What’s driving fixed income ETF growth?

The market volatility that followed the declaration of the COVID-19 pandemic in March 2020 affected all corners of the fixed income markets. Cash bond markets seized up, including even parts of the US Treasury market, and the largest debt funds saw their market prices fall below the theoretical values of their underlying securities. Critics had long argued that ETFs could exacerbate volatility due to forced selling, and that pricing dislocations reflected that something was “broken” in the market. On the contrary, during 2020 fixed income ETFs proved, once again, to be invaluable tools providing price discovery and liquidity during periods of extreme market volatility.

The stressed market conditions of early 2020 revealed the relative opacity and fragmentation in over-the-counter bond markets. On the other hand, many fixed income ETFs proved to be essential risk management tools to navigate the choppy market. We had seen during several stress periods and as recently as the fourth quarter of 2018 that when market volatility rises and liquidity in cash bonds dries up, fixed income ETF trading volumes will fill the gap. During yet another unprecedented market event, these structures held up and provided critical liquidity tools and information to market participants. Moreover, the Federal Reserve’s intervention in the credit markets by first purchasing fixed income ETFs while still developing a plan for cash bonds was seen as an endorsement of the structure of ETFs as the most efficient mechanism for gaining diversified exposure. The Fed’s nod to fixed income ETFs was followed by an influx of flows as the market grew to be worth $1.1 trillion while the Fed itself ended up holding just $8.6 billion of debt funds[1].

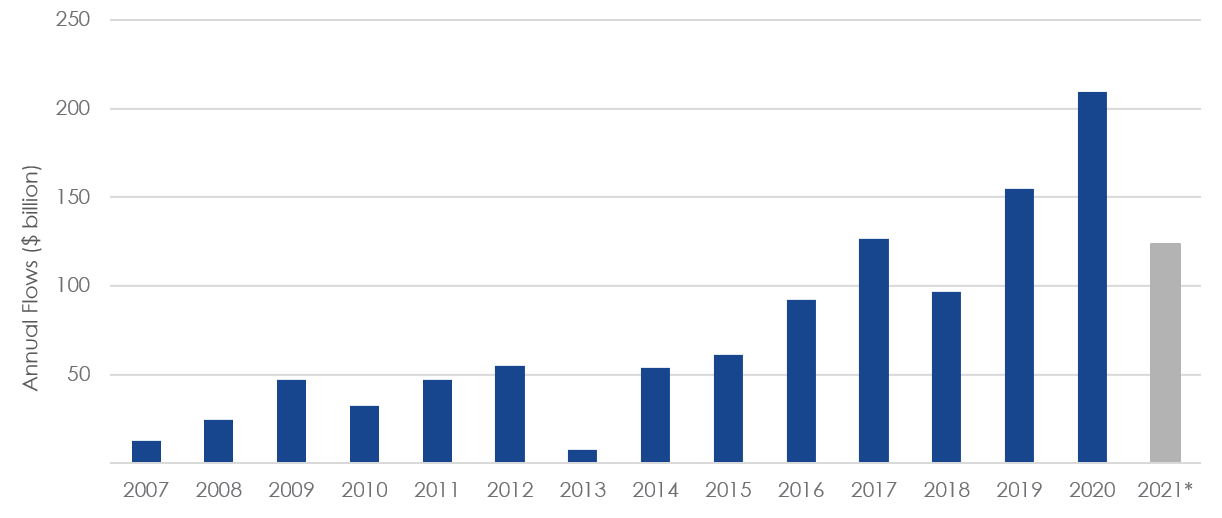

Booming Bond ETFs: Debt funds absorbed record flows in 2020

*YTD Flows as of 8/4/2021

Source: Bloomberg Intelligence

Fixed income ETFs have seen broader adoption by institutional investors, advisors, RIAs and individual investors. Fixed income ETFs have provided pension funds and insurance companies a tool to streamline portfolio construction and effectively manage portfolio risk. According to S&P Dow Jones Indices, in the first quarter of 2021, more than half of dollar-traded volume by insurance companies was in fixed income ETFs—an impressive feat given that ETFs as a whole represented only about 35% of year-end 2020 insurance assets[2]. Asset managers have been adopting fixed income ETFs as both strategic and tactical allocation tools to enhance liquidity and to reduce potential cash drag on portfolio performance. Broader adoption of fixed income ETFs by institutional investors may improve liquidity for all shareholders and drive down trading costs. This trend may drive further growth in fixed income ETFs, which remain a small fraction of total fixed income assets.

Despite the prolonged low yield environment, the search for income and demand for fixed income has remained strong. US bond mutual funds and ETFs attracted $380 billion in net inflows compared to $246 billion in equities over the six months ending June 30[3]. Strong equity markets have driven some investors to lock in gains at current valuations, and market strategists expect a rotation back into fixed income assets as inflation worries subside[4]. Demographic factors such as an aging population and the need to preserve a steady retirement income also sustain demand for fixed income assets. Pension plans have also been moving into long-dated bond funds to hedge against the risk of a future draw down in stocks.

We expect demand for fixed income ETFs to continue. A key driver of this growth may come from demand for incremental yield by assuming additional credit risk. Second quarter earnings estimates are expected to see 65% growth compared with the same period last year—the strongest rate of growth since the Great Recession. Although yields for non-investment grade bonds are low on an absolute basis, valuations reflect strong balance sheets[5] and a strong economic outlook. By allowing income seeking investors to efficiently access segments of the market that offer unique value, such as fallen angel high yield bonds, ETFs can help to build portfolios that provide both income and potential outperformance. Likewise, total return strategies in core fixed income that take a more selective approach through a rules-based strategy to identify value may be attractive to investors as well. These strategies allow investors to earn attractive income with outperformance potential versus the broad market without having to assume significant incremental risk. ETFs can deliver this potential outperformance with a lower cost than actively managed mutual funds, with the added benefits of transparency, liquidity and tax efficiency.

Against the backdrop of low yields in developed markets, higher yielding emerging markets debt may also be attractive for income seeking investors. Although the economic recovery in emerging markets has been uneven, the growth gap versus developed markets remains. While developed market central banks remain frozen, many EM central banks have increased policy rates this year, a step which may be a positive catalyst to emerging markets local currencies that remain at historically undervalued levels. Moreover, local emerging markets debt may be a useful tool to shield investors from U.S. policy risks. On the corporate debt side, emerging markets high yield bonds provide investors a higher quality exposure, based on current ratings, with lower historical default rates compared to U.S. high yield corporate debt. High yield emerging markets corporate bonds currently also offer higher yields and spreads than U.S. high yield corporate bonds, with a lower average duration. At the very least, there is an attractive diversification opportunity in this asset class, given the virtually 0% overlap with U.S. high yield indexes. Fixed income ETFs, provide investors with an efficient way to access various emerging markets debt asset classes, exposure to which has traditionally been either limited or expensive.

Another area of growth may be sustainable fixed income investing through ETFs. Assets in sustainable fixed income ETFs nearly tripled from $7.6 billion at the end of 2019 to $21.2 billion by end of 2020[6]. Investors trying to navigate the complexities of ESG may find data driven sustainable indexed exposure more transparent and easy to access via ETFs. The green and sustainable debt market continues to grow and may top $650 billion in 2021, representing growth of 32% over the previous year[7]. Despite the sheer growth in green bonds issuance it has been difficult for most investors to access these bonds, whose proceeds are used to achieve a positive impact, including carbon reduction. Investors looking to add green bond exposure to their portfolios might find rules based and transparent ETFs useful. These ETFs are built on indices that maintain stringent inclusion standards that provide exposure to bonds financing environmentally impactful projects. This approach can overcome some of the challenges of applying more subjective, and often inconsistent, issuer-level ESG-ratings to a bond portfolio. We may also see product innovation driving growth in other traditional fixed income asset classes, such as sustainable approaches to investing in municipal bonds markets.

Related to munis, fiscal policy changes under consideration by the Biden administrations to raise the top income tax bracket is driving record flows into the municipal bond funds. Munis appear to be a vehicle of choice for investors trying to navigate the upcoming tax regulations and looking to generate tax-advantaged income.

Currently with $75 billion in assets, municipal bond ETFs represent a small but growing fraction of the $4 trillion state and local government debt market[8]. Broader adoption of municipal bond ETFs could boost the asset growth in fixed income ETF assets.

Fixed income ETFs have provided a degree of flexibility for investors that previously did not exist in bond markets. The universe of fixed income ETFs has expanded rapidly and matured in countless ways since the first bond ETF launched in 2002. The large variety of fixed income ETF offerings available today allow investors to customize portfolios based on their investment objectives and risk profiles. Fixed income ETFs have proven through multiple cycles to be liquid during periods of heightened volatility and have formed a reputation as important tools for price discovery and risk management during periods of market duress. The low cost, transparent, and diversified nature of fixed income ETFs make them a vehicle of choice for individual and institutional investors alike.

Fixed income ETFs are on pace to beat record inflows from last year, propelled by supportive markets, demographic and policy dynamics. Institutional and broader adoption by the markets of the wide array of fixed income ETFs currently available holds promise for future growth in this previously misunderstood investment tool.

Disclosures

Please note that VanEck may offer investments products that invest in the asset class(es) or industries included herein.

This is not an offer to buy or sell, or a recommendation to buy or sell any of the securities/financial instruments mentioned herein. The information herein represents the opinion of the author(s), but not necessarily those of VanEck, and these opinions may change at any time. Non-VanEck proprietary information contained herein has been obtained from sources believed to be reliable, but not guaranteed. Not intended to be a forecast of future events, a guarantee of future results or investment advice. Historical performance is not indicative of future results. Current data may differ from data quoted. Any graphs shown herein are for illustrative purposes only.

All investing is subject to risk, including the possible loss of the money you invest. As with any investment strategy, there is no guarantee that investment objectives will be met and investors may lose money. Diversification does not ensure a profit or protect against a loss in a declining market. Past performance is no guarantee of future results.

References:

- https://www.bloomberg.com/news/articles/2021-06-07/no-fed-no-problem-for-credit-etfs-with-more-than-1-trillion?sref=wyMYZNQq

- https://www.etftrends.com/equity-etf-channel/insurers-bought-corporate-bond-etfs-sold-by-others-in-early-2021/

- Source: Bloomberg

- https://www.ft.com/content/787d1be6-e7d9-43a2-b77c-07916fe19f3e

- https://www.cnbc.com/2021/07/14/the-junk-bond-market-is-on-fire-this-year-as-yields-hit-a-record-low.html

- https://www.etfexpress.com/2021/06/08/301533/ishares-reports-huge-asset-growth-sustainable-fixed-income-etfs

- https://www.moodys.com/research/Moodys-Sustainable-bond-issuance-to-hit-a-record-650-billion--PBC_1263479

- https://www.bloomberg.com/news/articles/2021-06-29/vanguard-blackrock-muni-etfs-reap-bonanza-in-record-cash-inflow?sref=wyMYZNQq