AI and Machine Learning: Moving from Pilot Program to Pragmatic Transformation

When implementing new technology into long-standing practices, sometimes it's incredibly worthwhile to reflect on the journey you have created doing so. This is exactly what BrownBrothersHarriman (BBH) has been doing. Kevin M. Welch, Managing Director, Investor Services explains.

When implementing new technology into long-standing practices, sometimes it's incredibly worthwhile to reflect on the journey you have created doing so. This is exactly what BrownBrothersHarriman (BBH) has been doing. Kevin M. Welch, Managing Director, Investor Services explains.

For most companies, the pursuit of artificial intelligence (AI) solutions often focuses on two goals: reducing costs and driving efficiency. These are noble pursuits, and surely COOs who bring projects to their board with cost and efficiency in mind receive praise. Focusing on these goals alone, however, may be ill advised.

The path to delivering true, lasting value is through harnessing intelligent automation that can act as a catalyst for end-to-end operational change. The goal, then, is not just building a slightly better version of an existing tool or process; it’s about creating an entirely new way to operate.

This approach — what we call pragmatic transformation — still has cost reduction and efficiency at its core, but it has the potential for a much greater impact.

How did we get here?

Like many in our industry, BBH has spent a considerable amount of time exploring how AI and machine learning can enhance the back and middle offices.

Based on our experience using robotic process automation (RPA) to automate discreet business processes, there was a natural evolution toward combining RPA with AI. After many iterations, we launched two AI and machine learning initiatives and the lessons we learned from our experience were profound.

In creating the framework for AI, we went through an operational metamorphosis, emerging with new processes, controls, and buy-in from stakeholders spanning the entire business.

We could also be introspective about some of the bigger themes that are shaping our business and our industry: operational efficiency, design thinking, agile project management, the future of work, employee roles and skillsets, and enterprise communication, just to name of few.

As we reflect on our own AI journey from pilot program to pragmatic transformation, we’d like to share three success factors that helped us achieve our goals.

Success factor 1: Invest in business problems, not AI

It’s clear that the big question for our industry is not “if” or “when” to invest and apply AI, but “how.” As we looked to implement AI, we learned that selecting the right use cases was crucial; but too often firms focus on an exciting technology solution without actually considering what it’s solving for.

This, of course, is easy to do, especially as firms establish innovation labs that aren’t fully entrenched in each business line. The first step for us was identifying a real business problem.

Consider an AI solution we created for our fund accounting business. In 2017, we had nearly one million “miscellaneous” cash wires flow into our accounting platform. Each one needed to be manually coded, researched, and resolved.

As you can imagine, this was an onerous task, requiring significant manpower and, more importantly, time. To solve this issue, we developed LINC (Language Identification Network Center). LINC uses natural language processing in a supervised machine learning framework to categorize cash breaks, while making recommendations to operations specialists. The machine does this by recognizing words contained in wire transfer text, and the algorithm then codes the description.

The result: 95% of entries are automatically coded compared to 65% before we deployed the solution. The second phase of this is moving beyond coding the exceptions to teaching the machine to resolve the breaks. This is where training is crucial. When teaching the machines, we need to ensure unconscious biases don’t produce unintended results; thorough reporting, benchmarking, and analysis will measure how well we’ve taught the machines.

Our second use case was in the data-rich area of Net Asset Value (NAV) reviews. Security pricing within NAV systems must be reconciled each night to ensure the NAV is 100% accurate. Using the traditional fixed thresholds, we were producing thousands of exceptions for our analysts to review each night, with less than 1% representing a true issue.

"The path to delivering true, lasting value is through harnessing intelligent automation that can act as a catalyst for end-to-end operational change."

To address this problem, we created ANTS (Anomaly NAV Tracking System) which uses predictive analysis and machine learning to eliminate the noise of false exceptions and brings forth exceptions that might not have been previously detected. Analysts, in turn, spend less time sorting through recurring exceptions thus enabling them to focus on resolving true NAV threats.

In building these solutions, we learned to differentiate between “automating to replace” and “augmenting through enhanced intelligence.” Automating to replace is typically filled by RPA. RPA, unlike AI or machine learning, is often a solution for tasks that have a series of repeatable, manual steps with no complex judgement required.

Augmenting through enhanced intelligence, on the other hand, can automate subjective and judgement-based tasks on top of many of the rote manual tasks RPA is already doing.

To recap, selecting the right use cases is crucial. To start, consider:

- A real business problem you need to solve

- An area that is rich with data – structured and controlled data is a prerequisite

- Whether you want to “automate to replace” or “augment through enhanced intelligence.”

Success factor 2: One step at a time – operating through iteration

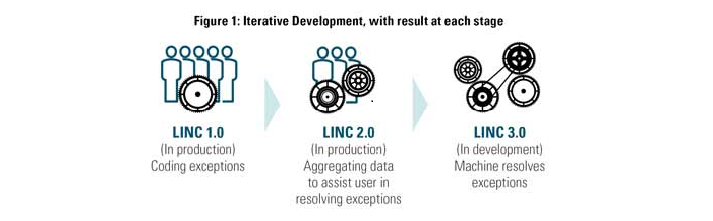

For many COOs, building support for AI adoption can be a daunting task. It certainly was for us. The prospect of expense creep, risk of failure, and redesigns can often detract from the success of a project. Building confidence is key. That’s why we turned to the agile/iterative approach when choosing how to build, deploy, and ingrain AI into our own operating model. For instance, when building LINC, we added capabilities in stages and could refine incrementally, as figure 1 illustrates.

This allowed us to celebrate victories along the way, while also keeping our goals aligned with the big picture. And by collating feedback and input from people across the business, we were able to generate support beyond our fund accounting group.

In short, we were able to transcend the “silo effect” and give our project much-needed visibility. We found that for navigating uncharted territories, like AI, you can’t have a standard waterfall approach, since that would assume you know all requirements and scope up front.

For AI projects, there is far more uncertainty as to how core systems will react and what data is available to fuel the engine. Starting with a small prototype and iterating based on feedback can help. Agile, however, will not solve these uncertainties, but it will arm your project team with the framework to solve challenges and adapt to new issues as they come.

Success factor 3: Plan ahead for adoption

When it comes to enterprise adoption, we learned that nothing is as important as formalizing processes for implementation. It all starts with communication, and since broad adoption (e.g., pragmatic transformation) was our goal, articulating the process across the enterprise was essential.

For instance, when building ANTS and LINC, we partnered with HR, service delivery, systems, and many other internal areas. We also included risk and audit control functions – all areas of our firm that typically wouldn’t be involved so early.

While this added time at the early stages of the project, it also brought a higher degree of understanding of how the technology worked and how the control environment evolved. This helped greatly with the next step of adoption: training.

Once we communicated our process, we established a training program to introduce the new roles our AI created. This was no easy task; after all, we were asking many employees to adapt, acquire new skills, and have a “machine learning” mindset.

"For AI projects, there is far more uncertainty as to how core systems will react and what data is available to fuel the engine."

Most, however, took to the training with enthusiasm. This type of transformation alleviated the need to look outside of our organization for talent. Despite what many suspect, “teaching the machines” does not require a PhD in computer science; but it does require a different frame of mind.

Previously, an analyst would process a transaction and move on to the next item until the work is complete for the day. The analyst would need to learn each step of the process to be able to carry out a specific task or job.

Now, our AI systems reference historical behaviors of our analysts to find patterns and anomalies that can automate such decisions and actions.

Our analysts no longer need to know the steps to carry out a task but instead how to analyze the performance of the system to ensure its accurate and learning correctly.

Finally, we learned that establishing key metrics before you begin can keep your project on track and allow you to maximize the return on the investment. We standardized metrics to monitor AI accuracy, application utilization, and efficiency.

In this manner, we could monitor in real time that the tool was being used as intended. Looking forward, these metrics are critical for the long-term success of our AI adoption, allowing us to know when and how often to retrain a model.

Where do we go next?

With these lessons in mind, we continue to look to the future. We will not only seek out the next areas of our business that are ripe for pragmatic transformation, but we will continue to evolve the areas where we’ve already seen success.

With our first AI projects underway, we’re now able to build momentum for further AI adoption to eliminate manual recons.

For us, it’s important to continually ask: Where can we improve? What can we do better? How do we continue to evolve? And most importantly, how can we create a better experience for our clients?

More information about BBH's journey to pragmatic transformation can be found here.

The views expressed as of August 2019 and are a general guide to the views of BBH. Brown Brothers Harriman & Co. (“BBH”) may be used as a generic term to reference the company as a whole and/or its various subsidiaries generally. This material and any products or services may be issued or provided in multiple jurisdictions by duly authorized and regulated subsidiaries. This material is for general information and reference purposes only and does not constitute legal, tax or investment advice and is not intended as an offer to sell, or a solicitation to buy securities, services or investment products. Any reference to tax matters is not intended to be used, and may not be used, for purposes of avoiding penalties under the U.S. Internal Revenue Code, or other applicable tax regimes, or for promotion, marketing or recommendation to third parties. All information has been obtained from sources believed to be reliable, but accuracy is not guaranteed, and reliance should not be placed on the information presented. This material may not be reproduced, copied or transmitted, or any of the content disclosed to third parties, without the permission of BBH. Pursuant to information regarding the provision of applicable services or products by BBH, please note the following: Brown Brothers Harriman Fund Administration Services (Ireland) Limited and Brown Brothers Harriman Trustee Services (Ireland) Limited are regulated by the Central Bank of Ireland, Brown Brothers Harriman Investor Services Limited is authorised and regulated by the Financial Conduct Authority, Brown Brothers Harriman (Luxembourg) S.C.A is regulated by the Commission de Surveillance du Secteur Financier. All trademarks and service marks included are the property of BBH or their respective owners. © Brown Brothers Harriman & Co. 2019. All rights reserved. IS-05329-2019-07-31