Why portfolio analytics must evolve for today’s markets

Over the past decade, regulatory changes have fueled private markets’ growth, driving some portfolios into uncharted territory. Traditional risk models, premised on the transparency of public markets, aren’t sufficient to estimate the volatility of a portfolio that includes both public and private investments.

Volatility metrics typically extended through scenario modelling and forward-looking analytics must now be refined to capture the uncertainty associated with the convergence of public and private markets. This is essential for a comprehensive risk assessment as advisors and their clients navigate the complexities of blended portfolios.

New risk realities

Volatility still matters, but it’s only part of the story. As more portfolios include private and semiprivate investments, other types of risk are coming into focus that aren’t easy to measure with traditional tools.

Liquidity, for instance, is a big one. Products like interval funds are seeing a resurgence based on the perception that they offer flexible access. However, a closer look will often show restrictions that limit investor access. Advisors need to understand not just what a product promises, but how it behaves when liquidity is tight.

Valuation is another growing challenge. In public markets, you can usually count on consistent pricing data. But, when it comes to private assets, pricing updates can be infrequent, methodologies vary, and data points can be patchy.

Private capital funds also report performance differently, often using internal rate of return instead of standard return metrics. Disclosure standards differ from one private vehicle to the next. This makes it difficult to compare private assets to public market investments.

Morningstar is developing tools to bring more clarity, incorporating factors such as redemption structures, gating histories, and liquidity event patterns, and leaning on proxy index data to estimate returns and volatility.

We make the invisible visible

Traditional stress tests assume things like continuous pricing and readily available historical data that aren’t always available when dealing with alternatives.

In practice, asset managers and advisors are left piecing together risk profiles from a patchwork of sources – PDFs, manager commentaries, sparse fact sheets. This fragmentation makes it challenging to gain insights or spot emerging risks early.

Morningstar is expanding coverage across vehicles and asset classes from private equity and venture capital to private credit and semiliquid funds, providing advisors data and analytics on approximately 1,000 private capital funds, 300 interval funds, and 80 tender offer funds.

Blended portfolios require new analytics

Fund taxonomies like the one developed by PitchBook can help bring order to the chaos by grouping funds into consistent, comparable categories. Morningstar is incorporating PitchBook private capital fund categories and adding new interval fund categories to our fund categorisation system.

Through this, we’ve developed a top-down Portfolio Composition framework to bring alternative exposures into sharper focus. This analytical view breaks the portfolio down by fund category to help advisors identify alternative strategies, and support portfolio construction aligned to client objectives.

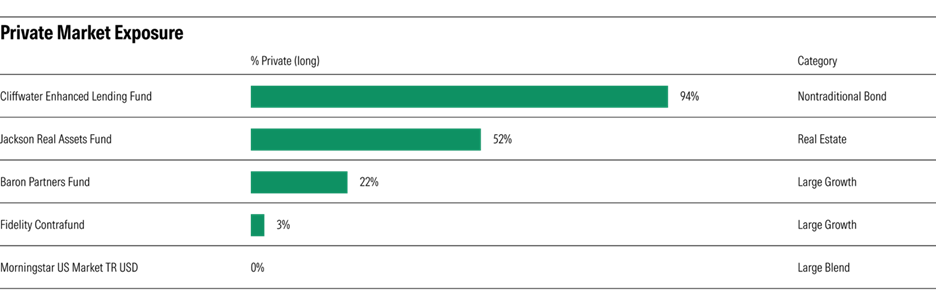

Plus, our new “% private” data point reveals the level of private market exposure in a fund or client account, rolling up all assets invested in private-capital funds and identifying at the holding level (when available) the percentage of assets invested in individual private equities, private real estate investments, and non-bank loans.

Private capital fund categories can support performance and risk analysis through benchmarking. When traditional data, like daily net asset values, isn’t available for a fund, these proxies are the next best option.

When clearly labeled and transparently disclosed, Proxy Returns can provide educated approximations in a data void, supporting informed decision-making in areas like performance and risk management. Morningstar has used PitchBook indexes to expand our Risk Model and Portfolio Risk Score to include private-capital, interval, and tender-offer funds.

The Portfolio Risk Scorecnow includes breakdowns of a portfolio’s “% Risk from Volatility” and “% Risk from Liquidity”. We infer the latter from adjusted private capital Proxy Return data for private capital funds and other fund characteristics and structure. This metric can help investors and advisors approximate how much liquidity risk they’re adding by venturing into semiliquid or private capital funds.

Real understanding is the first step

While many accredited investors meet the wealth or income thresholds, that doesn’t always mean they fully understand the intricacies of what they’re investing in – especially when it comes to private markets.

In complex portfolios, misalignment between expectation and reality can lead to unwanted surprises. Advisors, and the tools they use, play a critical role in making this step easier.

Frameworks that break down things like liquidity structures or risk exposure into plain, actionable insights can support better discussions and stronger client relationships. It's about creating alignment between what clients think they’re getting and what their portfolio delivers.

Resilient portfolios over reactive

Advisors and asset managers need to shift their portfolio construction strategies from reactive to resilient.

That means going beyond traditional volatility measures to:

- Provide rigorous but accessible private-asset liquidity and volatility risk metrics

- Use “next best” data when available

- Benchmark thoughtfully across relevant peer groups

We’re working with familiar tools in new contexts, where access may be limited and disclosures less consistent. Resilience here means not just reacting to shocks, but preparing for them with better tools, deeper data, and stronger client alignment.

Gain more insight into modern risk and how to adapt through Morningstar.