When volatility causes complexity, how can wealth managers create opportunity?

Today’s investors are voting with their feet, willing to change advisors and add new relationships, while searching out the products, services and advice they need to make sense of an increasingly complex investing world. That insight is one of the more surprising findings to come from the 2023 EY Global Wealth Research Report.

Conducted during a period of exceptional volatility, the results show that far from consolidating assets, clients are increasingly willing to spread their portfolios across several providers. Investors are attempting to safeguard their wealth by transferring their assets to a provider capable of delivering better investment performance and diversifying their portfolio. As these investors seek better investment options, advisors are facing the challenge of meeting complex client demands while keeping up with the fast-paced financial innovation and accelerating technological transformation to stay ahead of the competition.

Investors’ fundamental goals, meanwhile, remain defensive: They’re less focused on creating purposeful legacies than they were during the pandemic. Yet clients reveal a growing appetite for advice and support, especially when it comes to new, complex investment products.

Report scope and results

The findings of the research are summarised in the full report. These draw on proprietary data obtained from a primary survey1 of more than 2,600 wealth management clients based in 27 key markets around the world. The report explores the implications of the often remarkably varied reactions of clients in different regions, of different ages, of differing levels of wealth – and even of different behavioural traits – to the complex and increasing volatile market environment.

For instance, Millennial clients stand out for their heightened uncertainty over their financial health. As a result, the same group also demonstrates an above-average appetite for advice and education, coupled with a greater willingness to try new products. Furthermore, younger investors are more likely to shift their investment approach at short notice – often switching to new wealth management providers altogether.

But the report doesn’t only examine shifting investor views. It also takes a close look at the actions wealth managers can take to transform their own activities in response. These range from initiatives, like harnessing artificial intelligence (AI) to maximise the value of multi-channel client interactions, to more fundamental changes such as pivoting from a “one-stop shop” strategy to an ecosystem approach based on performing a specialised, differentiated role in collaboration with others.

Three areas of focus appear

1. Navigating complexity

In “navigating complexity,” we look at how different cohorts are reacting to uncertainty and complexity. We also explore the opportunities for providers that can develop a strategic approach to providing more personalised, meaningful support, so clients are empowered to take control of their financial futures.

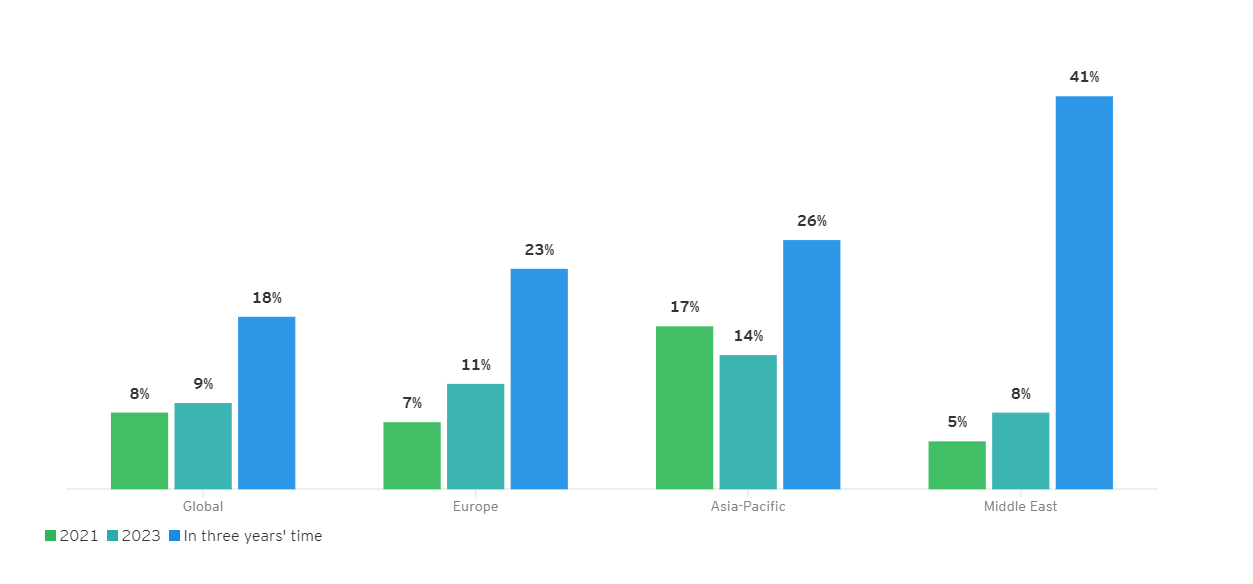

The proportion of clients working with FinTechs to manage their wealth is expected to double from 9% to 18% over the next three years – attracted by the sector’s low charges, specialised digital experiences and low-friction switching. That growth is expected to be even more dramatic in Europe (increasing from 11% of clients to 23%), Asia-Pacific (14% to 26%) and the Middle East (8% to 41%).

Historical and projected usage of FinTechs

A bar chart showing the historical and projected usage of FinTechs from 2021 through 2026 across Global, Europe, Asia-Pacific and Middle East, with usage in the Middle East expected to grow exponentially, from 8% in 2023 to 41% in three years' time, while in Asia-Pacific the projection is 26% in three years' time, 23% in Europe in three years time' and 18% globally in three years' time (compared to 9% today globally).

2. Empowering clients

In “empowering clients,” we look at the need for a step-change in personalisation, and examine how wealth managers can enhance their hybrid engagement models: Harnessing innovative digital collaboration tools and offering a seamless, omni-channel combination of self-service interactions, virtual engagement and traditional in-person advice.

Client appetite for virtual advisor interactions has been transformed since the pandemic. In our 2021 survey, just 12% of clients identified virtual consultations as their preferred advice channel; this figure now stands at over 40%, becoming the most preferred channel for planning and advice activities.

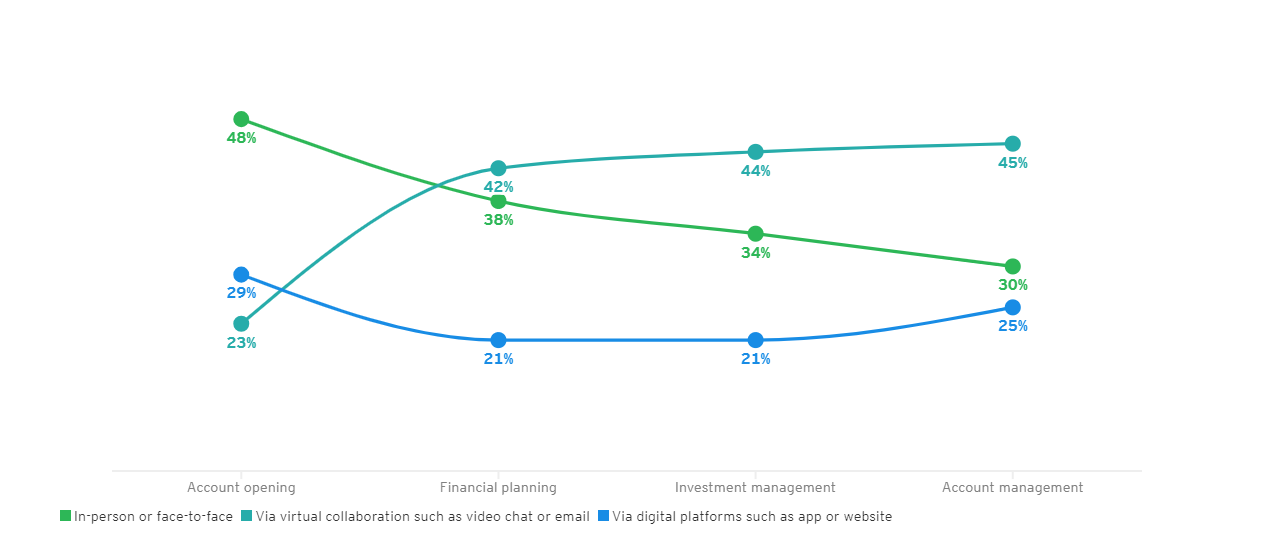

Preferred engagement channels clients want to interact with a wealth management provider during each investment lifecycle

A chart showing the preferred methods of interaction (in-person, virtual collaboration and digital platforms) across account openings, financial planning, investment management and account management. In-person is the most preferred method for account opening, at 48%, but that drops to 30% for account management. In that category, virtual collaboration is most widely sought with 45% noting it as their preference. Digital-only platforms such as an app or the website are least preferred for financial planning, investment management and account management.

3. Delivering value

In “delivering value,” we compare clients’ levels of satisfaction with new asset classes such as private markets and digital assets with those of traditional investment products such as actively managed funds. We also look at the improvements that wealth managers can make in product deployment, education, tax and succession planning – along with clarity over charges – in order to develop more compelling value propositions.

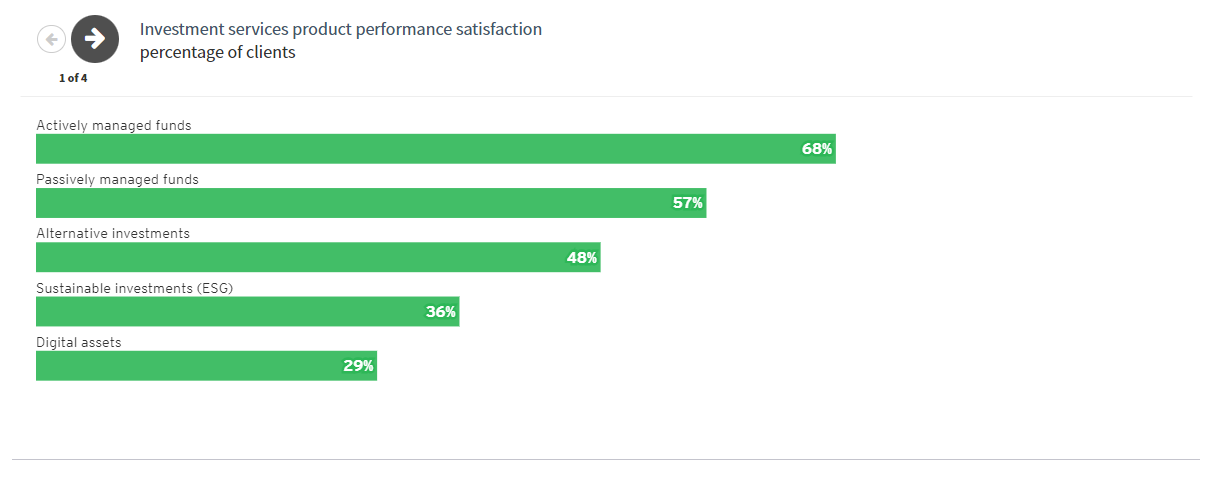

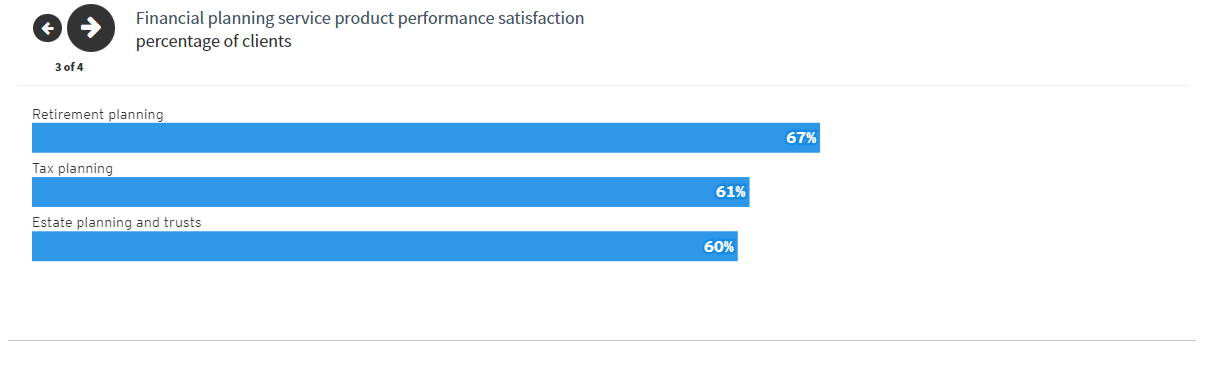

While 85% of clients are satisfied with their level of access to products, satisfaction with performance of different product categories varies significantly. There is an opportunity for providers to improve satisfaction for innovative investment asset classes, foreign exchange and financial education.

A chart showing percentage of client satisfaction across different products/services including investment services, banking and insurance, financial planning services and specialised services. The study found that 68% of clients are satisfied with the investment services product performance of their actively managed funds, but only 29% of those clients are satisfied with the performance of their digital assets. Banking and insurance clients rate their satisfaction with health and life insurance at 63%, while that drops to 47% for foreign exchange services. In the financial planning service product performance category, 67% of clients are satisfied with their retirement planning services, dropping to 61% for tax planning and 60% for estate planning. Lastly, in the specialized services category, 54% of clients say they're satisfied with their private healthcare services, while only 37% say they're satisfied with their concierge/luxury services.

The research suggests that the exceptional circumstances of recent quarters may be creating more competitive opportunities for wealth managers than at any point in recent years. At the same time, providers face a growing, interlinked set of challenges – including a challenging combination of eroding wallet share and increasing client expectations.

Seizing the opportunities provided by this moment of flux will depend on wealth managers’ ability to differentiate themselves – building satisfaction and value by empowering clients to achieve their goals despite the increasing complexity they face.

EY were Platinum Sponsors of IMpower 2023. Find out more about the event here >>

References

- Conducted during October and November 2022

*Originally published on EY.com