BNPP AM ESG-focused fund becomes top performer in Asia in 2020, 25th January 2021.

[8] Methodology: market cap weighted assessment of BNPP AM view of broad cross-sector Energy Transition universe where we can find evidence of environmental solutions.