Inflation has dominated headlines in recent weeks. Here is a brief guide for explaining the current situation to clients, and tips on helping them navigate it with confidence.

What the numbers show us right now

The most common inflation benchmark is Consumer Price Index (CPI), based on overall consumer prices in urban areas.

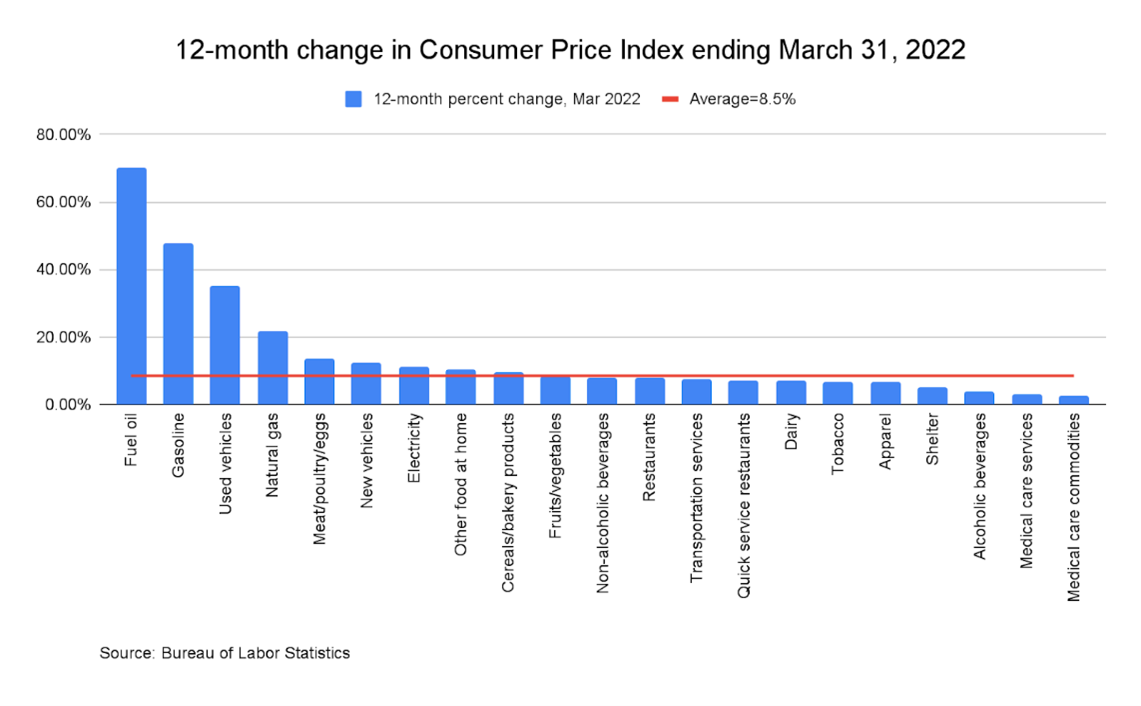

The CPI increased 8.5% for the 12 months ending March 31, 2022, compared to less than 2% in the two years prior.

Fuel oil saw the largest price increase, at 70%, followed by gasoline at 43%, used vehicles at 37%, and natural gas at 21%.

(Anyone who has filled up their gas tank, paid a heating bill, or shopped for a used car has seen this effect!)

The overall increase in CPI, and the news coverage devoted to it, is understandably top of mind for investors.

Financial advisors are in a unique position to help clients zoom out to address concerns and discuss what this means for them.

Here are five ways to do that.

Discuss inflation in personal terms

Because CPI is a national average, each household will experience inflation in different ways based on what they buy and where they live.

What to do: Discuss with clients how CPI is calculated, and point out that in addition to high-inflation categories such as gas prices and food, other categories like clothes, housing, alcohol, and medical care have seen lower inflation.

Why: Getting beyond the headlines and TV chatter helps clients gain context, and it lays the groundwork for decisions that are based in facts, not fear.

Help clients measure their true inflation rate

Advisors can go a step further and quantify inflation impacts.

What to do: Help clients compare their spending from a year ago to now in several categories. This can be done with integrated software that tracks your clients’ spending, or the client can look at bank and credit card statements.

If the client doesn’t have software that automatically tracks expenses, you can provide them with a spreadsheet template. This should include the categories used by the government to track inflation, such as food, housing, transportation, medical care, apparel, and recreation. The client can then fill in their expenses in each category.

Why: By looking at spending in these categories and comparing it to the prior year, the advisor helps the client get a more accurate picture of how inflation is affecting them personally.

This kind of knowledge will arm the client with more confidence that they have a true picture of how inflation is affecting them, and may make them less anxious and likely to demand significant changes.

Emphasize the long-term track record of capital markets

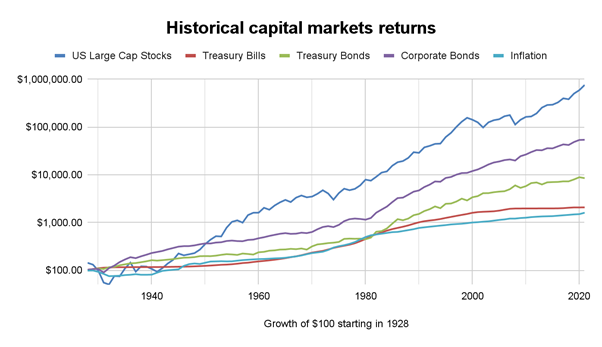

It’s obvious but always worth emphasizing: For a long-term investor to maintain her purchasing power through retirement (that is, staying ahead of inflation and managing taxes carefully), there is no wealth-building asset like stocks.

Historically, investors in diversified investment portfolios have outpaced inflation over most periods, with U.S large cap stocks, treasury and corporate bonds all outperforming inflation handily. Investing, instead of holding onto cash, is arguably the best way to combat the effects of inflation.

What to do: Share charts like the one below on historical returns to remind clients that their investment strategy is sound and will succeed over time, despite occasional hiccups.

Source: Aswath Damodaran, Stern School of Business at New York University

Why: Sharing data like this helps investors see the value of staying the course, and reminds them that drastic changes aren’t typically needed during downturns or periods of high inflation.

However, time horizons differ for each client, and require different approaches from the advisor. Hence the next tip:

Adjust for the client’s time horizon

Clients who have long time horizons are more readily able to harness the power of capital markets to combat inflation. For investors with shorter-term needs, however, inflation can have a considerable effect on the purchasing power of their assets.

What to do: For investors more sensitive to inflation, discuss the options of higher allocations to inflation-hedging instruments, covering both direct and indirect hedging tactics:

Direct hedge:

- Treasury Inflation-Protected Securities (TIPS). TIPS are bonds issued by the US government that provide for a total rate of the return that adjusts for inflation. Historically, they have similar positive real returns in both inflationary and noninflationary periods. As TIPS are backed by the full faith and credit of the US government, they have low credit risk.

Indirect hedges:

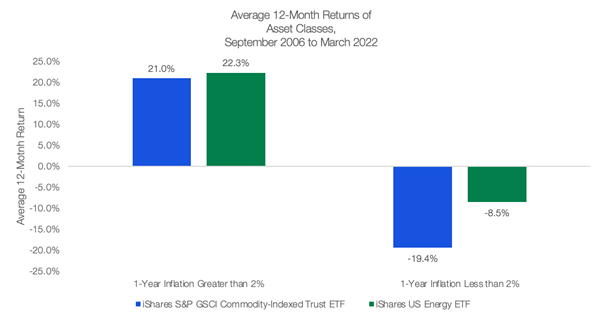

- Energy. The energy sector has typically outperformed other sectors in times of higher inflation.

- Commodities. Commodities ETFs track a broad range of commodity exposures including energy, metals, agriculture and livestock, which have historically outperformed when there is significant inflation, and have underperformed when there is insignificant or no inflation.

Source: Quandl/Federal Reserve Bank of St. Louis

Why: If an investor is approaching the distribution (retirement) phase of their life, incorporating a glidepath approach that includes these assets can provide peace of mind for those concerned with unexpected inflation.

Take advantage of technology

In recent years personalisation has become an expected feature of daily life. Think of how consumer services personalise your experience based on your specific preferences.

Wealth management is going through a similar shift. Innovations in technology now make it possible to seamlessly customise and reposition portfolios based on investor’s needs and specific situations. Explaining this shift in wealth management to clients — and making them aware of technology-driven tools that can optimise their portfolios — can reassure them that they are receiving the same personalised benefits in their portfolios that they receive in other parts or their life.

For example, Vise’s platform includes investment strategies that enable advisors and clients to pursue higher expected returns, and to customize their portfolios by weighting allocations toward favourable stocks, asset classes, and sector allocations.

What to do: Explain to clients how modern wealth management platforms offer greater access than before to nimble, personalised strategies, such as weighting portfolios toward industries and sectors that tend to perform better in an inflationary environment.

Why: Clients will feel reassured that they have access to technology that helps them optimize their portfolios during difficult periods, rather than suffering without recourse.

Inflationary periods are opportunities to demonstrate the value of your expertise. You can give clients historical context, help them better tune out the noise and understand their particular situations, and comfort them by demonstrating how they have best-in-class technology supporting them.

The end result: Deeper relationships with clients, and better positioning when the economic tide turns.

Find more expert insights on the wealth management industry here >>

Nothing contained in this article constitutes tax, accounting, regulatory, legal, insurance or investment advice. Neither the information, nor any opinion, contained in this document constitutes a solicitation or offer by Vise or its affiliates to buy or sell any securities or other financial instruments, nor shall any such security be offered or sold to any person in any jurisdiction in which such offer, solicitation, purchase, or sale would be unlawful under the securities laws of such jurisdiction. Images shown are for informational and illustrative purposes only, and may not reflect actual performance. Decisions based on information contained in this document are the sole responsibility of the advisor.

Vise AI Advisors LLC ("Vise") is an investment adviser registered with the Securities and Exchange Commission (SEC). Registration of an investment adviser does not imply any specific level of skill or training and does not constitute an endorsement of Vise by the Commission.

Copyright © 2022 - Vise