When the stock market dips, so does your stomach. You’re not alone:

70% of American investors are keeping money out of the market to protect it from loss.1

70% of American investors are keeping money out of the market to protect it from loss.1

50% of American investors believe they need to accumulate more to retire, but are too nervous to invest in today’s market.1

50% of American investors believe they need to accumulate more to retire, but are too nervous to invest in today’s market.1

Did you know? Inflation hit a 40-year high in 2022.2

Conservative investments like bonds may not offer the growth you need and keeping cash could actually be losing you money. Without the opportunity for a level of growth, you could risk outliving your investments.

Cash

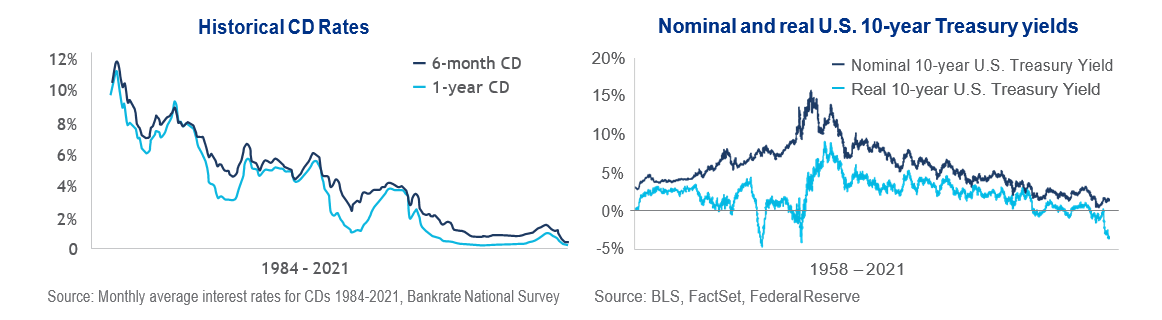

Despite recent rises in interest rates, savings tools like CDs, Money Market Funds, and traditional savings accounts still aren't earning very much.

Bonds

As interest rates rise, it makes existing bonds less attractive. Bond yields have been more or less falling since the 1980s, and once you consider inflation, your return is negative.

How Buffered EFTs Can Help

When building your portfolio, your financial professional worked with you to determine how comfortable you are with risks, and diversified your money to meet your needs. Now they’ve evaluated a new type of investment for your portfolio called a Buffered Exchange-Traded Fund (ETF), from AllianzIM.

AllianzIM 20% Buffered Outcome ETFs are designed to offer more predictability and risk mitigation against market dips from 0% to 20%.

The Benefits of Buffered ETFs

• Let you participate in potential stock market growth (up to a limit known as a Cap)

• Provide a Buffer against the first 20% of index losses if the market dips

• Rebalance at the end of each Outcome Period with a new Cap

• Can be held indefinitely in a portfolio for a long-term strategy

Designed To Help in Market Dips - Big and Small

Consider this: During the past 65 years, there have only been three years in which the negative returns of the S&P 500® have exceeded 20%.

Buffered Outcome ETFs may help you feel more comfortable during market volatility and keep you invested for the long haul.

If you are retired, they also help you take your Required Minimum Distributions and other withdrawals confidently, knowing you have some risk mitigation during volatile market swings.

Risk Management is in Our DNA

As part of one of the largest asset management and diversified insurance companies globally, Allianz Investment Management LLC maintains a long track record of developing and executing risk management strategies.

An Important Note About Allianz Buffer ETFs and Bonds

Buffered Outcome ETFs seek to track the return of a reference asset (benchmark index) to a cap while targeting a predetermined buffer against loss over an outcome period. The funds use FLEX options to gain exposure. Buffer ETFs carry equity risk, which has historically been greater than bond risk. In order to produce a positive return, Buffer ETFs need equities to rise. If the equities fall more than the predetermined buffer, investors risk a loss. Unlike bonds, Defined Outcome ETFs cannot rise when equities fall.

Unlike equities, bonds pay coupons and their returns are not directly tied to the equity market. The price of a bond does not need to increase for an investor to profit. In addition,

the price of bonds are affected by supply and demand. As a result, bond prices have historically risen when equities have fallen as investors seek safety outside of equities. Bonds have maturity dates at which point principal must be repaid or a default occurs. Bonds are higher in the capital structure than equities and therefore carry significantly lower risk of loss.

In addition, Buffered Outcome ETFs do not provide income which is the typical investment objective of bond funds. The underlying options provide exposure to the price-return of their respective reference asset and therefore investors do not receive dividends or investment income through an investment in a Buffer fund.

Find out more about Wealth Management EDGE here >>

- Allianz 3Q 2021 Quarterly Market Perceptions Study, an online survey with a nationally representative sample of 416 respondents age 18+ with $200k+ in investible assets.

- U.S. Bureau of Labor Statistics (2022 February 10), Consumer Price Index.