When one plus one equals more than two

The low interest rate environment across many of the world’s major economies since the global financial crisis meant many fixed income investors have found the search for yield a constant challenge over the past decade.

It is a battle that is set to continue, with many central banks globally vowing to keep rates steady at least until the end of 2019, following the lead of the US Federal Reserve (Fed) and the European Central Bank.

Read Rob Neithart – Capital Group Global High Income Opportunities Fund Portfolio Manager, explain how.

How did the innovative approach of GHIO combining EM debt and corporate high-yield securities came about?

The Global High Income Opportunities strategy², on which our Luxembourg domiciled fund³ is based, was developed in 1998 when we realised that many of our best investment ideas actually shared the same characteristics. This despite the fact that these ideas came from different market segments and areas that many preferred to manage separately.

At its origin, GHIO was focused on two asset classes: high-yield corporate debt and EM debt. The type of research that leads to good judgments in EM debt was actually similar to the work required in the corporate high-yield space, as both asset classes have relatively high yields and typically react similarly towards changes in the macro environment.

But as the asset classes developed, so did GHIO. It can now be described as a global credit portfolio with a primary emphasis on a broad range of sectors within the higher-yielding spectrum of the fixed income universe. This all- currency investment universe includes EM corporate bonds.

Even today, many strategies claim to access a global high income opportunity set but only focus on corporate high-yield bonds. We believe that GHIO is unique in capturing the opportunities arising from the broad universe of EM debt and corporate high-yield bonds.

Why EM debt and corporate high-yield bonds?

GHIO was developed with the vision that corporate high-yield bonds and EM debt offer similar risk-return profiles but follow different market cycles. By investing flexibly across these asset classes, we could offer greater diversification and potentially generate more consistent returns.

In addition, corporate high-yield and EM debt usually offer higher yields than investment-grade bonds, and the income component has been one of the main drivers of GHIO’s returns. This is particularly attractive to investors who are apprehensive about the global economic outlook, as the income provides a more stable source of return. If the macroeconomic environment proves better than expected, the potential for capital appreciation could allow GHIO to offer equitylike returns, but with lower volatility due to the income component. It is our belief that diversification across asset classes is key for more stable returns.

Given the complexities involved with covering such a large investment universe, how does the asset allocation process work?

There are complexities involved with covering such a large investment universe. Here the asset allocation process is key and since the inception of the strategy in 1998, we have followed the same asset allocation process. Ultimate responsibility lies with the two portfolio managers for the strategy, but it is very much a group decision based on key inputs from a number of teams. We incorporate guidance from our Portfolio Strategy Group, which meets regularly to discuss our views on the economic environment and fixed income markets. We also draw on the views of the Risk and Quantitative Solutions Group on asset class risk and portfolio construction.

Discussions primarily revolve around relative value across the investment universe based on the analysis of the high-yield and EM debt teams. The key objective is to find different signals and opportunities across both asset classes by paying close attention to not only spreads, but also fundamentals and other technical conditions.

To gain greater insights, the research analysts and portfolio managers travel frequently to meet with important stakeholders such as companies, central bank staff members, politicians, bankers, regulators and industry leaders. We also take into account the judgments of industry analysts looking at corporate high-yield bonds and the insights of sovereign analysts across EM debt.

This collaborative process creates a rich body of information that we can draw upon and determine how to position the portfolio. Once a decision has been made to adjust allocations across the asset classes, changes are executed either by shifting our cash levels or selling bonds. However, allocation adjustments are strategic decisions and are not tactical moves over a short timeframe.

Our research ideas and investment judgments tend to be more thematic and have a longer investment horizon, as we do not believe we have an information advantage in anticipating short-term sector or market developments. Consequently, allocation changes are more gradual as we believe the cost and disruption involved with shorter-term trading decisions are incompatible to us our clients’ needs.

GHIO boasts an impressive track record in terms of driving returns from bottom-up investment returns – what has been the fund’s key success driver?

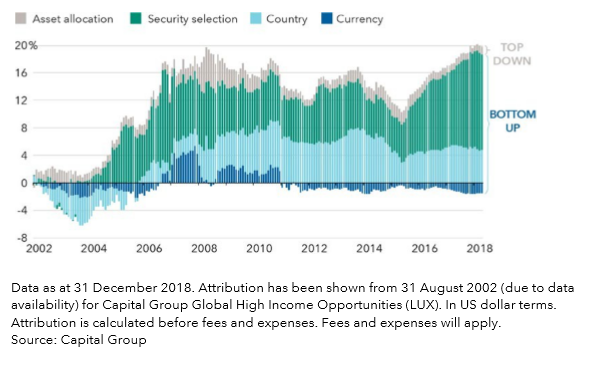

Since the fund’s inception, credit decisions have been the dominant contributor to excess returns. Consistent, premium security selection can only be achieved by creating a conducive process that promotes constant sharing, discussion and generation of ideas.

Markets have changed drastically over the past 20 years. The number of investable countries has increased from around 20 to 70. EM debt is just as diverse, and there is now a huge selection of local currency-denominated bonds.

With a continually evolving market environment, the skills required to be successful have remained the same. Good credit decisions will always be a function of quality research. The fund is able to rely on two groups of analysts that are separately dedicated to corporate high-yield bonds and EM debt and collectively are able to provide insights across high-yield corporate bonds, EM fixed income, hard currency bonds, local currency corporate notes and index-linked bonds.

Unlike at most other firms, our analysts manage money directly within client portfolios. The analysts are constantly feeding ideas into the investment process through frequent discussions. Sharing insights across such a wide variety of subasset classes is one of our competitive advantages as a company. Such discussions encourage analysts to discuss investment themes and challenge one another’s assumptions.

This dynamic investment approach, focusing on fundamental, bottom-up analysis, is the cornerstone of the fund’s long-term success and has been instrumental in allowing us to add value through security selection rather than asset allocation, a characteristic that we believe offers greater scope to deliver consistent, attractive returns.

1. Refers to Capital Group Global High Income Opportunities (LUX) 10-year average annual distribution income of 7.7% over the period 31 December 2008 to 31 December 2018. Source: Capital Group

2. The inception of Capital Group Global High Income Opportunities strategy was 31 May 1998.

3. The inception of Capital Group Global High Income Opportunities (LUX) was 7 May 1999.