Following the advent of growing fiduciary regulation, and the rise in the transparency and ESG agenda, I recently reflected on the significance of my professional institute's motto: 'My word is my bond'. What that means has been carefully stipulated into various codes and professional standards to measure one's self by on a day to day basis (as much anyone can). Fiduciary has also been expanded into society and environmental level through industry initiatives like UN Principles for Responsible Investment (PRI).

But, can this be digitalised?

Fiduciary certainly goes well beyond selecting the cheapest passive fund and leaving it there for 25 years. However the very concept of fiduciary could be more transparent, for example does an investor require a human to offer a fiduciary service or indeed to be a fiduciary fund selector?

Legally yes but then the law has long lagged technology and science. That's not the question for today; rather could computers act in a fiduciary manner? Before we regress into a pre-programmed negative response, consider that humans litter history with malfeasance; the polar opposite to fiduciary, to act 'uberrima fides' (in utmost good faith) the key basis of insurance and banking contracts from hence most of the modern fund management industry grew. Madoff, Arch Cru, boiler rooms, LIBOR-rigging, flash boys and so on.

Alas technology has been an instrument of poor practice and will increasingly be so in future. However that is the consequence of human hands not computers. Computers are not predisposed of wrongdoing only programmed to do so, a thought for the rapid proliferation of RoboAdviser platforms. With the rise of robots, the battle for white collar roles has begun. Robots have already won the blue colour space which requires physical interaction. White collar roles by and large have little physicality to overcome, lots of talking, thinking, writing reports, drinking coffees. Martin Ford's book 'Rise of the Robots' captures the bleak outlook for white colour professionals. The second digital age if you will. Visions of 'WestWorld' sensationalise the at times quiet and not so quiet digital revolution. The asset management industry ('the City') is actually one of the last bastions of human industrial intensity, be it actuaries, fund managers, consultants or professional fund investors and the myriad of pseudo executives and support staff in between. A quick visit to LinkedIn tells the story.

"the hurdle machines have to cross to out-perform humans with college degrees isn't that high." Martin Ford, Author 'The Rise of the Robots'.

“The end game scenarios seem kind of severe. From here on in, it’s really, really, really going to change and it’s going to change faster than we can handle.” Matt Beane, MIT, '5 White Collar Jobs Robots have Taken', Forbes Feb 2015

The truth is that our industry has controlled the capital, funding technology progression, we are somewhat conflicted to see digitalisation usurping our own roles. Questions:

- If no conflict exists then why do we have so many humans involved?

- Is our capacity to act legally, in a fiduciary way, replaceable with technology?

- What advantage do we human beings place on being better at performing certain functions?

What does being a fiduciary require? Empathy, diligence, determination, trustworthiness, expertise, judgement. Putting the investor before yourself. These may seem all-too-human and a realm beyond digitalisation yet when Google's DeepMind AlphaGo program beat South Korea's Lee Se-dol 4-1 in the first of a series of games in Seoul in Mar 2016, then the concept of learning and adaptive artificial intelligence ('AI') took a huge step forward.

How AI overcame Go

Firstly rewind back to IBM's 200 million board positions per second Deep Blue computer, which challenged then reigning world chess champion Garry Kasparov in 1996. In a six-game match played in 1996, Kasparov prevailed but a year later lost dramatically. Over 2500 years old, in terms of rules, Go has considerably simpler rules than chess. Black and White sides each have access to black and white stones on a 19 by 19 grid. Once placed, stones don’t move. The aim of the game is to completely surround and capture opposite stones, which are then removed from the board. Here the complexity and artistry arises—organic battles from the corners to the centre of the board. Given that a typical chess game has a branching factor of about 35 and lasts 80 moves, the number of possible moves is vast, about 35 to the power of 80 possible moves, aka the “Shannon number”. Go is much much bigger. With its breadth of 250 possible moves each turn, and 150 likely moves, then there are about 250 to the power of 150 possible moves.

"What is noteworthy is that AlphaGo’s algorithms do not contain any genuinely novel insights or breakthroughs. The software combines good old-fashioned neural network algorithms and machine-learning techniques with superb software engineering running on powerful but fairly standard hardware.. the heart of the computations are neural networks, distant descendants of neuronal circuits operating in biological brains. Layers of neurons, arranged in overlapping layers, process the input.. and derive increasingly more abstract representations of various aspects of the game using something called convolutional networks." Christof Koch, March 19, 2016, Scientific American.

In many ways the computations of a fund selector are far more complex than Go stratagem but the small judgemental biases are similar. Asset allocation, over and under weighting assets against a 'neutral', giving rise to tactical positions, have their very root in war strategy and hence Go. Of course fund selection is neither science nor art, it combines fuzzy logic with data inputs into a decision. Those biases can have both intended and unintended consequences, welcome and less welcome outcomes. The underperformance and survivorship bias among great swathes of fund managers points to the need for some sort of logic but one that perhaps eludes many. Is the human condition the weak link?

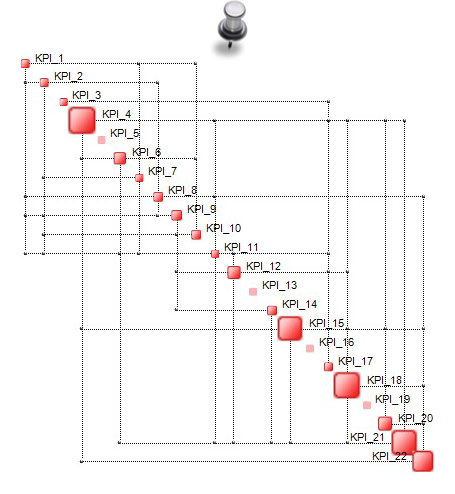

Imagine if fund selection can be derived from software: a neural network computing program that can screen thousands of funds and make judgements, shortlist recommendations, assess suitability and compatibility against a mandate or investor needs and monitor the outcome of those decisions, all the while underwriting the capability of a fund manager based on a model, new information and past data, recommending changes while simultaneously weighing the impact to the portfolio and topical metrics like turnover, cost. Performance analysis has already been digitalised, other types of information can be stored and used for learning, algorithms can replicate judgemental nudges and biases based on common material changes like manager experience, tenure, benchmark, fund changes, moving firm, news flow and so on. In many ways software can far better interpret the signals, their significance needs to lay a good starting baseline and self-learning. In many ways the components already exist as separate Fintech; it simply needs a complex adaptive algorithm to link it all together. Perhaps a framework like Ontonix for example (see below).

The other challenge is the retention of experience, digital wisdom if you will. Here AlphaGo solved through coupling self-learning with a differentiable neural computer (DNC). Memory requires memory, literally. "The DNC architecture differs from recent neural memory frameworks, in that the memory can be selectively written to as well as read, allowing iterative modification of memory content." according to its developers. The DNC then uses three distinct forms of differentiable attention. The first is content lookup, the second records transitions between consecutively written locations and the third allocates memory for writing. All mind-bending stuff for a mere fund analyst!

Of course computers can be clever, yes, but have no inherent sense of self, humanity or fiduciary at creation. The first obstacle (or perhaps safeguard) is the absence of consciousness. The second is no morality. How then can Robo-selectors put the client above all others? If you conclude that either the human experience carries an unassailable premium or that computational algorithms can never encapsulate what it means to be fiduciary then perhaps solutions yet lie in human network platforms, the wisdom of the crowd. Collating and computing based on the shared experience of hundreds or even thousands of other fund selectors could be powerful. Consider that digital does not need to better the human experience; simply delver a comparable outcome that is devoid of illogical biases, consistent, reactive, impervious to influence and marketing to make objective decisions. If on the other hand you believe that the concept of fiduciary lies in a hierarchy of needs, rules and protocols, then these could potentially be digitalised.

"One thing wealth managers and financial advisers may want to bear in mind before enthusiastically advising clients to invest in robotics is that it would be the equivalent of turkeys voting for Christmas if robots are developed which can manage money successfully on a discretionary basis." Alex Sebastian, Portfolio Adviser, 13 November 2014.

A Fiduciary Algorithm?

Firstly Robots follow 3 guiding laws: the Three Laws of Robotics ('Asimov's Laws') devised by the science fiction author Isaac Asimov. However they have come to b fundamental guiding principles for the Robotics industry and do too should they apply to the fiduciary Robo-Adviser and Robo-Selector. The rules were introduced in his 1942 short story "Runaround". The Three Laws, in the "Handbook of Robotics, 56th Edition, 2058 A.D.", being:

- A robot may not injure a human being or, through inaction, allow a human being to come to harm.

- A robot must obey the orders given it by human beings except where such orders would conflict with the First Law.

- A robot must protect its own existence as long as such protection does not conflict with the First or Second Laws.

The fiduciary duty falls initially to the programmer of the algorithm that instructs the programme to make decisions. Taking these laws it is not unfathomable that computers can be programmed to put the interest of the client first and foremost to;

- Uphold a fiduciary standard and all conflicts of interest must be disclosed. A computer has no conflicts unless they are first programmed. Like a driverless car its' function is to serve the purpose without question.

- A fiduciary has a “duty to care” and must continually monitor not only a client’s investments, but also their changing financial situation. A computer can monitor 24/7 continuously and is not restricted by fatigue or the adviser/fund selector's diary. A sequence can be included if the client does not supply an update within x days or could be linked to the client's accounts, email, diary and so on.

- Understand changes to a client’s risk tolerance, perhaps after a painful bear market. Perhaps there was a family change. Under the suitability standard, the financial planning process could begin and end in a single meeting. For fiduciaries, that first client meeting marks only the beginning of the legal obligation. We have seen the term 'orphan clients', and humans have a great track record of dropping less profitable clients (value pools).

- Monitor, adapt, assess fund changes. The reality is that many fund investors do not monitor their decisions often enough or with objectivity. They are susceptible to heuristic biases. Yet a computer can continuously monitor cost, turnover, risk, changes and performance. It can monitor RSS feeds, performance, fund manager commentary, portfolio positions, information supplied by the client, instructions, deal flow, thousands if not millions of data points analysed through neural networks.

From the above the algorithm can include a core hierarchy of neural paths and decision trees: Efficacy of active management versus benchmark/passive based on a learning empirical algorithm and relative valuation of index momentum, the carbon impact of a portfolio, the environmental, social and governance score of the fund and underlying stocks, Stewardship score, economic value comparison of available universes and fund structures, risks relating to the firm like fines or corporate restructures, rating changes, flow data, people changes, process issues, significant portfolio turnover or positioning changes, risks, performance issues, ongoing costs. From these broad sections the algorithm can create thousands of rules, rankings, logic maps and decision points driving to further questions or a BUY, HOLD or SELL decision. More importantly a self-learning function refines and redefines the algorithm consistently. I have often wondered if I, and other fund selectors, were put in a lab and tested then could our shared experience be digitalised?

“It doesn’t matter what is out there. Judgment, skill and expertise is always going to be necessary and I don’t think you can put all that into an artificial intelligence solution.. you can definitely gain tremendous benefit from artificial intelligence and its development. That will be complementary with active managers. I don’t think one necessary replaces the other.” Kai Sotorp, chief executive of Manulife Asset Management. FT, June 26, 2016, by Attracta Mooney.

For example the software could observe a sector change, fund renaming or fund merger. It can automatically send an email to a fund manager or obtains an E due diligence questionnaire (E-DDQ) in realtime from the growing number of digital information warehouses. In many ways the steps taken by fund selectors are rules-based but the implementation by Robo can be faster, more efficient and more objective. Software does not have to sleep, play golf, or spend time with the kids. Currently the Securities and Exchange Commission is increasing its scrutiny of “reverse churning.” As more advisers and wealth managers move their compensation toward annual fees, the human incentive has shifted from doing excessive transactions (churn) to generate commissions, towards doing less for a fee.

Go, No-Go?

The move towards more fiduciary transparency is an important step towards digitalising it and indeed Robo-selection. The danger is that self-learning AI itself compromises the fiduciary obligation to the investor and it is here where Asimov's laws need to be hardwired and continuously measured. The other challenge is storing learning and experience, an issue among humans that Nicholas Taleb flagged in 'Black Swan' and perhaps AlphaGo's DNC can solve. Perhaps the answer is more symbiotic than we might be led to believe. A third way? If you feel the notion of digital fiduciary is still more science fiction than threat then you may be right. We can at least counter the progress of technology at becoming better cyborgs, to use technology, to use the cloud, the crowd, to generate positive fiduciary evidence for the value added by human fund selection. Robo is Go, your move!

JB Beckett is the author of #NewFundOrder and will be taking part in the panel discussion, Let's talk selection: implementing real change in the selection process at FundForum Asia 2017 in Hong Kong, 24 - 26 April.