Seeing green: Tailoring distribution strategies to the evolving sustainability landscape

Responsible investment is now a permanent fixture in any news and analysis of European fund distribution – but not only due to its popularity. As sustainability considerations become more deeply embedded in the asset management industry, available taxonomies continue to grow in number, further fragmenting ways of doing business – such as the upcoming Sustainability Disclosure Requirements (SDR) in the UK – or seeking to offer a more globally comparable framework – such as the recently issued standards from the International Sustainability Standards Board (ISSB). All of this adds more layers to the decision-making process around pan-European distribution strategies.

Local appeal

Even within existing and upcoming regulatory frameworks, there is another factor asset managers need to consider when positioning their responsible-investment propositions: Client demand. Different client types and markets express different needs when it comes to the intensity of ESG appetite, which can inform asset managers about the most suitable product offerings and marketing requirements.

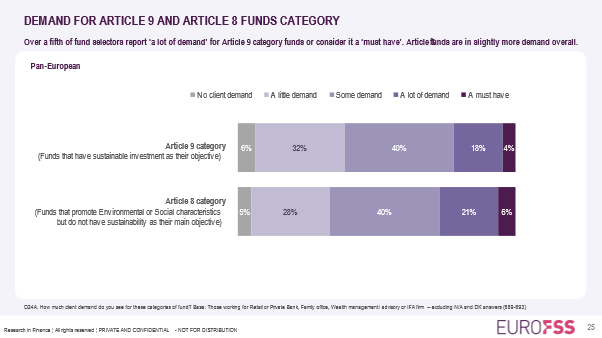

The recently published results of wave 2 of Research in Finance’s European Fund Selector Study (EuroFSS) highlighted robust retail demand across all markets studied for both article 8 and article 9 funds, the ‘lighter green’ and ‘darker green’ products falling within scope of the EU’s Sustainable Finance Disclosure Regulation (SFDR).

The highest levels of interest stem from Benelux, France and Germany. Taking the article 8 category as an example, 41% of respondents in Benelux said that they see either a lot of demand for such funds, or that they are a ‘must have’ – the highest proportion of any market. However, focussing purely on ‘must have’ responses, France leads the field, with 16% of respondents claiming it is essential.

At the other end of the scale, very few selectors say that they see ‘no client demand’ for article 8 funds; the only markets where this accounted for more than 5% of responses were Spain (10%), the UK (8%), and the Nordics (7%). Responses from institutional respondents also varied by market, as explored in a previous article “How can European asset managers meet fund selectors’ needs in the current climate?”.

The SFDR categories – especially article 8 – may be subject to further enhancements to their rules to clarify required disclosures, and further alleviate any concerns of greenwashing. However, whether an asset manager aims for the more stringent article 9 categorisation or is happy to settle for article 8, both categories are clearly currently enjoying a healthy uptake – albeit more so in some markets than others.

A range of routes

Considering both regulatory divergence and variances in local investor appetite for sustainable investments, there is no ‘one size fits all’ approach to adapting distribution strategies to sustainability requirements. That is borne out in practice, with asset managers taking various routes to providing responsible investments.

Some of these approaches were explored by participants in a panel chaired by Research in Finance at Fund Forum this year. While responsible investment considerations are critical for all asset managers operating in Europe these days, some groups have opted to place sustainability at the heart of their brands. Candriam is one such example, striking sponsorship deals with organisations that share its commitment to sustainability. Columbia Threadneedle Investments spoke of its decision to apply a conservative interpretation to sustainability regulations to ensure a robust application of related practices, as well as being well positioned for rules to be reshaped and tightened further in future. Meanwhile, PIMCO highlighted that it tailors the intensity of its sustainability offering in accordance with client needs, to ensure that they are getting as much or as little exposure as desired.

If you would be interested in learning more about how demand for sustainable investments varies across markets and client types, as well as the brands held in highest regard by European fund selectors for responsible investing, please get in touch with Research in Finance for a discussion of the headline findings from the latest wave of EuroFSS.

Research In Finance was a Silver Sponsor of IMpower 2023. Find out more about the event here >>