What does leadership have to do with risk management?

Increasingly, the role of the risk managers extends beyond the handling of traditional financial risks, and incorporates more non-financial risks like reputational and operational risks. To successfully manage these, risk managers, especially Chief Risk Officers, need to take on leadership roles. But what makes one a leader, not just a manager? Katja Rieger, Founder Xponential and Board Member at Swiss Re Insurance Linked Investment Management AG, explores what leadership means in action, and how the focus on leadership is changing along with the changing risk landscape.

For me, leadership is the ability to make hard decisions in a fast-changing world. Leadership is making the right choices, as opposed to the easy ones, especially when it’s a question of doing the right thing versus gaining quick profit. Leadership is taking the longer-term perspective even at personal risk. For banks, it is about whose money you take; for insurance, it is about whether you ensure green versus brown ventures. Making these decisions is not easy, but how you handle these questions shows whether you lead or whether you rely on hierarchal power. Leadership is also about being a role model to your team – walk the talk. If you value transparency, you will have to communicate well, clearly, and frequently. You will also reward those, who disagree with you, and thank those who come forward with uncomfortable truths.

What does leadership have to do with risk management?

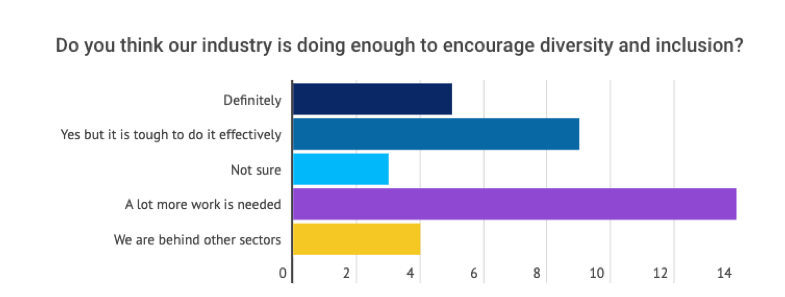

In a recent survey, RiskMinds received the following answers from risk managers:

Honesty, integrity, and listening are the qualities named most often and it is easy to understand why. Risk managers are the ones, who have to find out about risks, so if you do not have a culture of honesty and transparency, that is pretty hard to do. Risk managers are the ones, who have to bring uncomfortable truths to the attention of leaders and their job is made much easier, when this is appreciated, listened to, and acted on. And finally, if the leader is not honest, you have a good chance that the organisation’s culture is, in general, not completely honest.

This theme is repeated in the answer of what risk managers are looking for in their employer. I do not dare imply that the reason this is mentioned so strongly is because this is something risk managers are missing in their current employers. However, responsibility and strong ethics are certainly qualities, that are very important for risk managers.

What I did find interesting is, that opportunity for personal growth did not get more votes. Because, to do a good job, working for good leaders is not enough. Risk managers have to have good leadership qualities themselves to do a good job, and, therefore, they need to grow personally.

Leadership skills in risk managers’ every day

Expanding on what leadership means (for me), leaders have the ability to build strong relationships. Strong relationships are based on trust, which in turn is based on credibility, reliability, and giving people the chance to understand you well. Therefore, another important skill for a leader is communication – both to communicate clearly and to listen well to others.

These skills are vital for risk managers because they’re not always the ones, who bring the good news. She may be the one, who keeps the 1st line of defense from doing something that could bring risk to the organisation. He is the one, who says “what if”.

But how do you do that? How do you communicate the risks, so they are accepted? How do you find out about risks, when you are not at the front line? The answer: communication and relationships.

The old stereotype of a risk manager is a math geek, who becomes a modeller, an actuary, or some other introverted nerdy type. As with all stereotypes this picture has flaws, but in the beginning of this still young profession, this was probably a fairly common one.

But things have changed. Change is common and faster than ever. The world is amazingly volatile and understanding risk is less about mathematical accuracy but more to do with the ability to understand an interconnected, shifting world.

Of course, we need all kinds of talents in risk management teams, from mathematical and analytical skills to good communicators and relationship builders. However, the latter two do not get enough focus yet. The good news is that risk managers can be trained up in these skills.

Imagine, instead of creating slides full of numbers and dry words, you use a story to communicate the risk and the potential consequences. Your colleagues would not just understand you better, they would be more likely to act within the risk parameters you’ve set out because they were influenced by your story. Imagine, instead of coming to monthly meetings, you could come together, listen to each other’s perspectives, and find common goals while building rapport.

The role of diversity in risk management

Diversity is a great way to find and understand risks from different perspectives. It is actually part of a personal growth journey towards leadership to become more curious and less judgmental about differences. Diversity goes, of course, well beyond the gender and race question. A really interesting aspect for risk managers can be neuro-diversity. People from the autism spectrum, with ADHD, or dyslexia are known to see different perspectives and often have complementary talents very valuable for risk managers. But diversity is not about one kind of diversity versus another. The good news about diversity is, when you start opening up to differences, you will in general open up. Appreciating diversity is a leadership trait, because

- It’s the ethical mindset and

- It’s the smart mindset for an increasingly diverse world.

Unfortunately, the result from the survey says, we still have a long way to go.

As you can see, risk management is all about leadership. Leadership to deliver the tough message, courageously. To persevere until your message is acted on and to communicate clearly and compellingly about the consequences, if not.

If you want to explore this more with me, let’s connect on 2 March 2021 at the RiskMinds Climate Change Risk & ESG focus day and join my roundtable. I am curious to hear your perspective.