Impact investing has a simple definition: Investments made with the intention to generate positive measurable social and environmental impact alongside financial returns.

Still, some confusion around impact investing continues to exist.

What is Impact Investing?

Ethical investing though as old as investing itself shaped into a separate asset class relatively recently.

In its simplest, broadest form it is negative screening, or simply excluding certain types of investments that are considered bad for society on the basis of “do no harm”. Investing with ESG integration looks deeper into whether the company is a responsible participant in society. When combined with positive screening, deploys capital to solve a particular environmental or societal problem on the basis of “do good” supporting transformational leaders within respective industries; also known as sustainable investing.

Impact investing is an investment strategy that goes beyond the above in both depth and width. It is a holistic approach aiming to achieve efficient allocation of capital to products and services that can have significant measurable net positive outcomes on people’s life and/or the planet, while also yielding market-rate financial returns.

There is a general agreement today that impact investing strategies can come hand in hand with financial returns. Impact investing has experienced constant growth to reach an estimated market size of USD 715 billion in 2020.

A major hurdle to the continuing development of a high-functioning impact investing market and attracting a larger investment community is the lack of a widely agreed measurement framework that caters well for different asset classes. This leaves the broader industry open for impact washing and other forms of easy-way-forward practices that can undermine the entire asset class. Standardisation of the impact measurement approaches for specific asset classes can be very beneficial for the industry and will streamline more capital toward impact-driven investments.

Within impact investing VC stands out as one of the most direct ways to be involved in the sustainable transformation of our society.

The role of a VC is much more than providing capital and monitoring the results, which is often the limit of traditional asset classes. Venture capital investors have direct and close contact with entrepreneurs. They might play a pivotal role in embedding an impact company mindset at a very early stage and driving positive change throughout the investment period. In that sense, engagement is a continuous process and not a separately reported effort.

Disclosures and reporting to investors are already frequent, detailed, and direct. As such the focus of regulatory framework development around transparency and disclosures (e.g. SFDR) is less relevant for protecting investors in venture capital. They might even hamper true-to-style impact VCs investing in transformational opportunities with longer-term material impact.

Being able to measure and manage impact on both company and portfolio level is of special importance in this space where widely agreed impact metrics do not yet exist.

Developing a robust, comprehensive impact measurement framework is a key to success for impact VCs.

Theory of Change: A steering tool for capital allocation and stewardship

A coherent, consistent practice of high-quality impact measurement and management must be implemented at the core of all impact investors seeking to understand and improve their actions. Effective measurement and management of impact data is essential if investors are to know whether they are actually achieving the outcomes they seek.

The Theory of Change framework is a logic 5-step model that streamlines the processes for investors to translate their impact intentions into real impact results. It provides structure and progress indicators to measure success.

It serves as a steering tool for impact investing both in capital allocation and stewardship during the period of investment.

Alignment with the SDGs — using global language to communicate impact goals

The UN Sustainable Development Goals are a set of globally agreed impact goals and probably the world’s largest change project ever. Although designed for (supra-) national policy-making, many investors including VCs align their impact measurement frameworks to the SDG framework to essentially use global language to communicate and validate their impact goals.

The framework includes measurable indicators for each SDG but not all of them are applicable at the micro or business level. Platforms, such as IRIS+ of the Global Impact Investing Network, try to bridge the deficiency in relevant indicators through thematic selections from other databases and science-based research. IRIS+ aligns its themes with the SDGs too.

Urban Impact Ventures: Our impact framework

Our approach to impact measurement and management levers on our proprietary SDG-aligned impact framework.

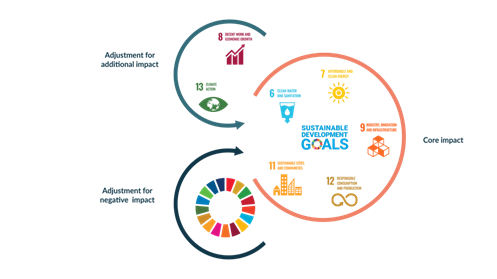

With that framework, we intend to capture both material positive and material negative impacts alongside all SDGs. We set specific targets per company derived from its Theory of Change for the average holding period of 5 years with a focus on the most relevant SDGs for sustainable urban transformation: SDG 6 — clean water, SDG 7 — clean energy, SDG 9 — innovation and infrastructure, SDG 11 — sustainable cities, SDG 12 — responsible consumption and production.

In addition, for each portfolio company, we capture 2 cross-dimensional SDG’s (SDG 8 — decent work and economic growth, SDG 13 — climate action) that we deem relevant for all our investments independent of the underlying urban investment theme.

Our impact performance over time is aligned with our carry entitlement resulting from the financial performance that we realise for our investors; a potential malus on the managers’ carry entitlement will still impact society through a dedicated foundation supporting local urban projects with grants.

UIV’s Impact Measurement Framework

UIV’s Impact Measurement Framework

Additionality of Impact: A further challenge

A major challenge for impact investing is the inability to claim and verify the additionality of impact generated per every new investment. Additionality is what has been generated as a positive outcome by a specific investment on top of what other external contributing factors provide for at that same time instant. Furthermore, many investors tend to focus exclusively on the positive impact generation, ignoring any negative impact generated by the business activity. Responsible impact investors should look through the “net positive” lens when estimating the impact generation potential of their prospective investments.

Overall, the industry must deliver many more success stories and further prove that making a profit and doing good for the planet and people should be the new normal in investing.

Urban Impact Ventures is a Dutch impact venture capital investor on a mission to improve urban quality of life in Europe. We support entrepreneurs that contribute to the sustainable transformation of the urban environment, with a focus on decarbonisation and circularity.

Urban Impact Ventures is a Dutch impact venture capital investor on a mission to improve urban quality of life in Europe. We support entrepreneurs that contribute to the sustainable transformation of the urban environment, with a focus on decarbonisation and circularity.

To find out more contact us at info@uiventures.com

This article was originally published on Urban Impact Ventures blog

Learn more about IMpower Incorporating FundForum 2023 here >>